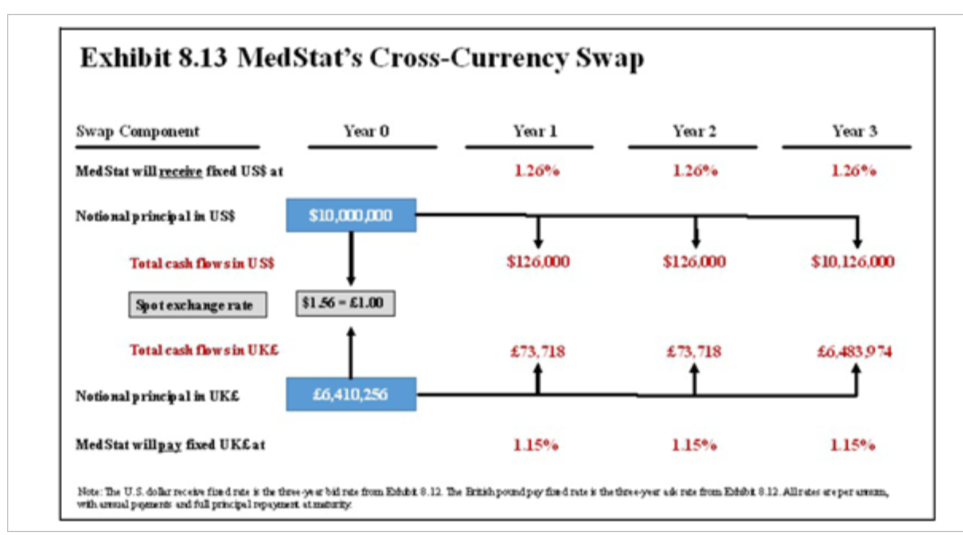

Question: MedStat had entered into a 3 - year cross - currency swap to pay British pounds at a fixed interest rate of 1 . 1

MedStat had entered into ayear crosscurrency swap to pay British pounds at a fixed interest rate of

and receive US dollars at a fixed interest rate of

when the spot exchange rate was

$equals

Using that same swap principal of

$ comma comma

and contractual payments, calculate the cost of unwinding the swap after one year has passedwith two years remaining if the twoyear fixed rate of interest on British pounds is now

the twoyear fixed rate of interest on US dollars is now

and the current spot exchange rate is

$equals

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock