Question: McGraw Hill Textbook Chapter 3 Question 6 (Part 1) Required information The following information applies to the questions displayed below). Wells Technical Institute (WTa, a

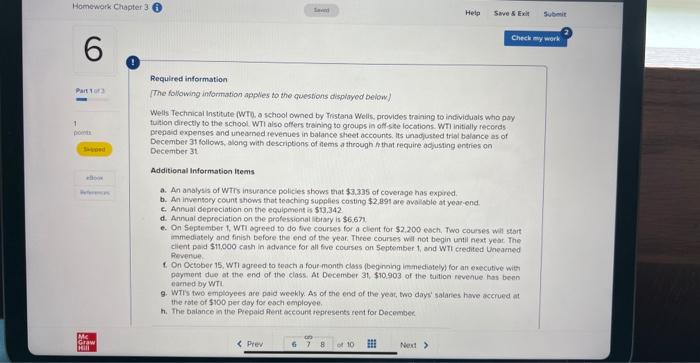

Required information The following information applies to the questions displayed below). Wells Technical Institute (WTa, a scheol owned by Tristana Wells, provides traning to indivicuais who pay tuition directly to the school WTI also offers traning to groups in oH see focations. WTI initially recceds: prepaid expenses and uneamed revenues in balance sheet accounts. Its unagjusted triel balance as of Decembet 3 follows, along with descriptions of fems a through h thist require adyusting entries on December 31 . Additional Information items a. An analysis of Wris insurance policies shows that $3.335 of coverage has expied. b. An inventery count thoms that teoching supplies costing $2,891 are moilsole at yoar-end c. Annual depreciation on the equipenent is 513.342 d. Annuat depreciation on the professipnal lablary is $6.67n e. On September 1. WTi agreed to do tive courses for a clent for $2.200 esch, Two courses wit start mimediately and finish before the end of the year. Three coures wal not begin until next yeat. The client paid $11,000 cash in attuance for all fuve courses on 5 eptember 1 , and WT credited Uneamed Reventue. 1. On Cetober 15, WII agreed to teach a fouf month class fbegining intemedibtely for an esecutive with poyment due at the end of the class At December 31, \$10.903 of the tuition revenue has been eamed by WTt. 9. WTIs two employees are paid weekly. As of the end of the yeat, two days' salaries heve accrued at the rate of $100 per day for each employee. h. The batance in the Piepaid flent account represents rent for December. Required information The following information applies to the questions displayed below). Wells Technical Institute (WTa, a scheol owned by Tristana Wells, provides traning to indivicuais who pay tuition directly to the school WTI also offers traning to groups in oH see focations. WTI initially recceds: prepaid expenses and uneamed revenues in balance sheet accounts. Its unagjusted triel balance as of Decembet 3 follows, along with descriptions of fems a through h thist require adyusting entries on December 31 . Additional Information items a. An analysis of Wris insurance policies shows that $3.335 of coverage has expied. b. An inventery count thoms that teoching supplies costing $2,891 are moilsole at yoar-end c. Annual depreciation on the equipenent is 513.342 d. Annuat depreciation on the professipnal lablary is $6.67n e. On September 1. WTi agreed to do tive courses for a clent for $2.200 esch, Two courses wit start mimediately and finish before the end of the year. Three coures wal not begin until next yeat. The client paid $11,000 cash in attuance for all fuve courses on 5 eptember 1 , and WT credited Uneamed Reventue. 1. On Cetober 15, WII agreed to teach a fouf month class fbegining intemedibtely for an esecutive with poyment due at the end of the class At December 31, \$10.903 of the tuition revenue has been eamed by WTt. 9. WTIs two employees are paid weekly. As of the end of the yeat, two days' salaries heve accrued at the rate of $100 per day for each employee. h. The batance in the Piepaid flent account represents rent for December

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts