Question: MC Questions 16-23. Geometric Returns, Unit Values, Arithmetic Returns, and Standard Deviations The following 8 questions refer to the follow returns for stocks for the

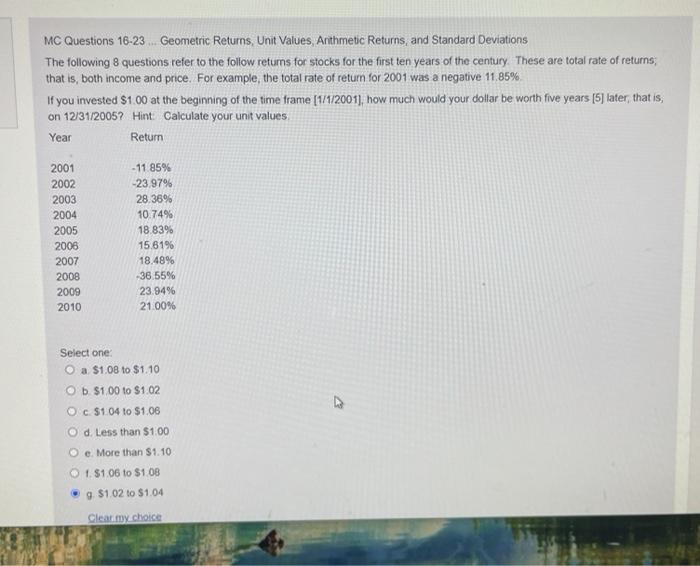

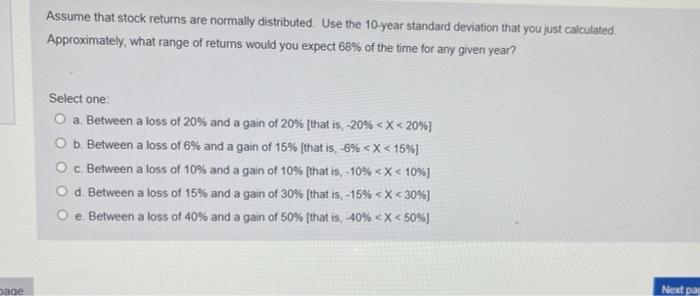

MC Questions 16-23. Geometric Returns, Unit Values, Arithmetic Returns, and Standard Deviations The following 8 questions refer to the follow returns for stocks for the first ten years of the century. These are total rate of returns that is, both income and price. For example, the total rate of return for 2001 was a negative 11.85% If you invested $1.00 at the beginning of the time frame (1/1/2001), how much would your dollar be worth five years (5) later, that is, on 12/31/2005? Hint Calculate your unit values Year Return 2001 2002 2003 2004 2005 - 11.85% -23.97% 28.38% 10.74% 18.83% 15,61% 18.48% 36.55% 23.94% 21.00% 2006 2007 2008 2009 2010 Select one O a $1.08 to $1.10 O b $100 to $1.02 O c $104 to $1.06 O d. Less than $1.00 Oe. More than $1.10 1. $1.05 to $1.08 9 $1.02 to $1.04 Clear my choice Assume that stock returns are normally distributed. Use the 10-year standard deviation that you just calculated Approximately, what range of returns would you expect 68% of the time for any given year? Select one O a Between a loss of 20% and again of 20% [that is, -20%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts