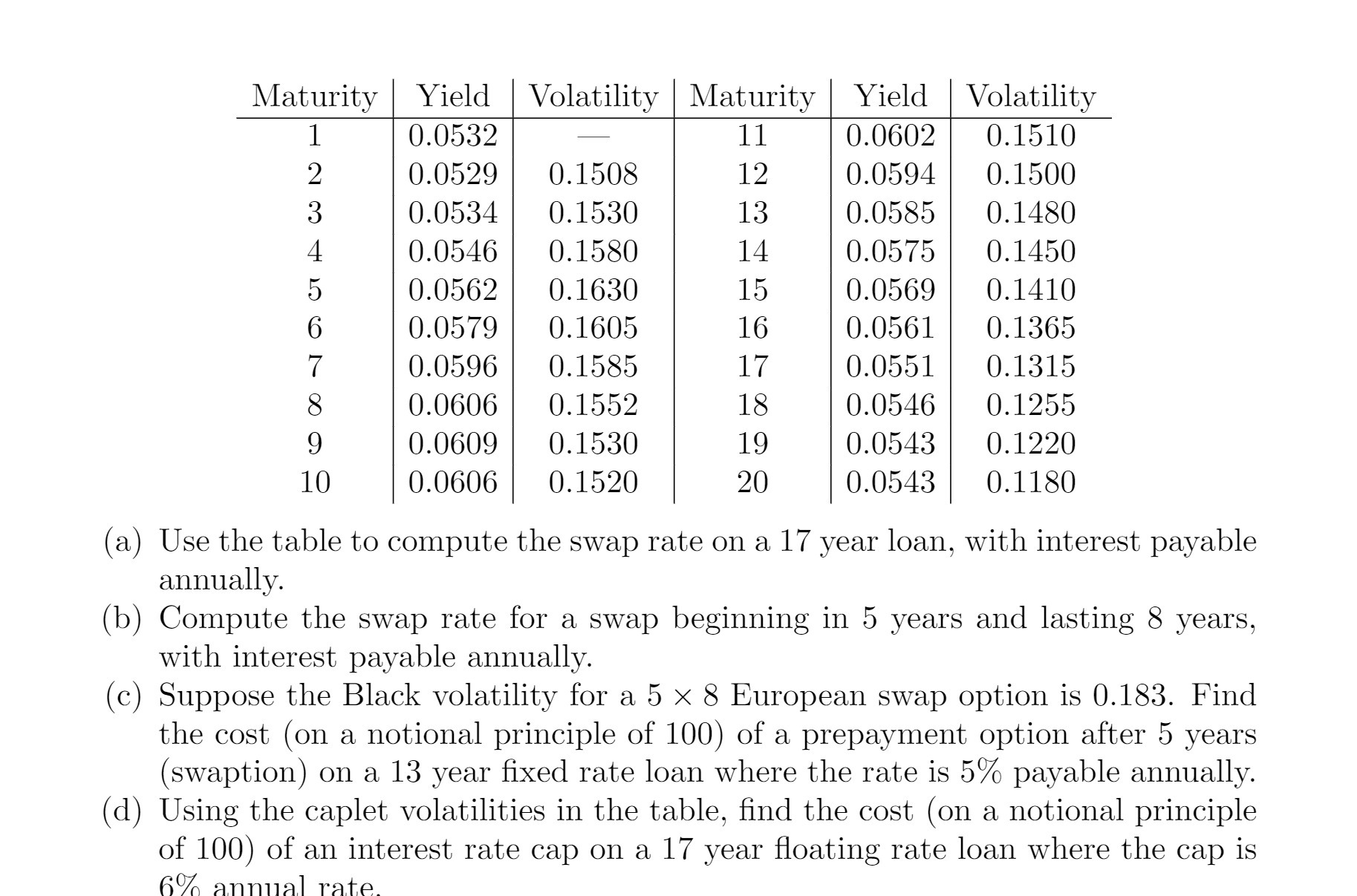

Question: Maturity Yield Volatility Maturity Yield Volatility 1 0.0532 7 11 0.0602 0.1510 2 0.0529 0.1508 12 0.0594 0.1500 3 0.0534 0.1530 13 0.0585 0.1480 4

Maturity Yield Volatility Maturity Yield Volatility 1 0.0532 7 11 0.0602 0.1510 2 0.0529 0.1508 12 0.0594 0.1500 3 0.0534 0.1530 13 0.0585 0.1480 4 0.0546 0.1580 14 0.0575 0.1450 5 0.0562 0.1630 15 0.0569 0.1410 6 0.0579 0.1605 16 0.0561 0.1365 7 0.0596 0.1585 17 0.0551 0.1315 8 0.0606 0.1552 18 0.0546 0.1255 9 0.0609 0.1530 19 0.0543 0.1220 10 0.0606 0.1520 20 0.0543 0.1180 (a) Use the table to compute the swap rate on a 17 year loan, with interest payable annually. (b) Compute the swap rate for a swap beginning in 5 years and lasting 8 years, with interest payable annually. (c) Suppose the Black volatility for a 5 x 8 European swap Option is 0.183. Find the cost (on a notional principle of 100) of a prepayment Option after 5 years (swaption) on a 13 year xed rate loan where the rate is 5% payable annually. ((1) Using the caplet volatilities in the table, nd the cost (on a notional principle of 100) of an interest rate cap on a 17 year oating rate loan where the cap is 6% annual rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts