Question: May I please have help with 6,7, 8 | Question 6 10 pts Holding time to maturity and yield to maturity constant, what can you

May I please have help with 6,7,8

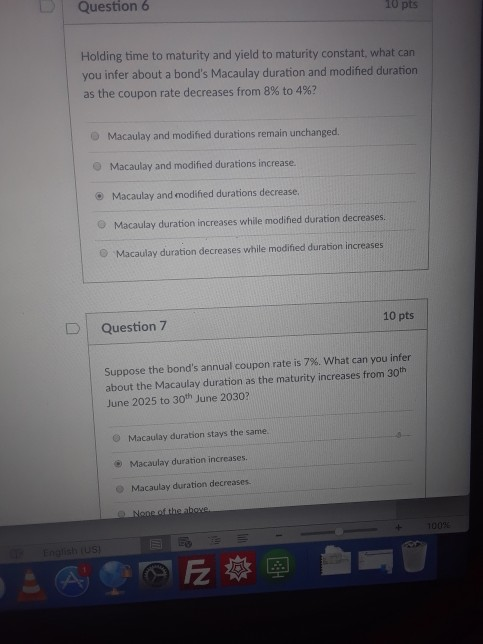

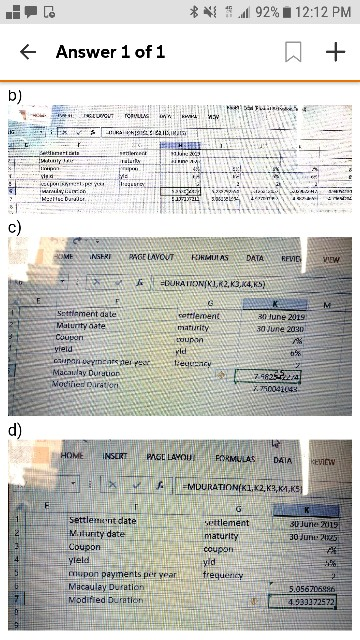

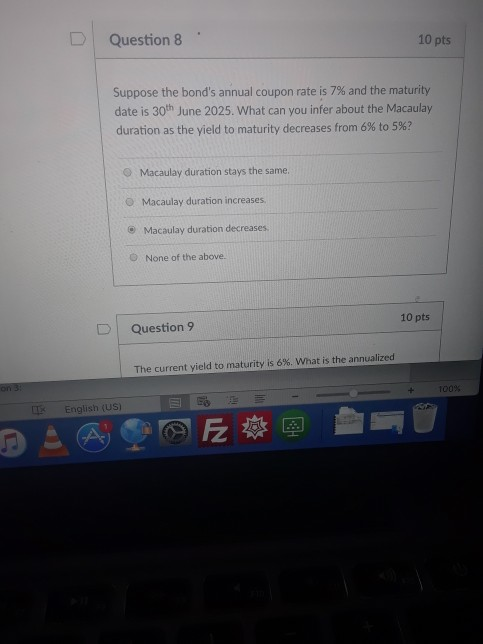

| Question 6 10 pts Holding time to maturity and yield to maturity constant, what can you infer about a bond's Macaulay duration and modified duration as the coupon rate decreases from 8% to 4%? O Macaulay and modied durations remain unchanged O Macaulay and modified durations increase Macaulay and modified durations decrease. O Macaulay duration increases while modified duration decreases. O Macaulay duration decreases while modified duration increases D Question 7 10 pts Suppose the bond's annual coupon rate is 7%, what can you infer about the Macaulay duration as the maturity increases from 30th June 2025 to 30th June 2030? 0 Macaulay duration stays the same. Macaulay duration increases. Macaulay duration decreases 100% .dl 92%. 12:12 PM Answer 1 of 1 b) 1NSFRI - ANGE LAYOUT ERMUI AS - DATA Erin Low seEx.ms. KATONKE,K2. KK4Rs) JF . ment date cottlement maturity 20 June 2019 30 June 2030 Maturity oate Couper Macauay Duration Mociier puratior 7 750041043 d) settlement date ettlement maturity coupon yld 3lfJune 2015 30 3U 25 Mnturity date coupon yleld nupon payments per year Macaulay Duration Modified Duration frequency 5.056706996 DQuestion 8 10 pts Suppose the bond's annual coupon rate is 7% and the maturity date is 30th June 2025. What can you infer about the Macaulay duration as the yield to maturity decreases from 6% to 5%? O Macaulay duration stays the same. Macaulay duration increases. e Macaulay duration decreases. None of the above. 10 pts D | Question 9 The current yield to maturity is 6%, what is the annualized 100% English (US)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts