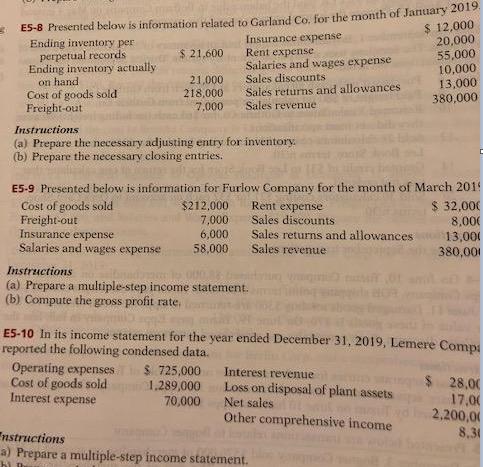

Question: ES-8 Presented below is information related to Garland Co. for the month of January 2012 Ending inventory per perpetual records Ending inventory actually on

ES-8 Presented below is information related to Garland Co. for the month of January 2012 Ending inventory per perpetual records Ending inventory actually on hand Cost of goods sold Freight-out Insurance expense Rent expense Salaries and wages expense Sales discounts Sales returns and allowances Sales revenue $ 12,000 20,000 55,000 10,000 13,000 380,000 $ 21,600 21,000 218,000 7,000 Instructions (a) Prepare the necessary adjusting entry for inventory. (b) Prepare the necessary closing entries. E5-9 Presented below is information for Furlow Company for the month of March 201! Cost of goods sold Freight-out Insurance expense Salaries and wages expense $ 32,000 $212,000 7,000 6,000 58,000 Rent expense Sales discounts Sales returns and allowances 8,000 13,000 Sales reveue 380,001 Instructions (a) Prepare a multiple-step income statement. (b) Compute the gross profit rate, ES-10 In its income statement for the year ended December 31, 2019, Lemere Compi reported the following condensed data. Operating expenses Cost of goods sold Interest expense $ 725,000 1,289,000 70,000 Interest revenue Loss on disposal of plant assets Net sales Other comprehensive income $ 28,00 17,00 2,200,00 8,31 nstructions a) Prepare a multiple-step income statement.

Step by Step Solution

3.55 Rating (159 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts