Question: = = = Merge & Center $ % 9 .000 Formatting as Table Styles 03 x fx B C D E F G 1 Instructions:

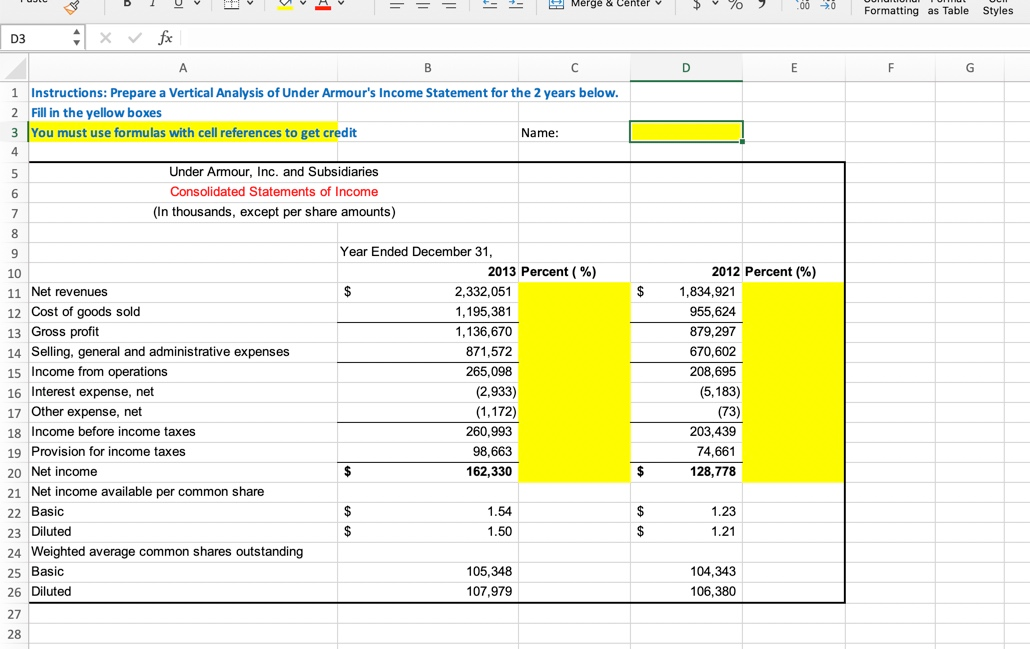

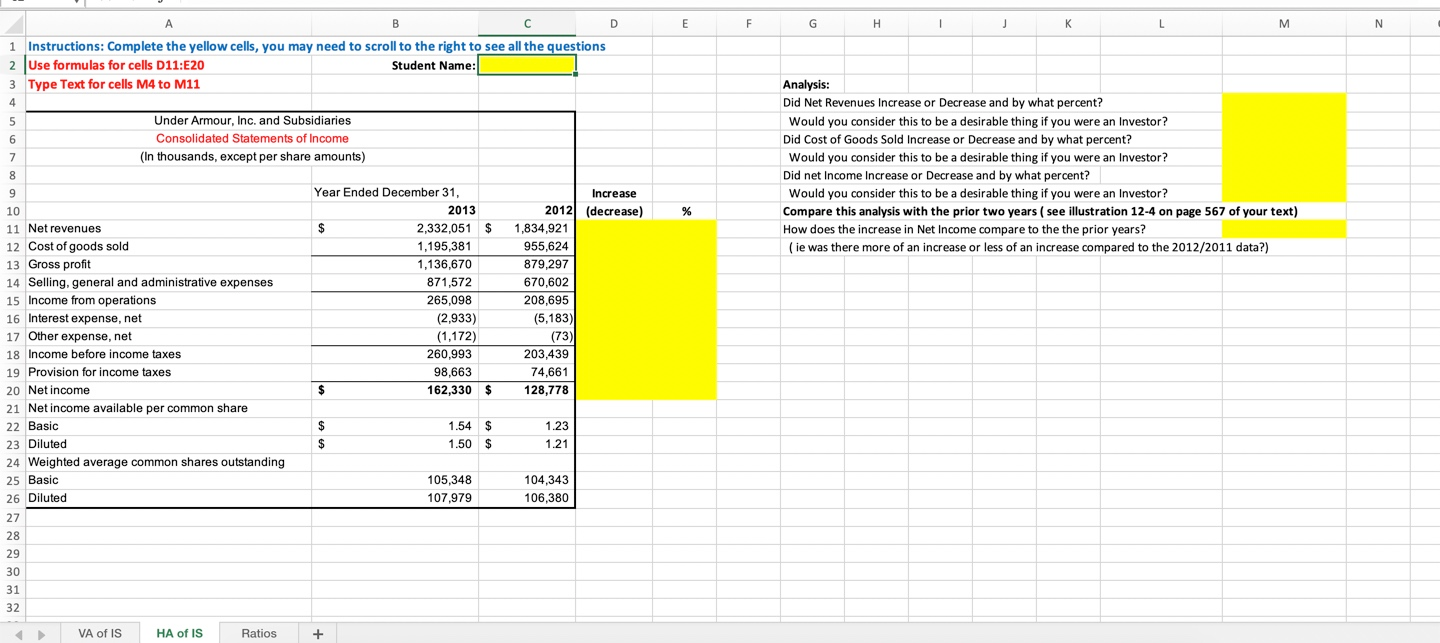

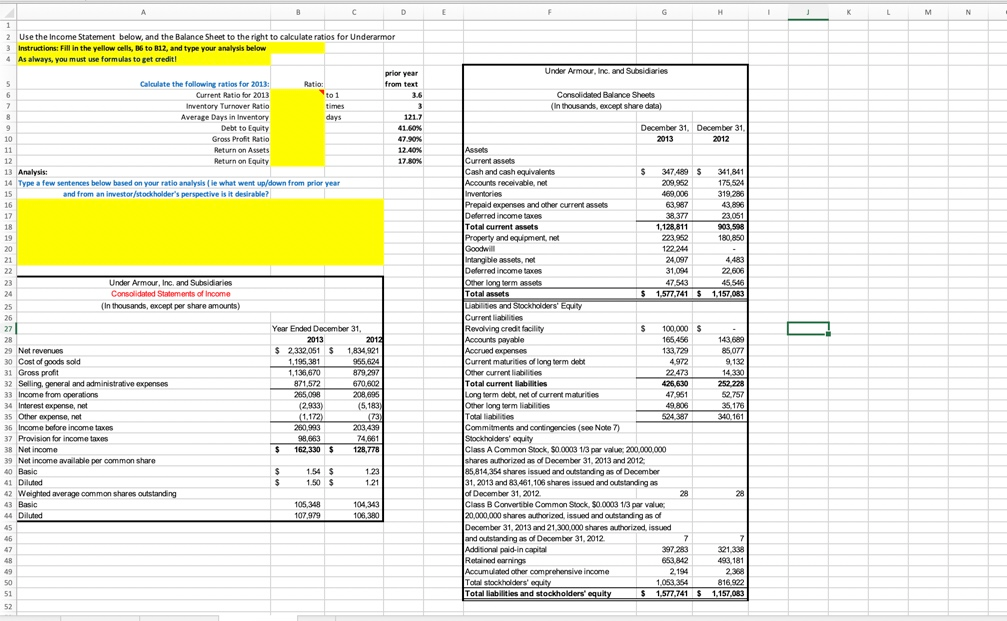

= = = Merge & Center $ % 9 .000 Formatting as Table Styles 03 x fx B C D E F G 1 Instructions: Prepare a Vertical Analysis of Under Armour's Income Statement for the 2 years below. 2 Fill in the yellow boxes You must use formulas with cell references to get credit Name: Under Armour, Inc. and Subsidiaries Consolidated Statements of Income (In thousands, except per share amounts) 11 Net revenues 12 Cost of goods sold 13 Gross profit 14 Selling, general and administrative expenses 15 Income from operations 16 Interest expense, net 17 Other expense, net 18 Income before income taxes 19 Provision for income taxes 20 Net income 21 Net income available per common share 22 Basic 23 Diluted 24 Weighted average common shares outstanding Basic 26 Diluted Year Ended December 31, 2013 Percent (%) 2,332,051 1,195,381 1,136,670 871,572 265,098 (2,933) (1,172) 260,993 98,663 162,330 2012 Percent (%) 1,834,921 955,624 879,297 670,602 208,695 (5,183) (73) 203,439 74,661 128,778 1.54 1.50 1.23 1.21 105,348 107,979 104,343 106,380 E F G H LM 1 Instructions: Complete the yellow cells, you may need to scroll to the right to see all the questions 2 Use formulas for cells D11:E20 Student Name: 3 Type Text for cells M4 to M11 Under Armour, Inc. and Subsidiaries Consolidated Statements of Income (In thousands, except per share amounts) Analysis: Did Net Revenues Increase or Decrease and by what percent? Would you consider this to be a desirable thing if you were an Investor? Did Cost of Goods Sold Increase or Decrease and by what percent? Would you consider this to be a desirable thing if you were an Investor? Did net Income Increase or Decrease and by what percent? Would you consider this to be a desirable thing if you were an Investor? Compare this analysis with the prior two years ( see illustration 12-4 on page 567 of your text) How does the increase in Net Income compare to the the prior years? (ie was there more of an increase or less of an increase compared to the 2012/2011 data?) 11 Net revenues 12 Cost of goods sold 13 Gross profit 14 Selling, general and administrative expenses 15 Income from operations 16 Interest expense, net 17 Other expense, net 18 Income before income taxes 19 Provision for income taxes 20 Net income 21 Net income available per common share 22 Basic 23 Diluted 24 Weighted average common shares outstanding 25 Basic 26 Diluted Year Ended December 31, 2013 2,332,051 $ 1,195,381 1,136,670 871,572 265,098 (2,933) (1,172) 260,993 98,663 162,330 $ Increase 2012 (decrease) 1,834,921 955,624 879,297 670,602 208,695 (5,183) (73) 203,439 74,661 128,778 1.54 $ 1.50 $ 1.23 1.21 105,348 107,979 104,343 106,380 VA of IS HA of IS Ratios + H K L M N 2 Use the Income Statement below, and the Balance Sheet to the right to calculate ratios for Underarmor 3 Instructions: Fill in the yellow cells, B6 to B12, and type your analysis below As always, you must use formulas to get credit! Under Armour, Inc. and Subsidiaries from text Consolidated Balance Sheets (In thousands, except share data) 121.7 Calculate the following ratios for 2013: Current Ratio for 2013 Inventory Turnover Ratio Average Days in Inventory Debt to Equity Gross Profit Ratio Return on Assets Return on Equity 13 Analysis: Type a few sentences below based on your ratio analysis (ie what went up/down from prior year and from an investorstockholder's perspective is it desirable? December 31. December 31, 2013 2012 47. 12.40% 17.80% 341,841 175.524 319 288 43.896 23.051 903.598 180 890 4.483 22.605 45.546 1.157 083 Under Armour, Inc. and Subsidiaries Consolidated Statements of income (In thousands, except per share amounts) Year Ended December 31. 2013 2013 $ 2.332,051 $ 1834921 1.195.381 965.624 1,136 670 879,297 871,572 670,602 265,098 208.695 (2.933) (5.183 (1,172) 260.993 203 439 74.661 162,330 128,778 Current assets Cash and cash equivalents 347 489 $ Accounts receivable, net 209.952 Inventories 489.006 Prepaid expenses and other current assets 63.987 Deferred income taxes 38.377 Total current assets 1,128,811 Property and equipment, net 223952 Goodwill 122.244 Intangible assets, net 24097 Deferred income taxes 31094 Other long term assets Total assets $ 1,577,741 $ Labilities and Stockholders' Equity Current liabilities Revolving credit facility 100,000 $ Accounts payable 165486 Accrued accenses 133 729 Current maturities of long term det 4.972 Other current liabilities 22 473 Total current liabilities 426,630 Long term debt, net of current maturities 47951 Other long term liabilities 49 805 Total liabilities 524 387 Commitments and contingencies (see Note 7) Stockholders' equity Class A Common Stock. $0 0003 1/3 per value: 200.000.000 shares authorized as of December 31, 2013 and 2012 85,814,354 shares issued and outstanding as of December 31, 2013 and 83 461 106 shares issued and outstanding as of December 31, 2012 Class B Convertible Common Stock. $0 0003 1/3 par value 20,000,000 shares authorized, issued and outstanding as of December 31, 2013 and 21,300,000 shares authorized, issued and outstanding as of December 31, 2012 Additional paid in capital 397283 Retained earnings 653842 Accumulated other comprehensive income 2.194 Total stockholders' equity Total liabilities and stockholders' equity $ 1,577,741 $ 141 699 85.077 9.132 14 330 252 228 52.757 35 176 340 161 29 Net revenues 30 Cost of goods sold 31 Gross profit 32 Selling general and administrative expenses 33 Income from operations 34 Interest expense, net 35 Other expense, net 36 Income before income taxes 37 Provision for income taxes 38 Net income 39 Net income available per common share 40 Basic 41 Diluted 42 Weighted average common shares outstanding 43 Basic 64 Diluted (73 1.54 1.50 $ $ 1.23 105,348 107 979 104,343 106,380 221.30 493 181 1,157,083

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts