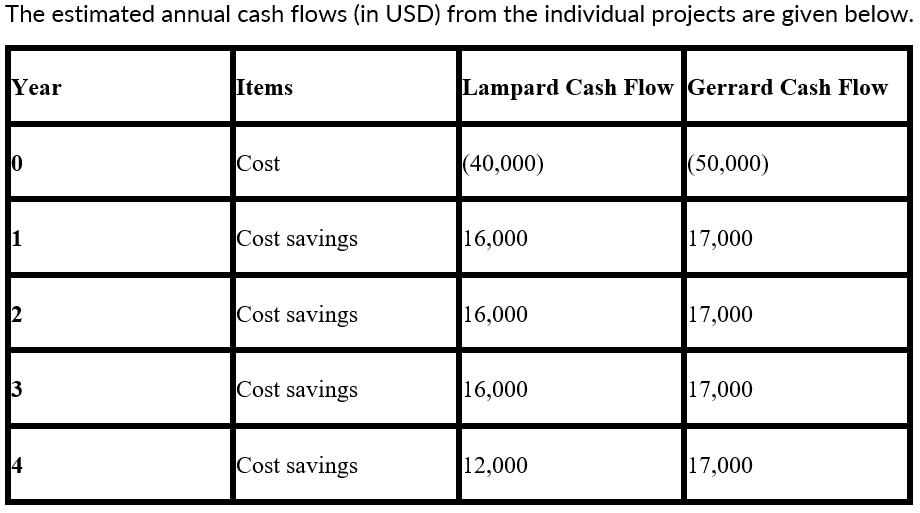

Question: Mega Plc. is planning to decide between the following two projects Lampard and Gerrard.The estimated annual cash flows (in USD) from the individual projects

The estimated annual cash flows (in USD) from the individual projects are given below. Year 10 - 2 3 + Items Cost Cost savings Cost savings Cost savings Cost savings Lampard Cash Flow Gerrard Cash Flow (40,000) 16,000 16,000 16,000 12,000 (50,000) 17,000 17,000 17,000 17,000

Step by Step Solution

There are 3 Steps involved in it

To determine the payback period for each project we need to accumulate the annual cash f... View full answer

Get step-by-step solutions from verified subject matter experts