Question: MC . 2 2 . 0 2 8 Which of the following statements is most CORRECT? a . The acquiring firm's required rate of return

MC

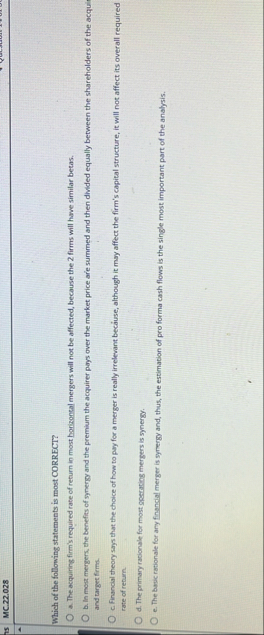

Which of the following statements is most CORRECT?

a The acquiring firm's required rate of return in most horizoncal mergers will not be affected, because the firms will have similar betas.

b In most mergers, the benefits of synergy and the premium the acquirer pays over the market price are summed and then divided equally between the shareholders of the acqui and target firms.

c Financial theory says that the choice of how to pay for a merger is really irrelevant because, although it may affect the firm's capital structure, it will not affect its overall required rate of renurn.

d The primary rationale for most geerating mergers is synergy.

e The basic rationale for any financial merger is synergy and, thus, the estimation of pro forma cash flows is the single most important part of the analysis.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock