Question: Matthew Lewis, Incorporated estimates that its break point (BPRE) is $18 million, and its WACC is 11.45 percent if common equity comes from retained

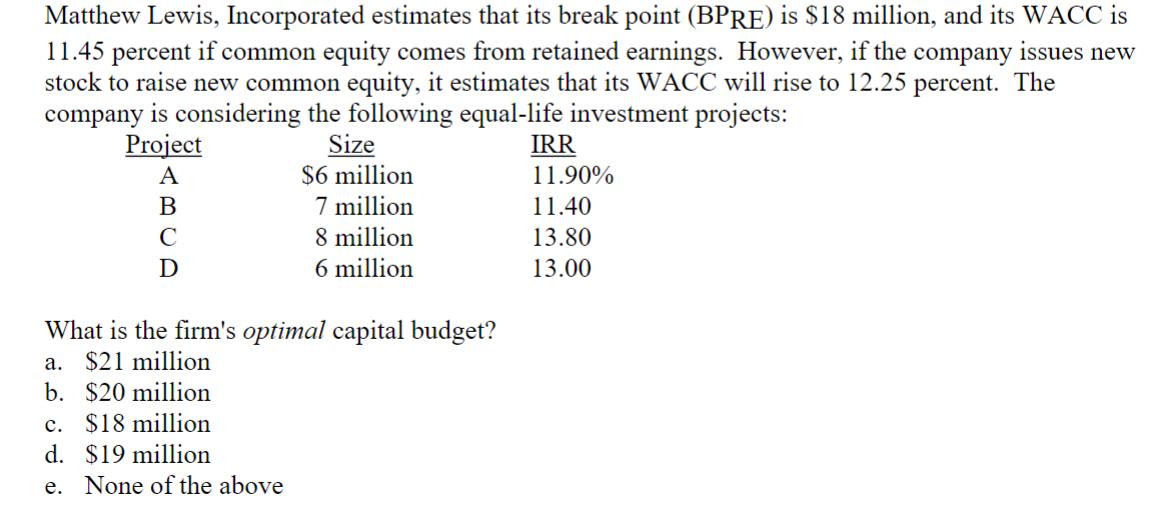

Matthew Lewis, Incorporated estimates that its break point (BPRE) is $18 million, and its WACC is 11.45 percent if common equity comes from retained earnings. However, if the company issues new stock to raise new common equity, it estimates that its WACC will rise to 12.25 percent. The company is considering the following equal-life investment projects: Project Size A $6 million B 7 million C 8 million D 6 million What is the firm's optimal capital budget? a. $21 million b. $20 million c. $18 million d. $19 million e. None of the above IRR 11.90% 11.40 13.80 13.00

Step by Step Solution

3.44 Rating (151 Votes )

There are 3 Steps involved in it

The detailed answer for the above question is provided below The firms optimal capital budget can be ... View full answer

Get step-by-step solutions from verified subject matter experts