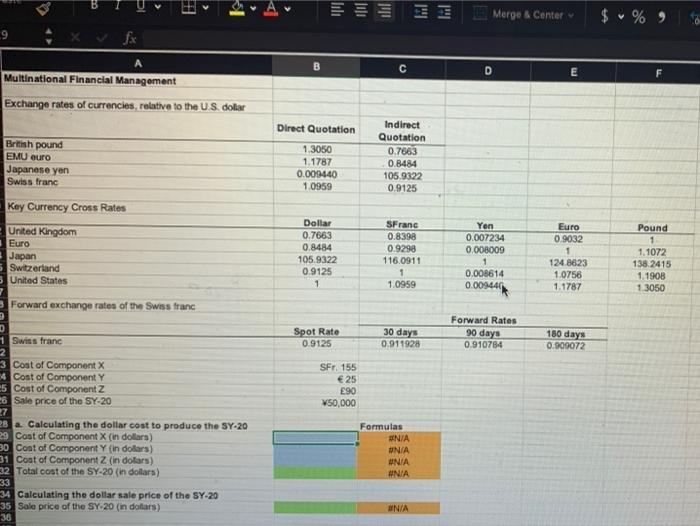

Question: Merge & Center $ % ) 9 A B D E Multinational Financial Management F Exchange rates of currencies, relative to the U.S. dolar Direct

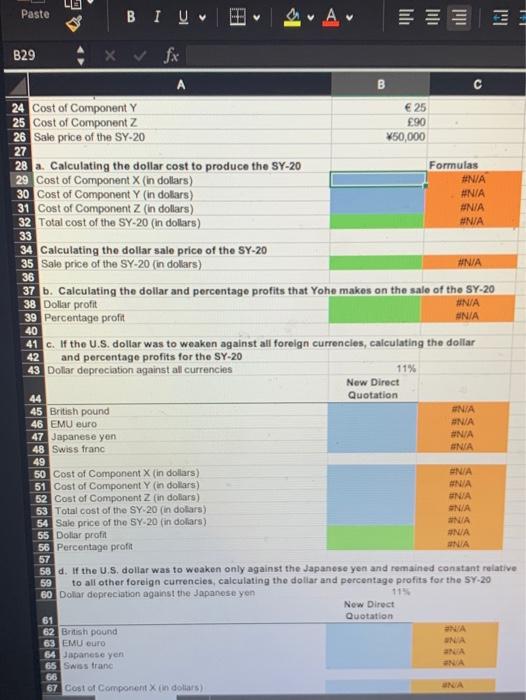

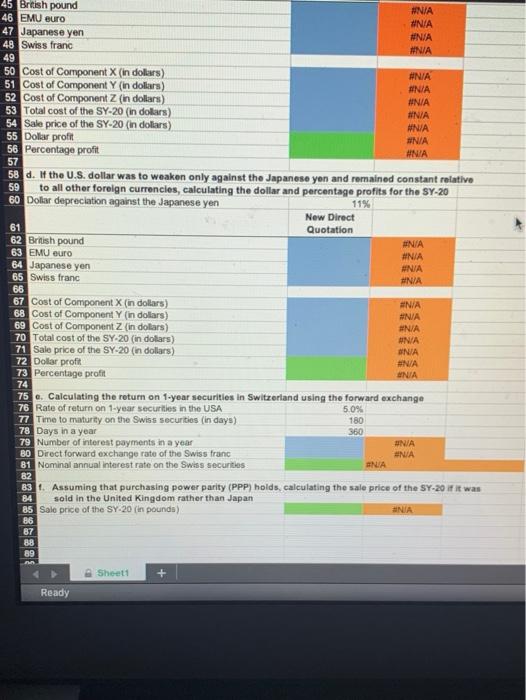

Merge & Center $ % ) 9 A B D E Multinational Financial Management F Exchange rates of currencies, relative to the U.S. dolar Direct Quotation British pound EMU euro Japanese yen Swiss franc 1.3050 1.1787 0.009440 1.0959 Indirect Quotation 0.7663 0.8484 105.9322 0.9125 Key Currency Cross Rates Pound 1 United Kingdom Euro Japan 5 Switzerland United States Dollar 0.7663 0.8484 105.9322 0.9125 SFranc 0.8398 0.9298 116.0911 1 1.0959 Yen 0.007234 0.008009 1 0.008614 0.009440 Euro 0.9032 1 124.8623 1.0756 1.1787 1.1072 138.2415 1.1908 1.3050 1 Forward exchange rates of the Swiss franc Spot Rate 0.9125 30 days 0.911928 Forward Rates 90 days 0.910784 180 days 0.909072 SFr 155 25 90 V50,000 D 1 Swiss franc 2 3 Cost of Component 4 Cost of Component Y 5 Cost of Component z 26 Sale price of the SY-20 27 28 a Calculating the dollar cost to produce the SY-20 29 Cost of Component X (in dollars) 30 Cont of Component Y in dollars) 31 Cost of Component z (in dolars) 332 Total cost of the SY-20 (in dollars) 33 34 Calculating the dollar sale price of the SY-20 35 Sale price of the SY 20 (in dollars) 36 Formulas #N/A UNIA UNIA #NIA #N/A Paste Paste B IV B29 x fx A B 24 Cost of Component Y 25 Cost of Component z 26 Sale price of the SY-20 25 90 450,000 27 Formulas #N/A #N/A N/A #N/A 33 #N/A 36 #N/A N/A 40 42 28 a. Calculating the dollar cost to produce the SY-20 29 Cost of Component X (in dollars) 30 Cost of Component Y in dollars) 31 Cost of Component Z (in dollars) 32 Total cost of the SY-20 (in dollars) 34 Calculating the dollar sale price of the SY-20 35 Sale price of the SY-20 (in dollars) 37 b. Calculating the dollar and percentage profits that Yohe makes on the sale of the SY-20 38 Dollar profit 39 Percentage profit 41 c. If the U.S. dollar was to weaken against all foreign currencies, calculating the dollar and percentage profits for the SY-20 43 Dollar depreciation against all currencies 11% New Direct 44 Quotation 45 British pound 46 EMU euro 47 Japanese yen #N/A 48 Swiss franc ANIA 49 50 Cost of Component X (in dollars) 51 Cost of Component Y (in dollars) NA 52 Cost of Component Zin dollars) NA 53 Total cost of the SY 20 (in dolars) N/A 54 Sale price of the SY-20 (in dolars) NA 55 Dollar profit NA 56 Porcentage profit NA 57 58 d. If the U.S. dollar was to weaken only against the Japanese yen and remained constant relative 59 to all other foreign currencies, calculating the dollar and percentage profits for the SY-29 60 Dollar depreciation against the Japanese yon ANIA #N/A NIA New Direct Quotation NA NA NA 61 62 British pound 63 EMU euro 64 Japanese yen 65 Swiss franc 66 67 Cost of Component X (in dollars) NA UNA #N/A #N/A #N/A #N/A #N/A #N/A #N #N/A #N/A #N/A #NIA 45 British pound 46 EMU euro 47 Japanese yen 48 Swiss franc 49 50 Cost of Component X (in dollars) 51 Cost of Component Y in dollars) 52 Cost of Component Z (in dollars) 53 Total cost of the SY-20 (in dollars) 54 Sale price of the SY-20 (in dollars) 55 Dollar profit 56 Percentage profit 57 58 d. If the U.S. dollar was to weaken only against the Japanese yen and remained constant relative to all other foreign currencies, calculating the dollar and percentage profits for the SY-20 60 Dolar depreciation against the Japanese yen New Direct 61 Quotation 62 British pound 63 EMU euro B4 Japanese yen 65 Swiss franc 66 67 Cost of Component X (in dollars 68 Cost of Component Y (in dollars) 69 Cost of Component Z (in dollars) 70 Total cost of the SY-20 (in dollars) 71 Sale price of the SY-20 (in dollars) 72 Dollar profit 73 Percentage profit 59 11% #N/A #N/A #N/A NIA #N/A #NA #N/A ANIA ONIA #N/A NA 74 75 e. Calculating the return on 1-year securities in Switzerland using the forward exchange 76 Rate of return on 1-year securities in the USA 5.0% 77 Time to maturity on the Swiss Securities (in days) 180 78 Days in a year 360 79 Number of interest payments in a year BO Direct forward exchange rate of the Swiss franc 81 Nominal annual interest rate on the Swiss securities UNIA #N/A NA 82 83. Assuming that purchasing power parity (PPP) holds, calculating the sale price of the SY-20 if it was 85 Salo price of the SY-20 (in pounds) 84 sold in the United Kingdom rather than Japan NA 86 87 8.8 89 Sheet Ready Merge & Center $ % ) 9 A B D E Multinational Financial Management F Exchange rates of currencies, relative to the U.S. dolar Direct Quotation British pound EMU euro Japanese yen Swiss franc 1.3050 1.1787 0.009440 1.0959 Indirect Quotation 0.7663 0.8484 105.9322 0.9125 Key Currency Cross Rates Pound 1 United Kingdom Euro Japan 5 Switzerland United States Dollar 0.7663 0.8484 105.9322 0.9125 SFranc 0.8398 0.9298 116.0911 1 1.0959 Yen 0.007234 0.008009 1 0.008614 0.009440 Euro 0.9032 1 124.8623 1.0756 1.1787 1.1072 138.2415 1.1908 1.3050 1 Forward exchange rates of the Swiss franc Spot Rate 0.9125 30 days 0.911928 Forward Rates 90 days 0.910784 180 days 0.909072 SFr 155 25 90 V50,000 D 1 Swiss franc 2 3 Cost of Component 4 Cost of Component Y 5 Cost of Component z 26 Sale price of the SY-20 27 28 a Calculating the dollar cost to produce the SY-20 29 Cost of Component X (in dollars) 30 Cont of Component Y in dollars) 31 Cost of Component z (in dolars) 332 Total cost of the SY-20 (in dollars) 33 34 Calculating the dollar sale price of the SY-20 35 Sale price of the SY 20 (in dollars) 36 Formulas #N/A UNIA UNIA #NIA #N/A Paste Paste B IV B29 x fx A B 24 Cost of Component Y 25 Cost of Component z 26 Sale price of the SY-20 25 90 450,000 27 Formulas #N/A #N/A N/A #N/A 33 #N/A 36 #N/A N/A 40 42 28 a. Calculating the dollar cost to produce the SY-20 29 Cost of Component X (in dollars) 30 Cost of Component Y in dollars) 31 Cost of Component Z (in dollars) 32 Total cost of the SY-20 (in dollars) 34 Calculating the dollar sale price of the SY-20 35 Sale price of the SY-20 (in dollars) 37 b. Calculating the dollar and percentage profits that Yohe makes on the sale of the SY-20 38 Dollar profit 39 Percentage profit 41 c. If the U.S. dollar was to weaken against all foreign currencies, calculating the dollar and percentage profits for the SY-20 43 Dollar depreciation against all currencies 11% New Direct 44 Quotation 45 British pound 46 EMU euro 47 Japanese yen #N/A 48 Swiss franc ANIA 49 50 Cost of Component X (in dollars) 51 Cost of Component Y (in dollars) NA 52 Cost of Component Zin dollars) NA 53 Total cost of the SY 20 (in dolars) N/A 54 Sale price of the SY-20 (in dolars) NA 55 Dollar profit NA 56 Porcentage profit NA 57 58 d. If the U.S. dollar was to weaken only against the Japanese yen and remained constant relative 59 to all other foreign currencies, calculating the dollar and percentage profits for the SY-29 60 Dollar depreciation against the Japanese yon ANIA #N/A NIA New Direct Quotation NA NA NA 61 62 British pound 63 EMU euro 64 Japanese yen 65 Swiss franc 66 67 Cost of Component X (in dollars) NA UNA #N/A #N/A #N/A #N/A #N/A #N/A #N #N/A #N/A #N/A #NIA 45 British pound 46 EMU euro 47 Japanese yen 48 Swiss franc 49 50 Cost of Component X (in dollars) 51 Cost of Component Y in dollars) 52 Cost of Component Z (in dollars) 53 Total cost of the SY-20 (in dollars) 54 Sale price of the SY-20 (in dollars) 55 Dollar profit 56 Percentage profit 57 58 d. If the U.S. dollar was to weaken only against the Japanese yen and remained constant relative to all other foreign currencies, calculating the dollar and percentage profits for the SY-20 60 Dolar depreciation against the Japanese yen New Direct 61 Quotation 62 British pound 63 EMU euro B4 Japanese yen 65 Swiss franc 66 67 Cost of Component X (in dollars 68 Cost of Component Y (in dollars) 69 Cost of Component Z (in dollars) 70 Total cost of the SY-20 (in dollars) 71 Sale price of the SY-20 (in dollars) 72 Dollar profit 73 Percentage profit 59 11% #N/A #N/A #N/A NIA #N/A #NA #N/A ANIA ONIA #N/A NA 74 75 e. Calculating the return on 1-year securities in Switzerland using the forward exchange 76 Rate of return on 1-year securities in the USA 5.0% 77 Time to maturity on the Swiss Securities (in days) 180 78 Days in a year 360 79 Number of interest payments in a year BO Direct forward exchange rate of the Swiss franc 81 Nominal annual interest rate on the Swiss securities UNIA #N/A NA 82 83. Assuming that purchasing power parity (PPP) holds, calculating the sale price of the SY-20 if it was 85 Salo price of the SY-20 (in pounds) 84 sold in the United Kingdom rather than Japan NA 86 87 8.8 89 Sheet Ready

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts