Question: May i get some help. Computing Depreciation Using Various Depreciation Methods To demonstrate the computations involved in several methods of depreciating a fixed asset, the

May i get some help.

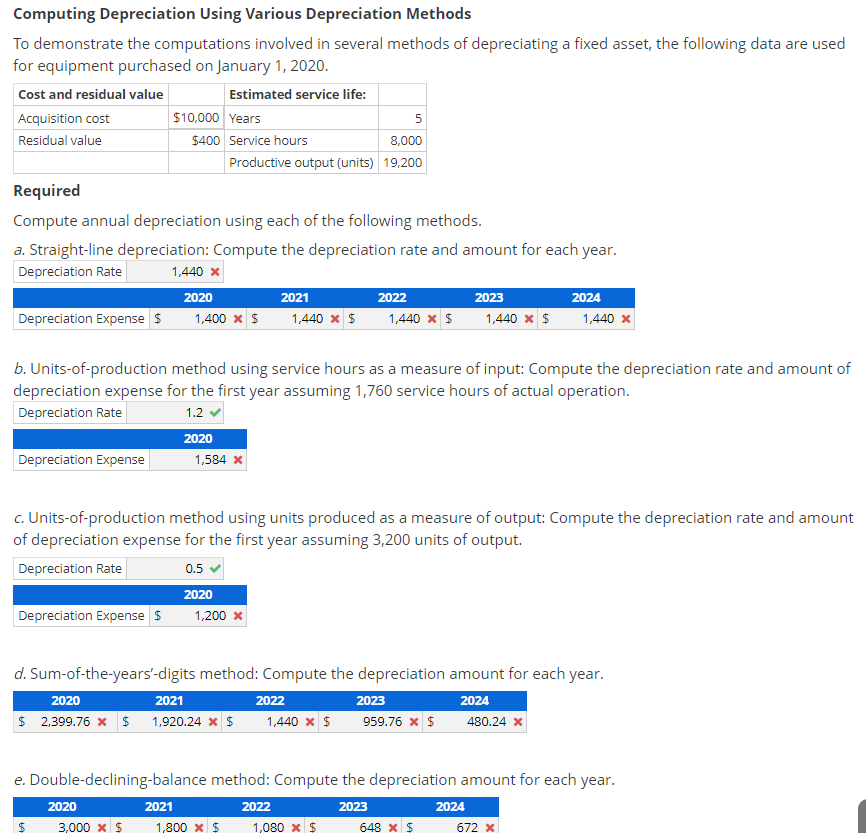

Computing Depreciation Using Various Depreciation Methods To demonstrate the computations involved in several methods of depreciating a fixed asset, the following data are used for equipment purchased on January 1, 2020. Cost and residual value Estimated service life: Acquisition cost $10,000 Years 5 Residual value $400 Service hours 8,000 Productive output (units) 19,200 Required Compute annual depreciation using each of the following methods. a. Straight-line depreciation: Compute the depreciation rate and amount for each year. Depreciation Rate 1,440 x 2020 2021 2022 2023 2024 Depreciation Expense $ 1,400 x $ 1,440 x $ 1,440 * $ 1,440 x $ 1,440 x b. Units-of-production method using service hours as a measure of input: Compute the depreciation rate and amount of depreciation expense for the first year assuming 1,760 service hours of actual operation. Depreciation Rate 1.2 2020 1,584 x Depreciation Expense c. Units-of-production method using units produced as a measure of output: Compute the depreciation rate and amount of depreciation expense for the first year assuming 3,200 units of output. Depreciation Rate 0.5 2020 1,200 x Depreciation Expense $ d. Sum-of-the-years'-digits method: Compute the depreciation amount for each year. 2020 2021 2022 2023 2024 2,399.76 * $ 1,920.24 * $ 1,440 * $ 959.76 * $ 480.24 $ e. Double-declining balance method: Compute the depreciation amount for each year. 2022 2023 2020 2024 2021 1,800 X $ $ 3,000 X $ 1,080 X $ 648 X 5 672 X

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts