Melissa, Nicole, and Ben are equal partners in the Opto Partnership (a calendar-year- end entity). Melissa...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

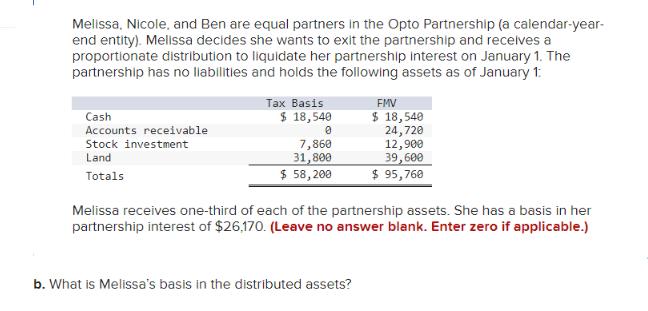

Melissa, Nicole, and Ben are equal partners in the Opto Partnership (a calendar-year- end entity). Melissa decides she wants to exit the partnership and receives a proportionate distribution to liquidate her partnership interest on January 1. The partnership has no liabilities and holds the following assets as of January 1: Cash Accounts receivable Stock investment Land Totals Tax Basis $ 18,540 0 7,860 31,800 $ 58,200 FMV $ 18,540 24,720 12,900 39,600 $ 95,768 Melissa receives one-third of each of the partnership assets. She has a basis in her partnership interest of $26,170. (Leave no answer blank. Enter zero if applicable.) b. What is Melissa's basis in the distributed assets? Melissa, Nicole, and Ben are equal partners in the Opto Partnership (a calendar-year- end entity). Melissa decides she wants to exit the partnership and receives a proportionate distribution to liquidate her partnership interest on January 1. The partnership has no liabilities and holds the following assets as of January 1: Cash Accounts receivable Stock investment Land Totals Tax Basis $ 18,540 0 7,860 31,800 $ 58,200 FMV $ 18,540 24,720 12,900 39,600 $ 95,768 Melissa receives one-third of each of the partnership assets. She has a basis in her partnership interest of $26,170. (Leave no answer blank. Enter zero if applicable.) b. What is Melissa's basis in the distributed assets?

Expert Answer:

Answer rating: 100% (QA)

The calculation of Melissas basis in the distributed assets step by step Melissa is receiving a prop... View the full answer

Related Book For

Taxation Of Individuals And Business Entities 2015

ISBN: 9780077862367

6th Edition

Authors: Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

Posted Date:

Students also viewed these accounting questions

-

Melissa, Nicole, and Ben are equal partners in the Opto partnership (calendar year-end). Melissa decides she wants to exit the partnership and receives a proportionate distribution to liquidate her...

-

The ABC partnership has the following assets: I/S Basis FMV Cash 60,000 60,000 Accounts Receivable 0 30,000 Inventory 60,000 90,000 Land 30,000 90,000 As outside basis in the partnership is equal to...

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1-5. Ivan's grandfather died and left a portfolio of municipal bonds. In 2012, they pay Ivan...

-

Calculate the numerical value of cross-price elasticity, exy, in each of the following situations. Do not round your interim calculations before obtaining the final solution (i.e. do not clear your...

-

Let a, b, c be three constant vectors drawn from the origin to the points A, B, C. what is the distance from the origin to the plane defined by the points A, B, C? What is the area of the triangle...

-

In words, the random variable X = _________________ a. the number of times Mrs. Plums cats wake her up each week. b. the number of times Mrs. Plums cats wake her up each hour. c. the number of times...

-

Fran Stein started an environmental consulting company and during the first month of operations (February 2012) the business completed the following transactions: a. Stein began the business with an...

-

David Ricardo of Iron Law, Inc. claims that he meets the company standard of spending an average of no more than $ 8 a day on business lunches. As company auditor, you take a random sample of 12 of...

-

1.Explain how tariffs work? 2.How can the lack of international competition impact prices in the United States? 3.Domestically, who benefits from tariffs? Who could tariffs be bad for? 3.Using the...

-

Open the Orders Solution.sln file contained in the VB2017\Chap03\Orders Solution folder. The interface provides a button for adding the number ordered to the total ordered, and a button for...

-

If you are receiving a $1202 coupon of a bond a year for four,5,6,10 years. and risk free rate is 7% . what will be the Present value for these amount received for respective years?

-

The following fact pattern contains all the relevant information. How do I prepare a straightforward discovery motion for a client of the firm utilizing this fact pattern? What specific documents...

-

Current Attempt in Progress Sandhill Corporation has current liabilities of $453,000, a quick ratio of 1.7, inventory turnover of 5.8, and a current ratio of 3.7. What is the cost of goods sold for...

-

20) Task ABUAEF D GHID J For the following tasks Duration 5 7 2 +650 12 4 3 6 4 5 Predecessor ABCDE C G F.H H Successor BU C D.G EEH E F I H I H J Constraints B overlaps A by 3 days. 3 days...

-

Stulz Co. is considering the purchase of $500,000 computer that has an economic life of five years. The computer will be depreciated based on the system enacted by the Tax Reform Act of 1986 (MACRS)....

-

Northwood Company manufactures a basketball selling for $25 per unit in a small plant heavily relying on direct labor workers. Thus, variable expenses are high, totaling $15.00 per ball, of which 60%...

-

All companies and their employees, regardless of the industry, work on sensitive or confidential data, intellectual property, and information systems. If a companys computer software and data are not...

-

What are the three kinds of research types? Explain each type.

-

Bryan followed in his father's footsteps and entered into the carpet business. He owns and operates I Do Carpet (IDC). Bryan prefers to install carpet only, but in order to earn additional revenue,...

-

Describe the order in which different types of tax credits are applied to reduce a taxpayer's tax liability.

-

Why does the tax law provide preferential rates on certain capital gains?

-

Sandblasting is a process in which an abrasive material, entrained in a jet, is directed onto the surface of a casting to clean its surface. In a particular setup for sandblasting, the casting of...

-

\(f(t)=\delta(t-\tau)\) corresponds to a force applied at a. \(t-\tau=0\) b. \(t-\tau <0\) c. \(t-\tau>0\)

-

Find the response of a viscously damped system under the periodic force whose values are given in Problem 1.116. Assume that \(M_{t}\) denotes the value of the force in newtons at time \(t_{i}\)...

Study smarter with the SolutionInn App