Question: Mcleod Ltd is about to undertake a project and has computed the NPV of the project using a variety of discount rates(as shown on the

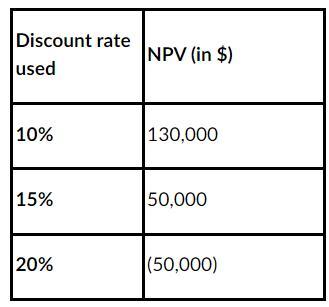

Mcleod Ltd is about to undertake a project and has computed the NPV of the project using a variety of discount rates(as shown on the table) :

i. Find out the approximate IRR for this project

ii. What decision would the management take if the discount rate used for this project happens to be 20%?

Consider the investment opportunity for a high-end clothing store inside a large and popular shopping mall in the Philippines. The project requires an upfront investment of $100,000. It has an expected cash-inflow of $60,000 in Year 1 of $60,000 and year 2 of $58,241. Find the IRR of the project.

Discount rate used 10% 15% 20% NPV (in $) 130,000 50,000 (50,000)

Step by Step Solution

★★★★★

3.31 Rating (157 Votes )

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

To find the approximate Internal Rate of Return IRR for the project we can use interpolation We know ... View full answer

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock