Question: Maxine's is considering either purchasing or leasing a $600,000 piece of specialized equipment. The equipment has a life of 5 years, belongs in a 30%

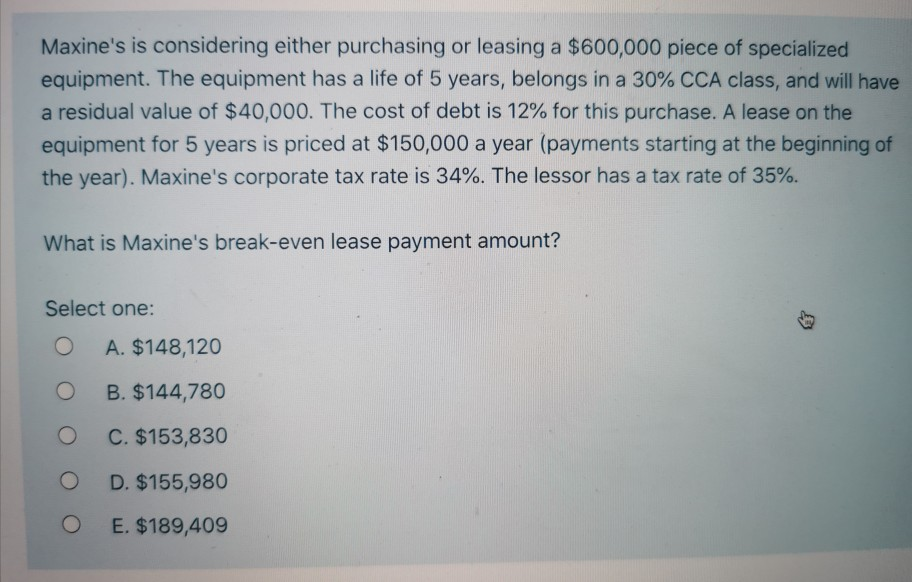

Maxine's is considering either purchasing or leasing a $600,000 piece of specialized equipment. The equipment has a life of 5 years, belongs in a 30% CCA class, and will have a residual value of $40,000. The cost of debt is 12% for this purchase. A lease on the equipment for 5 years is priced at $150,000 a year (payments starting at the beginning of the year). Maxine's corporate tax rate is 34%. The lessor has a tax rate of 35%. What is Maxine's break-even lease payment amount? Select one: A. $148,120 B. $144,780 O C. $153,830 D. $155,980 O E. $189,409 Maxine's is considering either purchasing or leasing a $600,000 piece of specialized equipment. The equipment has a life of 5 years, belongs in a 30% CCA class, and will have a residual value of $40,000. The cost of debt is 12% for this purchase. A lease on the equipment for 5 years is priced at $150,000 a year (payments starting at the beginning of the year). Maxine's corporate tax rate is 34%. The lessor has a tax rate of 35%. What is Maxine's break-even lease payment amount? Select one: A. $148,120 B. $144,780 O C. $153,830 D. $155,980 O E. $189,409

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts