Question: May I have help with part J only please thank you Financial Statement Analysis The financial statements for Nike, Inc., are available in Appendix E.

May I have help with part J only please thank you

May I have help with part J only please thank you

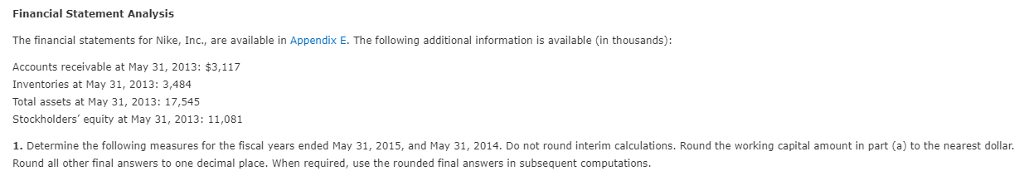

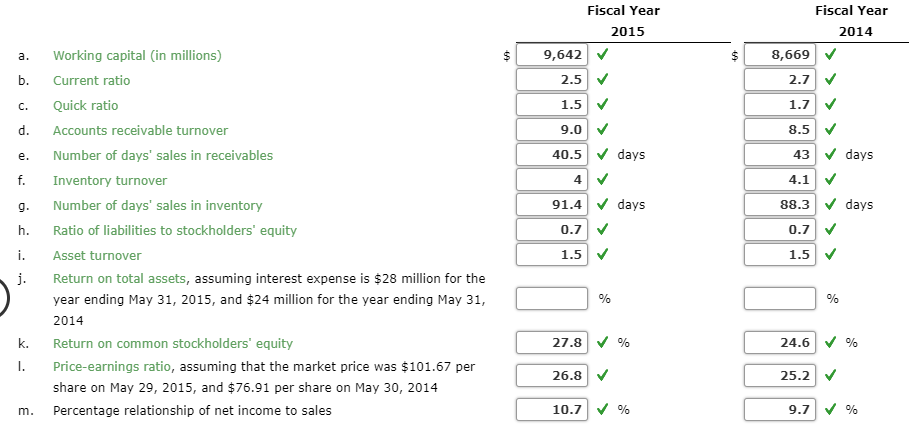

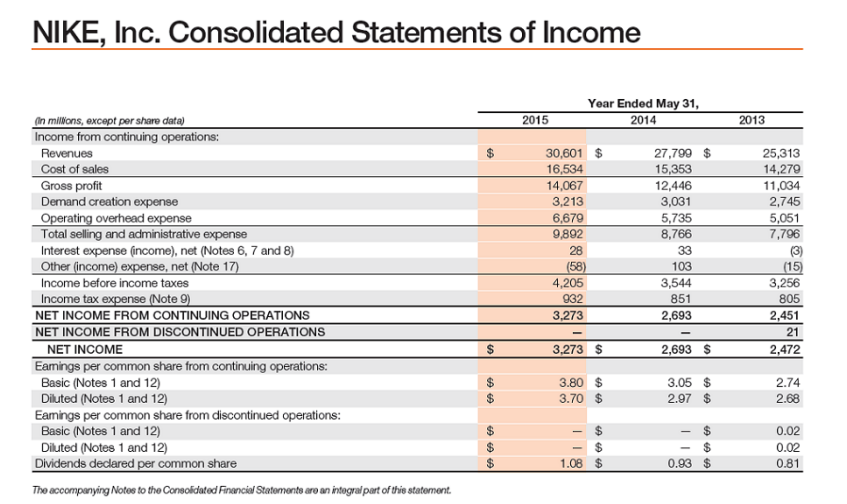

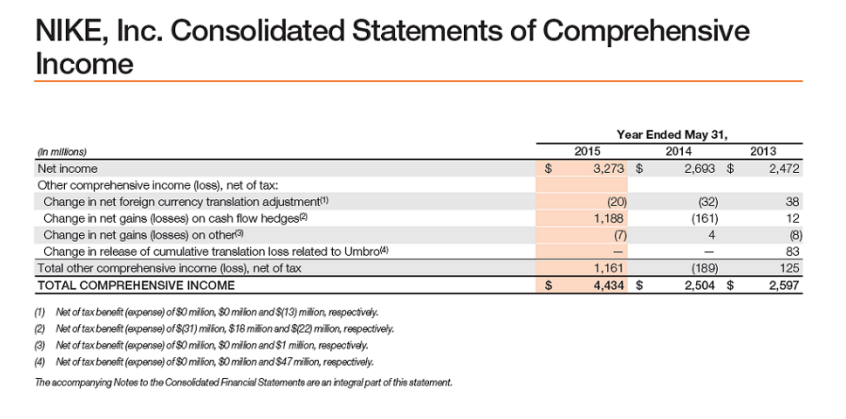

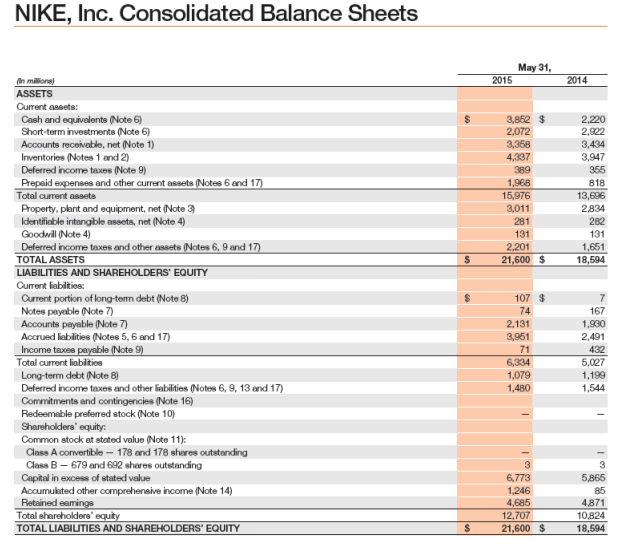

Financial Statement Analysis The financial statements for Nike, Inc., are available in Appendix E. The following additional informations available in thousands): Accounts receivable at May 31, 2013: $3,117 Inventories at May 31, 2013: 3,484 Total assets at May 31, 2013: 17,545 Stockholders' equity at May 31, 2013: 11,081 1. Determine the following measures for the fiscal years ended May 31, 2015, and May 31, 2014. Do not round interim calculations. Round the working capital amount in part (a) to the nearest dollar Round all other final answers to one decimal place. When required, use the rounded final answers in subsequent computations. Fiscal Year Fiscal Year 2015 2014 $ 9,642 2.5 1.5 9.0 $ 8,669 a. Working capital (in millions) b. Current ratio c. Quick ratio d. Accounts receivable turnover e. Number of days' sales in receivables f. Inventory turnover g. Number of days' sales in inventory h. Ratio of liabilities to stockholders' equity 1.7 8.5V 43 days 4.1 40.5 days 4 91.4 days 88.3 days 0.7 1.5 0.7 1.5 Asset turnover j. Return on total assets, assuming interest expense is $28 million for the year ending May 31, 2015, and $24 million for the year ending May 31, 2014 Return on co 24.61 % 27.8 % 26.8 10.71 % k. mmon stockholders' equity I.Price-earnings ratio, assuming that the market price was $101.67 per 25.2 share on May 29, 2015, and $76.91 per share on May 30, 2014 Percentage relationship of net income to sales m. NIKE, Inc. Consolidated Statements of Income Year Ended May 31 2014 2015 2013 In milions, except per share data) Income from continuing operations: 27,799 S$ 30,601 $ 16,534 14,067 3,213 25,313 14,279 11,034 2,745 5,051 7,796 Cost of sales Gross proft Demand creation expense 15,353 12,446 3,031 5,735 8,766 Total selling and administrative expense Interest expense (income), net (Notes 6, 7 and 8) 9,892 103 3,544 851 2,693 net 4,205 3,273 3,273 S Income before income taxes