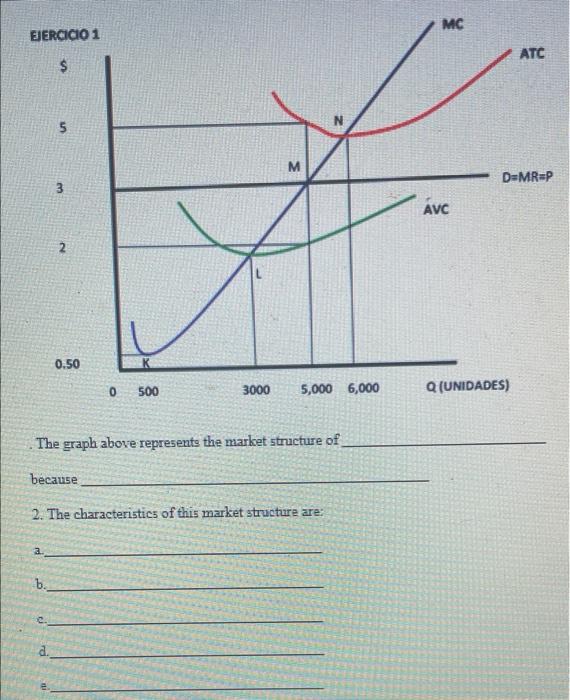

Question: MC EJERCICIO 1 ATC $ 5 M DEMR=P AVC 2 0.50 0 500 3000 5,000 6,000 Q (UNIDADES) The graph above represents the market structure

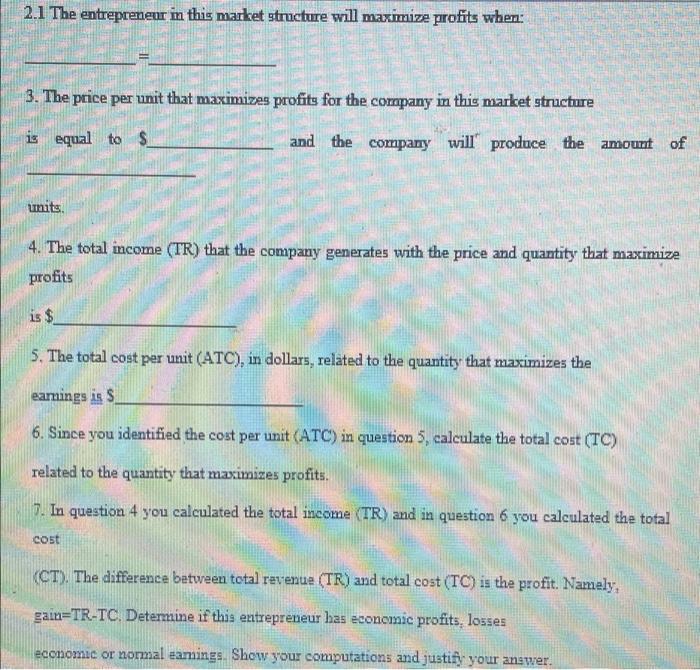

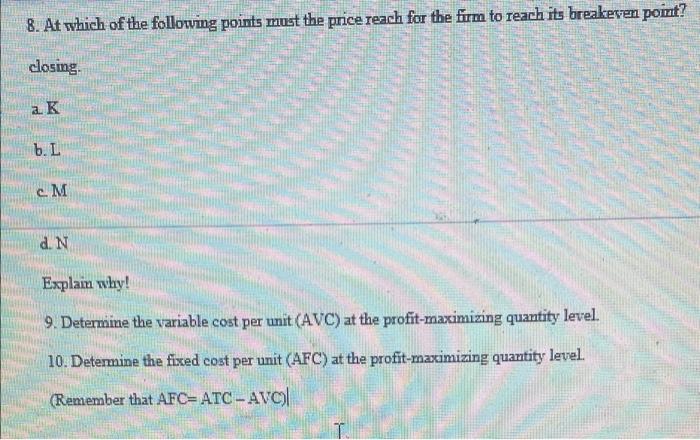

MC EJERCICIO 1 ATC $ 5 M DEMR=P AVC 2 0.50 0 500 3000 5,000 6,000 Q (UNIDADES) The graph above represents the market structure of because 2. The characteristics of this market structure are: a b. 2.1 The entrepreneur in this market structure will maximize profits wher: 3. The price per unit that maximizes profits for the company in this market structure is equal to $ and the company will produce the amount of units 4. The total income (TR) that the company generates with the price and quantity that maximize profits is $ 5. The total cost per unit (ATC), in dollars, related to the quantity that maximizes the earnings is $ 6. Since you identified the cost per unit (ATC) in question 5, calculate the total cost (TC) related to the quantity that maximizes profits. 7. In question 4 you calculated the total income (TR) and in question 6 you calculated the total cost (CT). The difference between total revenue (TR) and total cost (TC) is the profit. Namely, gain=TR-TC. Determine if this entrepreneur has economic profits, losses economic or normal earings. Show your computations and justify your answer. 8. At which of the following points must the price reach for the firm to reach its breakeven point? closing. ak b.L M dN Explain why! 9. Determine the variable cost per unit (AVC) at the profit-maximizing quantity level. 10. Determine the fixed cost per unit (AFC) at the profit-maximizing quantity level. (Remember that AFC= ATC-AVC|

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts