Question: May i have help on this please? A US speculator enters a futures contract for June delivery of SF125,000 on January 26. The futures exchange

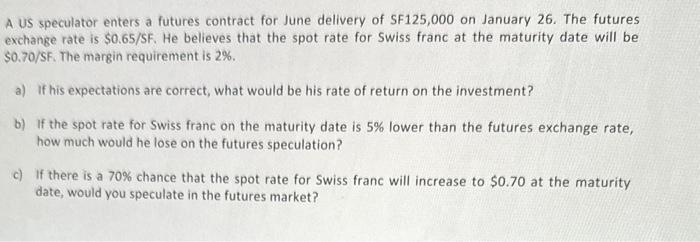

A US speculator enters a futures contract for June delivery of SF125,000 on January 26. The futures exchange rate is $0.65/SF. He believes that the spot rate for Swiss franc at the maturity date will be $0.70/SF. The margin requirement is 2%. a) If his expectations are correct, what would be his rate of return on the investment? b) If the spot rate for Swiss franc on the maturity date is 5% lower than the futures exchange rate, how much would he lose on the futures speculation? c) If there is a 70% chance that the spot rate for Swiss franc will increase to $0.70 at the maturity date, would you speculate in the futures market

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts