Question: Maxine agrees to purchase Chase's property utilizing a private annuity. Chase's table life expectancy is ten years at the date of the agreement and the

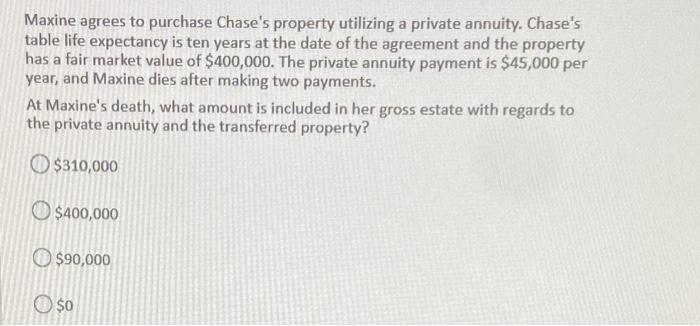

Maxine agrees to purchase Chase's property utilizing a private annuity. Chase's table life expectancy is ten years at the date of the agreement and the property has a fair market value of $400,000. The private annuity payment is $45,000 per year, and Maxine dies after making two payments. At Maxine's death, what amount is included in her gross estate with regards to the private annuity and the transferred property? $310,000 O $400,000 $90,000 O $0

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock