Question: Milestone Co. analyzing two financial plan for their newly form subsidiary. The plans are described as follows: The market price of the stock is RM12.70

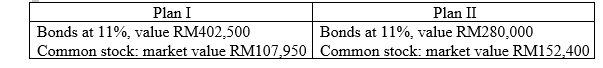

- Milestone Co. analyzing two financial plan for their newly form subsidiary. The plans are described as follows:

The market price of the stock is RM12.70 and the corporate tax rate is 34 percent.

Required:

- Find the EBIT EPS indifference level associated with the two financing plans.

- Prepare a pro forma income statement if the earnings before interest and taxes (EBIT) is expected to be RM175,000. Which financing plan should be selected and why?

Plan I Plan II Bonds at 11%, value RM402.500 Bonds at 11%, value RM280.000 Common stock: market value RM107,950 | Common stock: market value RM152,400

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts