Question: Maxine agrees to purchase Jacob's property utilizing a private annuity. Jacob's table life expectancy is ten years at the date of the agreement, and

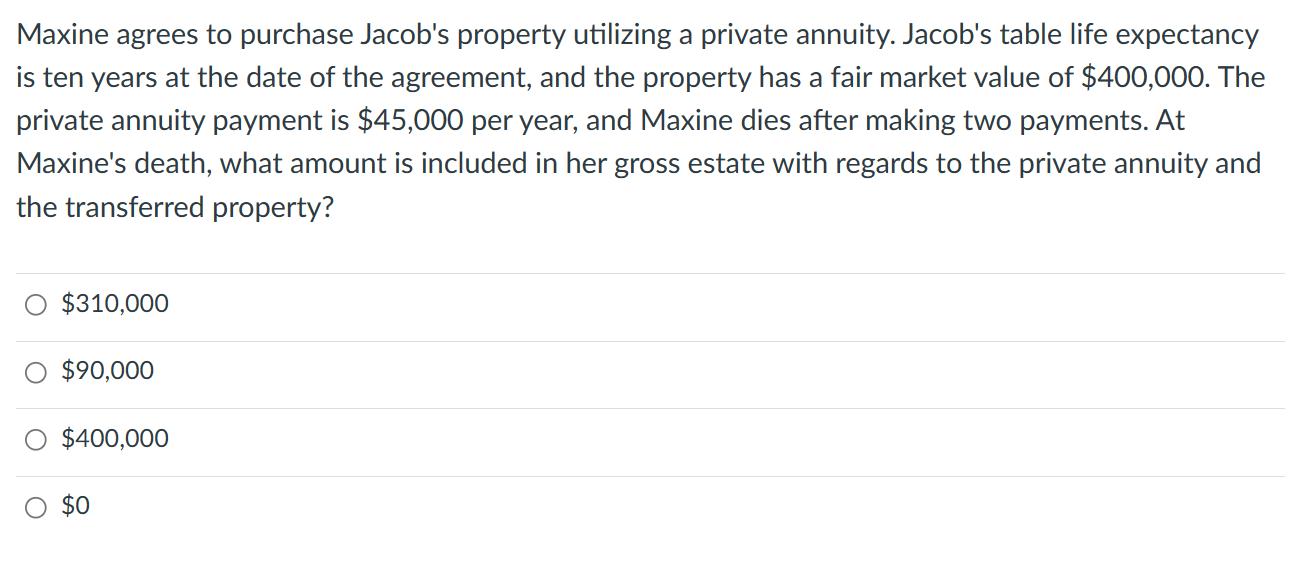

Maxine agrees to purchase Jacob's property utilizing a private annuity. Jacob's table life expectancy is ten years at the date of the agreement, and the property has a fair market value of $400,000. The private annuity payment is $45,000 per year, and Maxine dies after making two payments. At Maxine's death, what amount is included in her gross estate with regards to the private annuity and the transferred property? $310,000 $90,000 $400,000 $0

Step by Step Solution

3.42 Rating (149 Votes )

There are 3 Steps involved in it

The detailed answer for the above question is provided below Privat... View full answer

Get step-by-step solutions from verified subject matter experts