Question: MC Question 4 (5 points) HMB considers to use a 1-year forward contract to hedge his position. When the contract was entered, the forward price

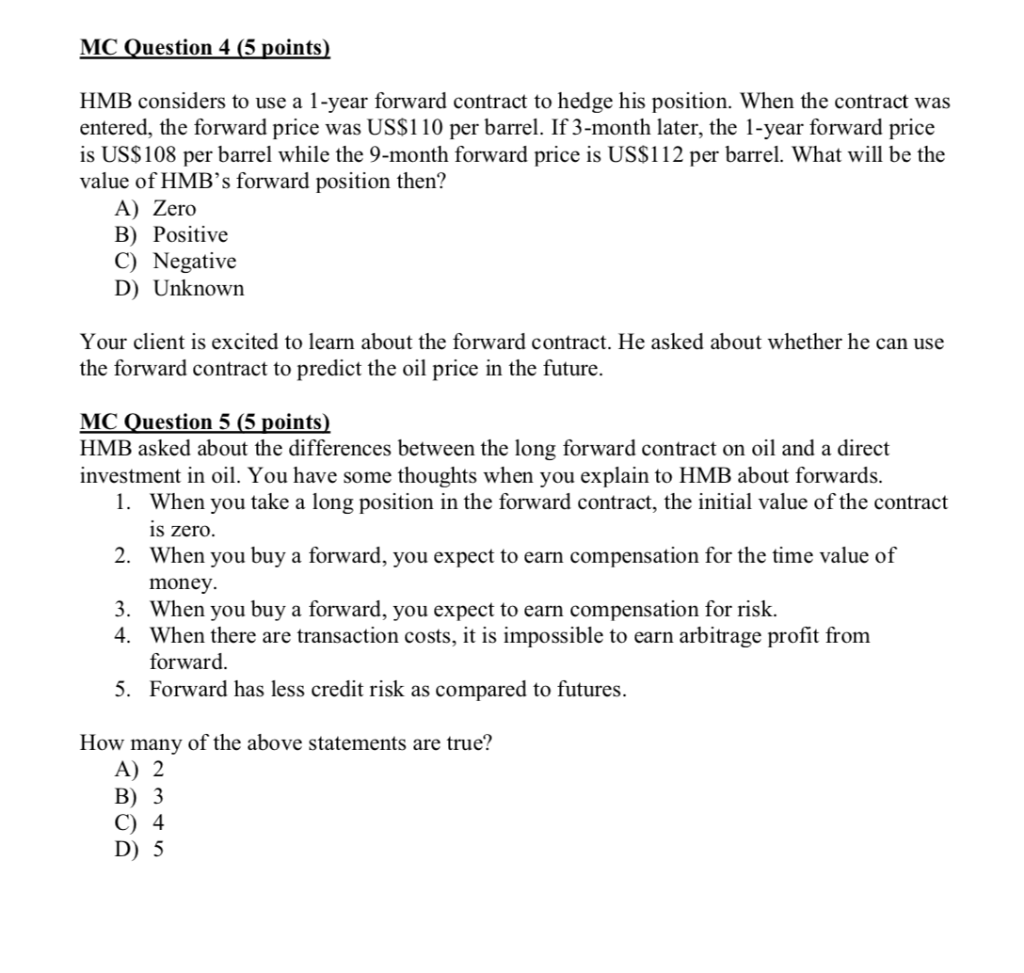

MC Question 4 (5 points) HMB considers to use a 1-year forward contract to hedge his position. When the contract was entered, the forward price was US$110 per barrel. If 3-month later, the 1-year forward price is US$ 108 per barrel while the 9-month forward price is US$112 per barrel. What will be the value of HMBs forward position then? A) Zero B) Positive C) Negative D) Unknown Your client is excited to learn about the forward contract. He asked about whether he can use the forward contract to predict the oil price in the future. MC Question 5 (5 points) HMB asked about the differences between the long forward contract on oil and a direct investment in oil. You have some thoughts when you explain to HMB about forwards. 1. When you take a long position in the forward contract, the initial value of the contract is zero. 2. When you buy a forward, you expect to earn compensation for the time value of money. 3. When you buy a forward, you expect to earn compensation for risk. 4. When there are transaction costs, it is impossible to earn arbitrage profit from forward. 5. Forward has less credit risk as compared to futures. How many of the above statements are true? A) 2 B) 3 C) 4 D) 5 MC Question 4 (5 points) HMB considers to use a 1-year forward contract to hedge his position. When the contract was entered, the forward price was US$110 per barrel. If 3-month later, the 1-year forward price is US$ 108 per barrel while the 9-month forward price is US$112 per barrel. What will be the value of HMBs forward position then? A) Zero B) Positive C) Negative D) Unknown Your client is excited to learn about the forward contract. He asked about whether he can use the forward contract to predict the oil price in the future. MC Question 5 (5 points) HMB asked about the differences between the long forward contract on oil and a direct investment in oil. You have some thoughts when you explain to HMB about forwards. 1. When you take a long position in the forward contract, the initial value of the contract is zero. 2. When you buy a forward, you expect to earn compensation for the time value of money. 3. When you buy a forward, you expect to earn compensation for risk. 4. When there are transaction costs, it is impossible to earn arbitrage profit from forward. 5. Forward has less credit risk as compared to futures. How many of the above statements are true? A) 2 B) 3 C) 4 D) 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts