Question: Max is married, with three children, aged 2, 8 and 9. He has been advised to purchase life insurance. Max is 32, whilst his

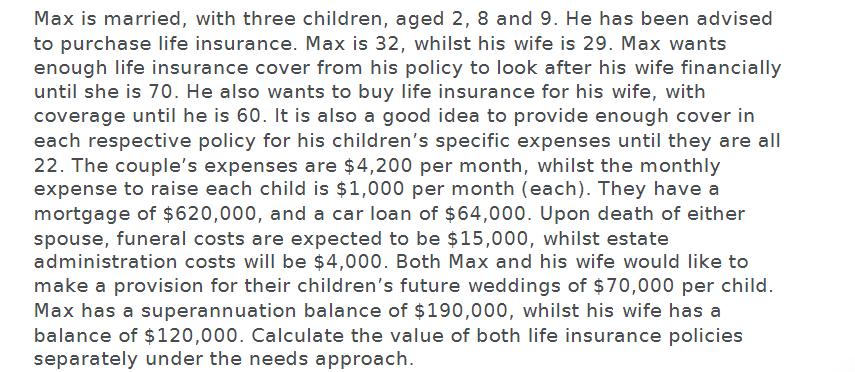

Max is married, with three children, aged 2, 8 and 9. He has been advised to purchase life insurance. Max is 32, whilst his wife is 29. Max wants enough life insurance cover from his policy to look after his wife financially until she is 70. He also wants to buy life insurance for his wife, with coverage until he is 60. It is also a good idea to provide enough cover in each respective policy for his children's specific expenses until they are all 22. The couple's expenses are $4,200 per month, whilst the monthly expense to raise each child is $1,000 per month (each). They have a mortgage of $620,000, and a car loan of $64,000. Upon death of either spouse, funeral costs are expected to be $15,000, whilst estate administration costs will be $4,000. Both Max and his wife would like to make a provision for their children's future weddings of $70,000 per child. Max has a superannuation balance of $190,000, whilst his wife has a balance of $120,000. Calculate the value of both life insurance policies separately under the needs approach.

Step by Step Solution

3.49 Rating (152 Votes )

There are 3 Steps involved in it

Max s life insurance policy 4 200 per month x 12 months x 38 y... View full answer

Get step-by-step solutions from verified subject matter experts