Income tax 3,256 NET INCOME FROM CONTINUING OPERATIONS NET INCOME FROM DISCONTINUED OPERATIONS 2,451 21 2,472 NET INCOME 2,693 S Eamings per common share from continuing operations: Basic (Notes 1 and 12) Diluted (Notes 1 and 12) 3.80 $ 3.70 $ 3.05 $ 2.97 $ 2.74 Eamings per common share from discontinued operations: Basic (Notes 1 and 12) Diluted (Notes 1 and 12) 0.02 0.02 0.81 1.08 $ 0.93 $ The accompanying Notes to the Consolidated Financial Statements are an integral part of thie statement NIKE, Inc. Consolidated Statements of Comprehensive Income Year Ended May 31 In milions) 2015 2014 2013 Net income 3,273 $ 2,693 $ 2,472 Other comprehensive income (loss), net of tax: Change in net foreign currency translation adjustmenti Change in net gains (osses) on cash flow hedges Change in net gains (losses) on other3 (20) 1,188 (32) (161) 4 38 12 e in release of cumulative translation loss related to Umbro4) Total other TOTAL COMPREHENSIVE INCOME 1,161 4,434 S 18 2,504 $ 83 125 2,597 rehensive income net of tax (1) Net of taxbenefit (xpense) of $0 milion, $0 milion and $(13) million, respectively. 2) Net oftaxbn(expense) of$(31) milion, $18 miltion and $(22) milion, reepectively (3) Net of tax beneft (expense) of $0 milion, $O milion and S1 milion, respectively 4) Net of taxbeneft(xpense) of $0 milion, $0 milion and $47 milion, reepectively. The accompanying Notes to the Consoidated Financial Statements are an integralpart of this statement NIKE, Inc. Consolidated Balance Sheets 2014 Cash and equivelents Note 6) Short-term investments Note 6) Accounts receivable, net (Note 1) Inventories (Notes 1 and 2) Deferred income taxes (Note 9) 3,852 $ and other current assets 6 and 1 Property, plant and equipment, net (Note 3 ldentifieble intangible assets, net (Note 4) Deferred income taxes and other assets LIABILITIES AND SHAREHOLDERS' EQUITY 9 and 1 Current portion of long-term debt (Note 8) Accounts payable(Note 7) Accrued liablities (Notes 5, 6 and 17) Deferred income taxes and other Sabilities Notes 6,9, 13 and 17) Commitments and contingencies (Note 16 Redeemable prefered stock (Note 10 Common stock at stated value (Note 11) Class A convertible 178 and 178 shares outstanding Class B- 679 and 692 shares outstanding Accumulated other comprehensive income (Note 14) TOTAL LIABIUTIES AND SHAREHOLDERS EQUITY

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts