Question: may i get help on this question 1. Amo Co. sold goods with a list price of $60,000 on Dec. 14. Because the customer is

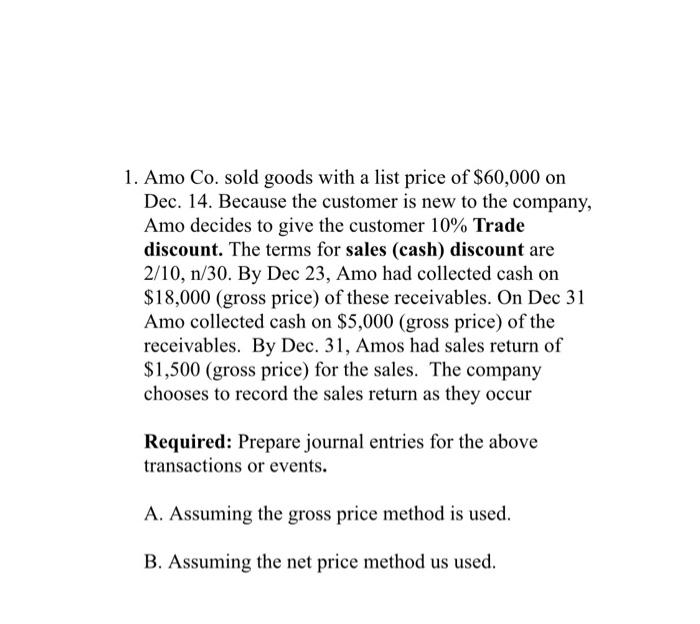

1. Amo Co. sold goods with a list price of $60,000 on Dec. 14. Because the customer is new to the company, Amo decides to give the customer 10% Trade discount. The terms for sales (cash) discount are 2/10, n/30. By Dec 23, Amo had collected cash on $18,000 (gross price) of these receivables. On Dec 31 Amo collected cash on $5,000 (gross price) of the receivables. By Dec. 31, Amos had sales return of $1,500 (gross price) for the sales. The company chooses to record the sales return as they occur Required: Prepare journal entries for the above transactions or events. A. Assuming the gross price method is used. B. Assuming the net price method us used

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts