Question: Problem #3 (18 marks) Maxine's is considering either purchasing or leasing a $6.3 million piece of specialized equipment. The equipment has a life of 4

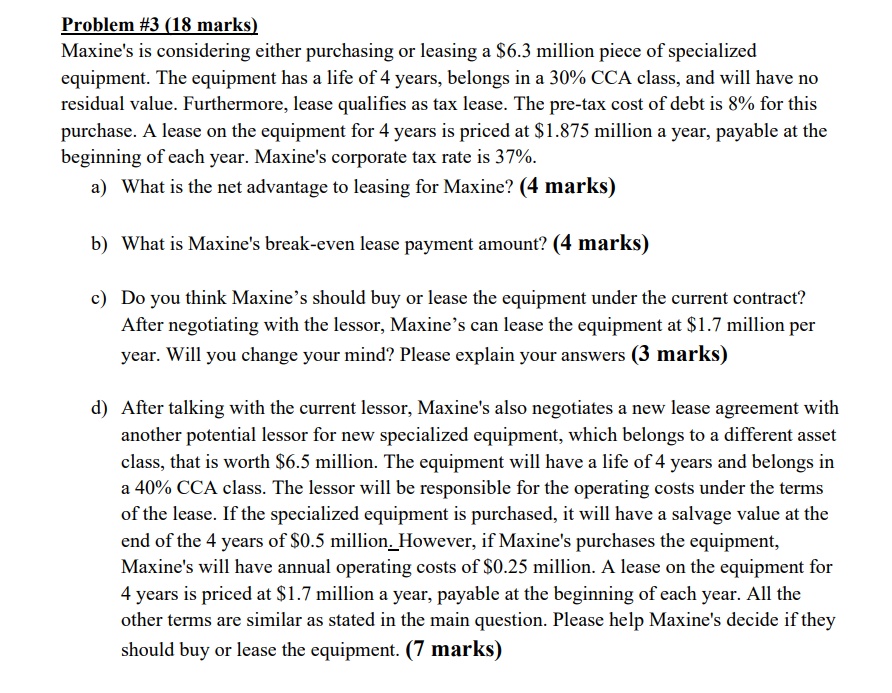

Problem \#3 (18 marks) Maxine's is considering either purchasing or leasing a $6.3 million piece of specialized equipment. The equipment has a life of 4 years, belongs in a 30% CCA class, and will have no residual value. Furthermore, lease qualifies as tax lease. The pre-tax cost of debt is 8% for this purchase. A lease on the equipment for 4 years is priced at $1.875 million a year, payable at the beginning of each year. Maxine's corporate tax rate is 37%. a) What is the net advantage to leasing for Maxine? (4 marks) b) What is Maxine's break-even lease payment amount? (4 marks) c) Do you think Maxine's should buy or lease the equipment under the current contract? After negotiating with the lessor, Maxine's can lease the equipment at $1.7 million per year. Will you change your mind? Please explain your answers (3 marks) d) After talking with the current lessor, Maxine's also negotiates a new lease agreement with another potential lessor for new specialized equipment, which belongs to a different asset class, that is worth $6.5 million. The equipment will have a life of 4 years and belongs in a 40% CCA class. The lessor will be responsible for the operating costs under the terms of the lease. If the specialized equipment is purchased, it will have a salvage value at the end of the 4 years of $0.5 million.However, if Maxine's purchases the equipment, Maxine's will have annual operating costs of $0.25 million. A lease on the equipment for 4 years is priced at $1.7 million a year, payable at the beginning of each year. All the other terms are similar as stated in the main question. Please help Maxine's decide if they should buy or lease the equipment. (7 marks) Problem \#3 (18 marks) Maxine's is considering either purchasing or leasing a $6.3 million piece of specialized equipment. The equipment has a life of 4 years, belongs in a 30% CCA class, and will have no residual value. Furthermore, lease qualifies as tax lease. The pre-tax cost of debt is 8% for this purchase. A lease on the equipment for 4 years is priced at $1.875 million a year, payable at the beginning of each year. Maxine's corporate tax rate is 37%. a) What is the net advantage to leasing for Maxine? (4 marks) b) What is Maxine's break-even lease payment amount? (4 marks) c) Do you think Maxine's should buy or lease the equipment under the current contract? After negotiating with the lessor, Maxine's can lease the equipment at $1.7 million per year. Will you change your mind? Please explain your answers (3 marks) d) After talking with the current lessor, Maxine's also negotiates a new lease agreement with another potential lessor for new specialized equipment, which belongs to a different asset class, that is worth $6.5 million. The equipment will have a life of 4 years and belongs in a 40% CCA class. The lessor will be responsible for the operating costs under the terms of the lease. If the specialized equipment is purchased, it will have a salvage value at the end of the 4 years of $0.5 million.However, if Maxine's purchases the equipment, Maxine's will have annual operating costs of $0.25 million. A lease on the equipment for 4 years is priced at $1.7 million a year, payable at the beginning of each year. All the other terms are similar as stated in the main question. Please help Maxine's decide if they should buy or lease the equipment. (7 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts