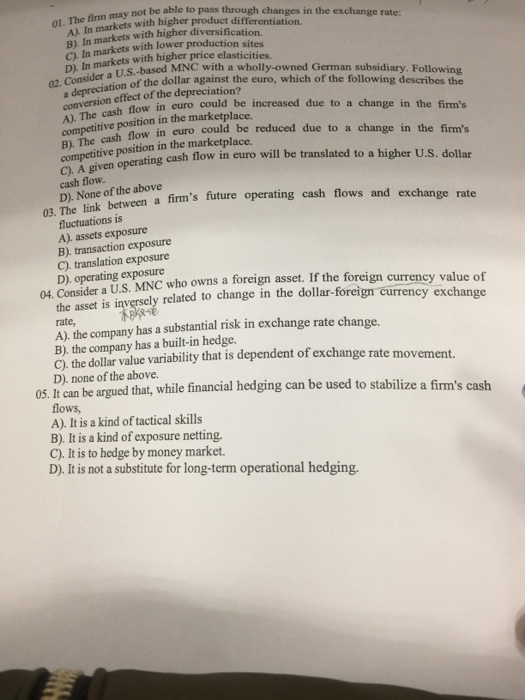

Question: may not be able to pass through changes in the exchange rate: A). In markets with higher product differentiation. B). In markets with higher diversification

may not be able to pass through changes in the exchange rate: A). In markets with higher product differentiation. B). In markets with higher diversification In markets with lower production sites In markets with higher price elasticities. D), In markets-bas MNC with a wholly-owned German subsidiary. Pollowing 02. Consider aion of the dollar against the euro, which of the following describes the effect of the depreciation? position in the marketplace. a depreciation conversion h flow in euro could be increased due to a change in the firm's competitive ow in euro could be reduced due to a change in the firm's cash flow in euro B). The in the marketplace. competitive post cash flow in euro will be translated to a higher U.S. dollar C). A given operating cash flow D). None of the above o3. The link between a firm's future operating cash flows and exchange rate fluctuations is A). assets exposure B). transaction exposure C). translation exposure D). operating exposure 04. Consider a U.S. MNC who owns a foreign asset. If the foreign currency value of the asset is inversely related to change in the dollar-foreign currency exchange rate, A). the company has a B). the company has a built-in hedge. C). the dollar value variability that is dependent of ex D) none of the above. substantial risk in exchange rate change. change rate movement. 05. It can be argued that, while financial hedging can be used to stabilize a firm's cash flows, A). It is a kind of tactical skills B). It is a kind of exposure netting. C). It is to hedge by money market. D). It is not a substitute for long-term operational hedging

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts