Question: MBA Managerial Accounting Handout Problem for Chapter 10B Fall 2020 Part A Wilson Company reported the following information related to their defined benefit pension plan

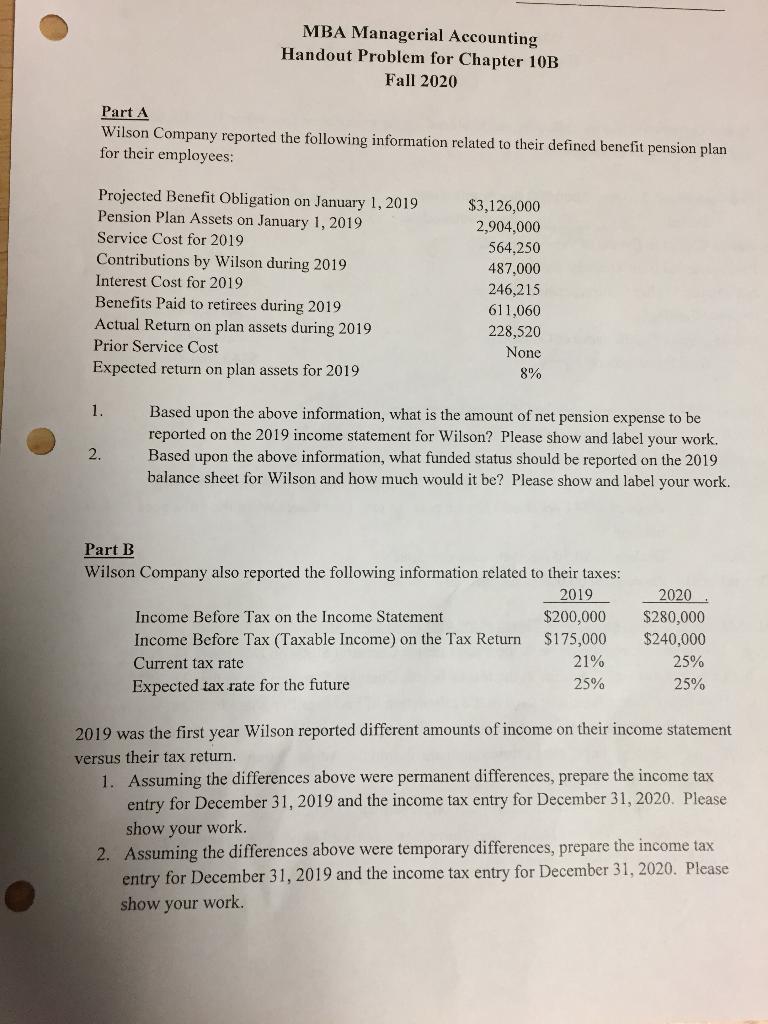

MBA Managerial Accounting Handout Problem for Chapter 10B Fall 2020 Part A Wilson Company reported the following information related to their defined benefit pension plan for their employees: Projected Benefit Obligation on January 1, 2019 Pension Plan Assets on January 1, 2019 Service Cost for 2019 Contributions by Wilson during 2019 Interest Cost for 2019 Benefits Paid to retirees during 2019 Actual Return on plan assets during 2019 Prior Service Cost Expected return on plan assets for 2019 $3,126,000 2,904,000 564,250 487,000 246,215 611,060 228,520 None 8% 1. Based upon the above information, what is the amount of net pension expense to be reported on the 2019 income statement for Wilson? Please show and label your work. Based upon the above information, what funded status should be reported on the 2019 balance sheet for Wilson and how much would it be? Please show and label your work. 2. Part B Wilson Company also reported the following information related to their taxes: 2019 Income Before Tax on the Income Statement $200,000 Income Before Tax (Taxable Income) on the Tax Return $175,000 Current tax rate 21% Expected tax rate for the future 25% 2020 $280,000 $240,000 25% 25% 2019 was the first year Wilson reported different amounts of income on their income statement versus their tax return. 1. Assuming the differences above were permanent differences, prepare the income tax entry for December 31, 2019 and the income tax entry for December 31, 2020. Please show your work. 2. Assuming the differences above were temporary differences, prepare the income tax entry for December 31, 2019 and the income tax for December 31, 2020. Please show your work MBA Managerial Accounting Handout Problem for Chapter 10B Fall 2020 Part A Wilson Company reported the following information related to their defined benefit pension plan for their employees: Projected Benefit Obligation on January 1, 2019 Pension Plan Assets on January 1, 2019 Service Cost for 2019 Contributions by Wilson during 2019 Interest Cost for 2019 Benefits Paid to retirees during 2019 Actual Return on plan assets during 2019 Prior Service Cost Expected return on plan assets for 2019 $3,126,000 2,904,000 564,250 487,000 246,215 611,060 228,520 None 8% 1. Based upon the above information, what is the amount of net pension expense to be reported on the 2019 income statement for Wilson? Please show and label your work. Based upon the above information, what funded status should be reported on the 2019 balance sheet for Wilson and how much would it be? Please show and label your work. 2. Part B Wilson Company also reported the following information related to their taxes: 2019 Income Before Tax on the Income Statement $200,000 Income Before Tax (Taxable Income) on the Tax Return $175,000 Current tax rate 21% Expected tax rate for the future 25% 2020 $280,000 $240,000 25% 25% 2019 was the first year Wilson reported different amounts of income on their income statement versus their tax return. 1. Assuming the differences above were permanent differences, prepare the income tax entry for December 31, 2019 and the income tax entry for December 31, 2020. Please show your work. 2. Assuming the differences above were temporary differences, prepare the income tax entry for December 31, 2019 and the income tax for December 31, 2020. Please show your work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts