Question: merger, acquisition and other restructuring activities. i need the answer of the question a and c Y vow-v v uvo Stay, Inc. is considering the

merger, acquisition and other restructuring activities.

i need the answer of the question a and c

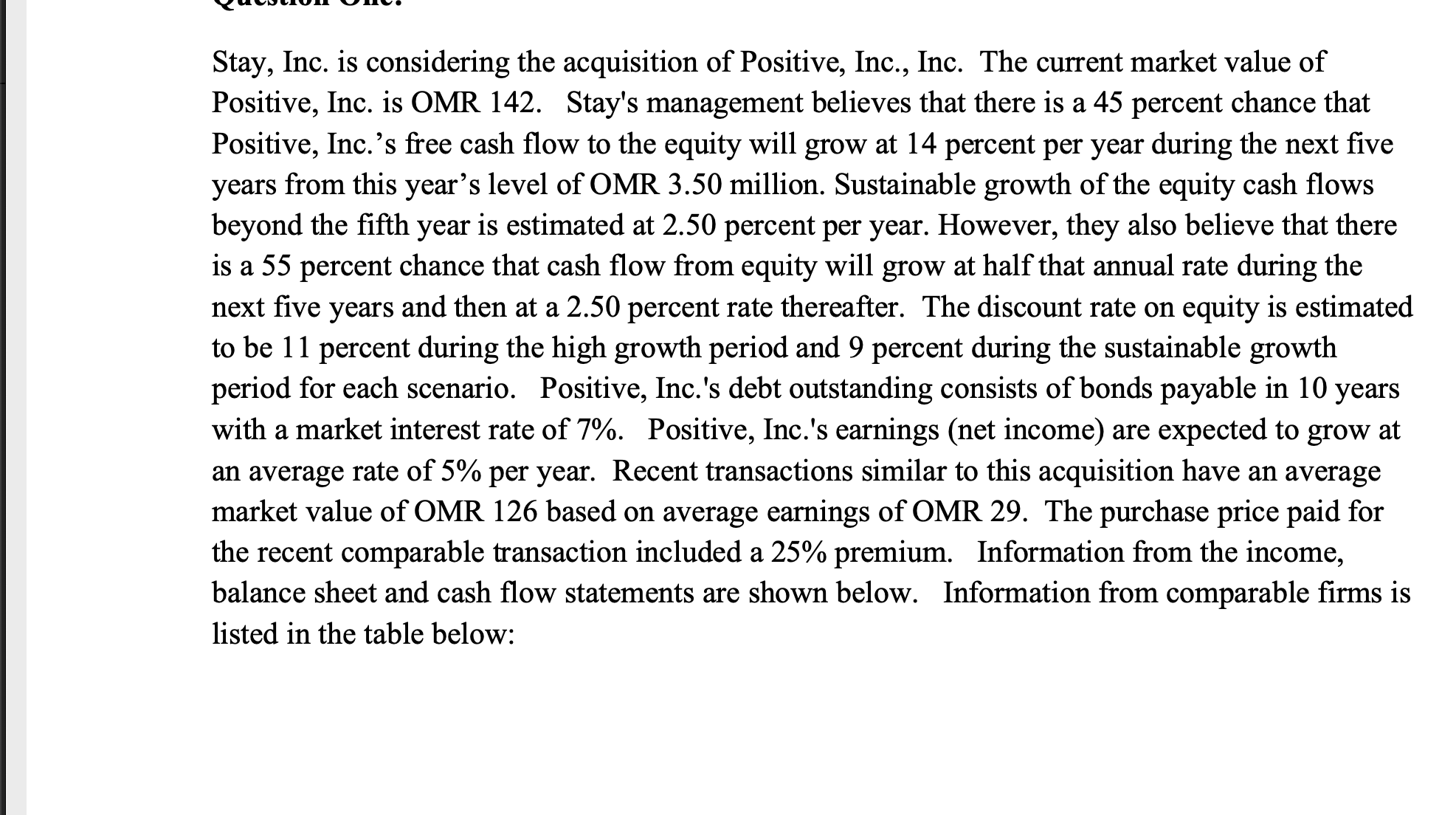

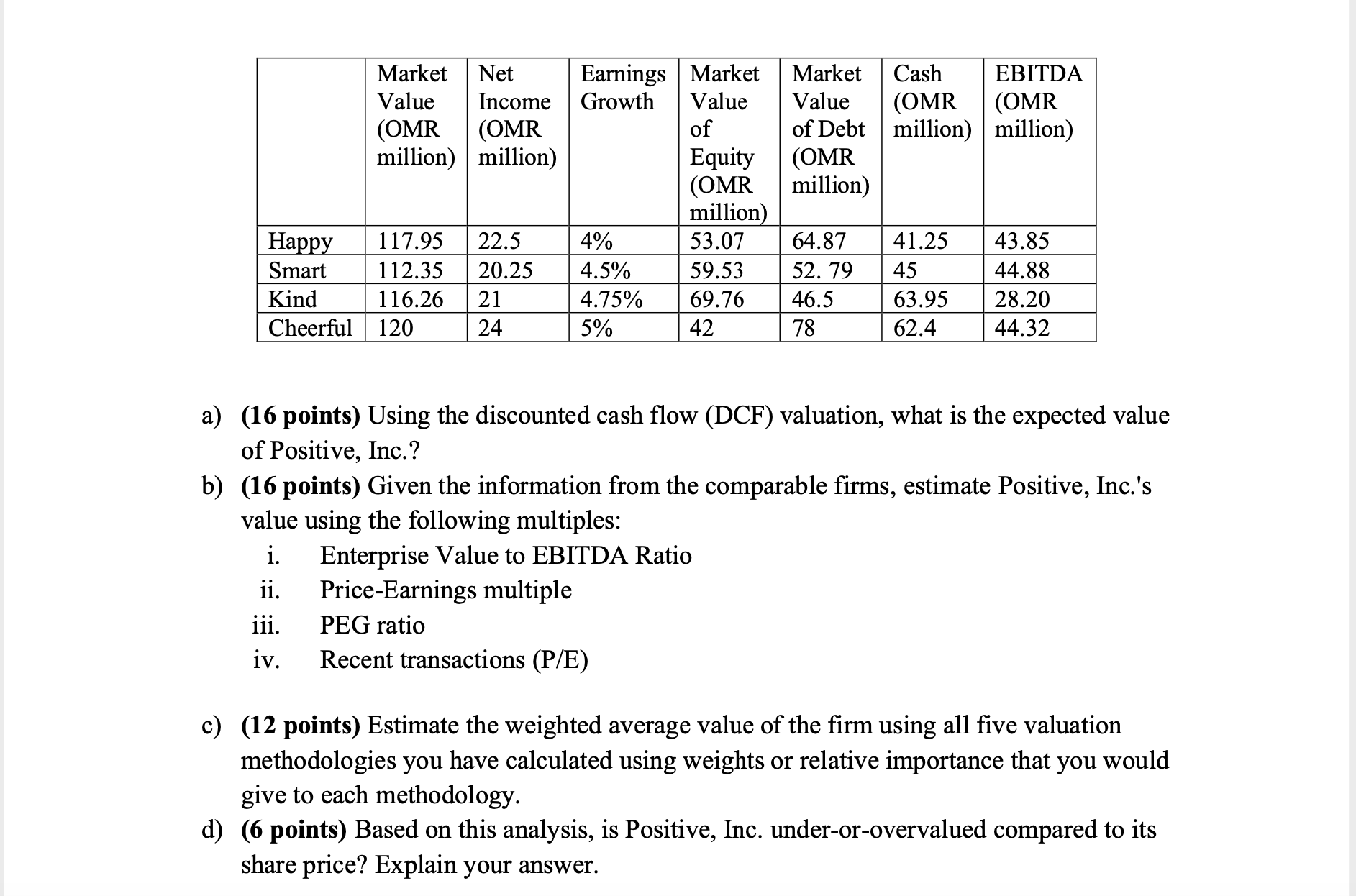

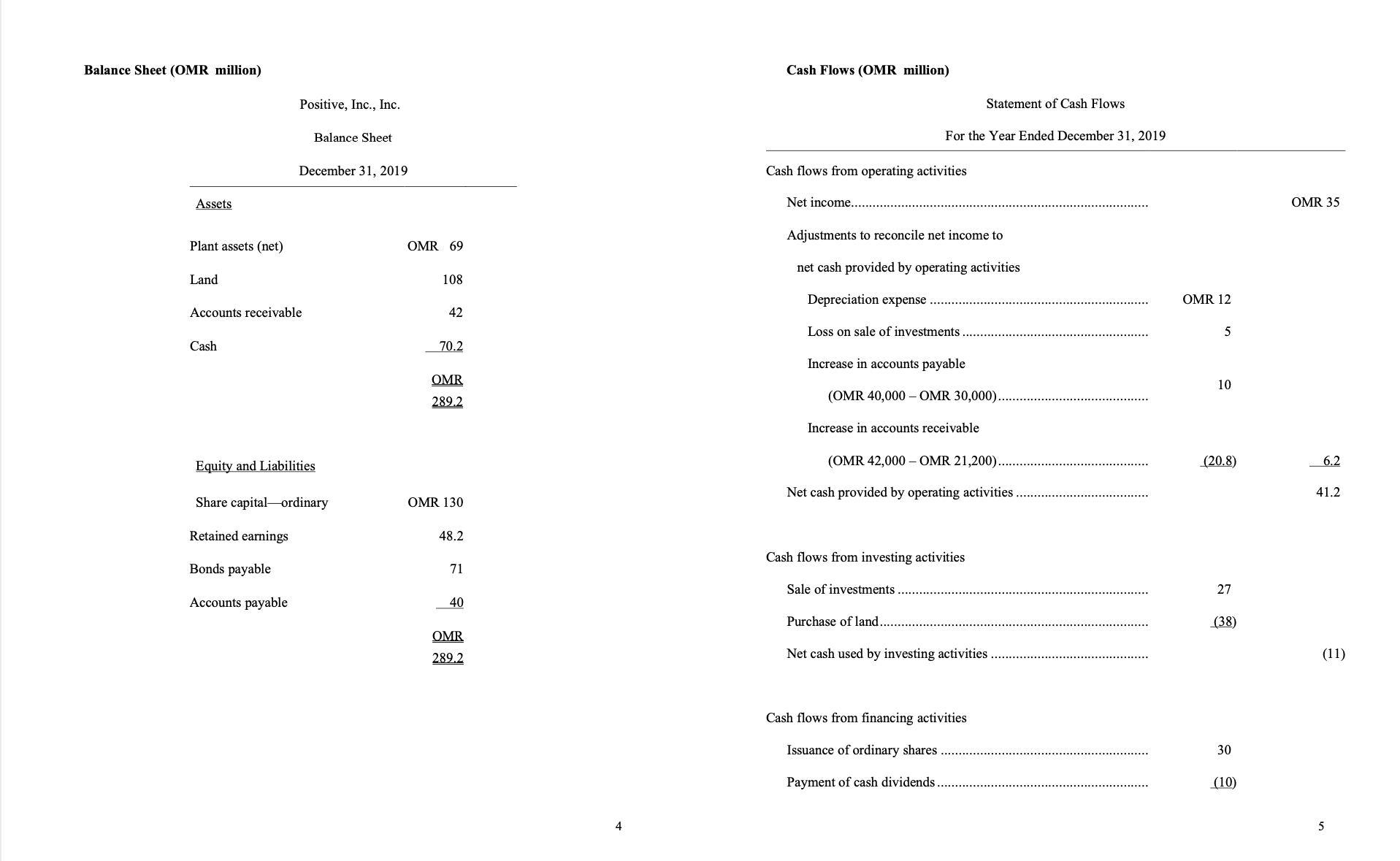

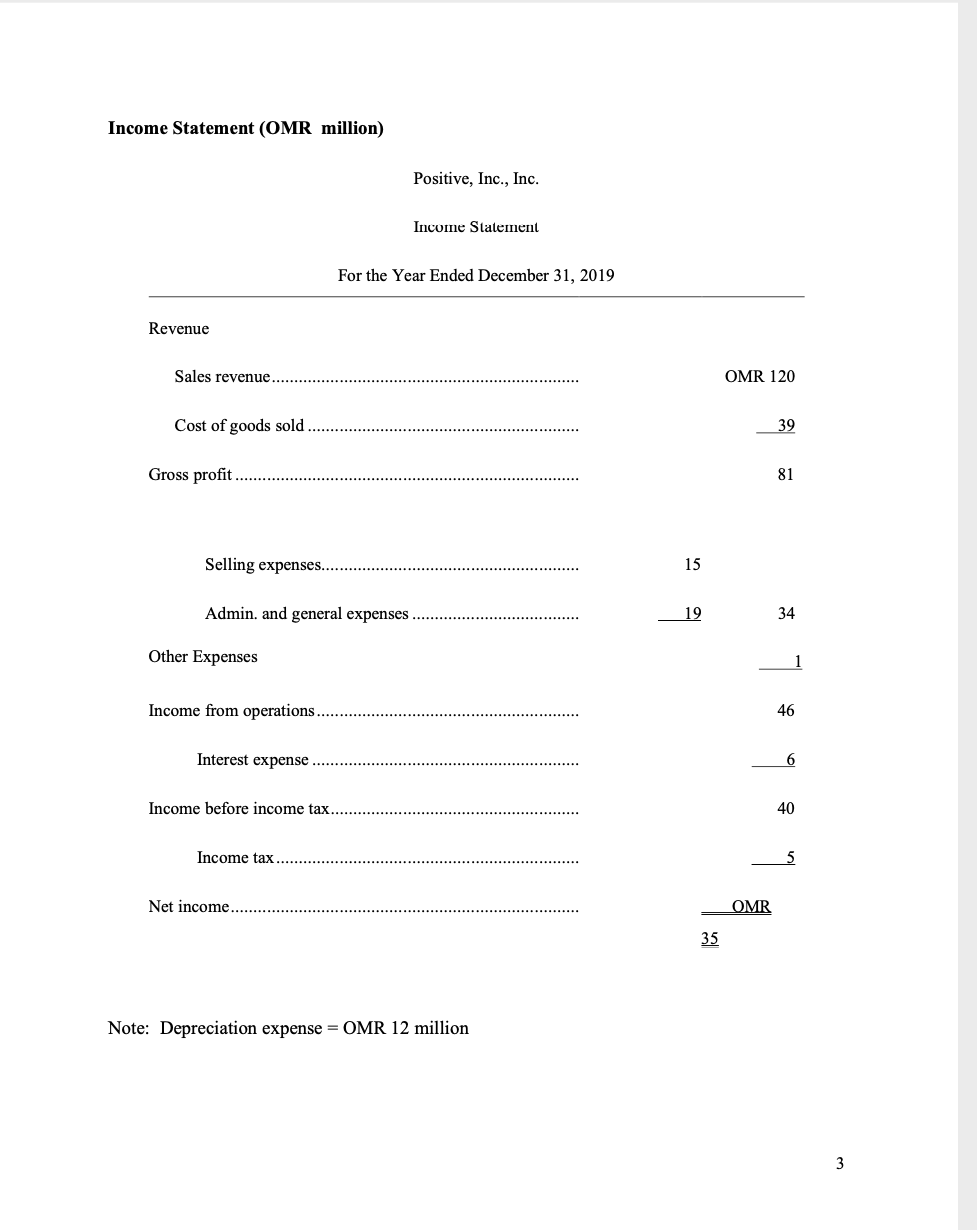

Y \"vow-v\" v uvo Stay, Inc. is considering the acquisition of Positive, Inc., Inc. The current market value of Positive, Inc. is OMR 142. Stay's management believes that there is a 45 percent chance that Positive, Inc.'s ee cash ow to the equity will grow at 14 percent per year during the next ve years from this year's level of OMR 3.50 million. Sustainable growth of the equity cash ows beyond the fth year is estimated at 2.50 percent per year. However, they also believe that there is a 55 percent chance that cash ow from equity will grow at half that annual rate during the next ve years and then at a 2.50 percent rate thereafter. The discount rate on equity is estimated to be 1 1 percent during the high growth period and 9 percent during the sustainable grth period for each scenario. Positive, Inc's debt outstanding consists of bonds payable in 10 years with a market interest rate of 7%. Positive, Inc.'s earnings (net income) are expected to grow at an average rate of 5% per year. Recent transactions similar to this acquisition have an average market value of OMR 126 based on average earnings of DIVER 29. The purchase price paid for the recent comparable transaction included a 25% premium. Information from the income, balance sheet and cash ow statements are shown below. Information from comparable rms is listed in the table below: b) d) Market Net Earnings Market Market Cash EBITDA Value Income Growth Value Value (OMR (OMR (OMR (OMR of of Debt million) million) million) million) Equity (OMR Happy 117.95 22.5 53.07 64.87 41.25 Smart 112.35 20.25 59.53 52. 79 45 Kind 116.26 21 69.76 46.5 63.95 . Cheerful 120 24 5% 42 78 62.4 44.32 (16 points) Using the discounted cash ow (DCF) valuation, what is the expected value of Positive, Inc? (16 points) Given the information from the comparable rms, estimate Positive, Inc.'s value using the following multiples: i. Enterprise Value to EBIT DA Ratio ii. Price-Earnings multiple iii. PEG ratio iv. Recent transactions (P/E) (12 points) Estimate the weighted average value of the rm using all ve valuation methodologies you have calculated using weights or relative importance that you would give to each methodology. (6 points) Based on this analysis, is Positive, Inc. underorovervalued compared to its share price? Explain your answer. Balance Sheet (OMR million) Cash Flows (OMR million) Positive, Inc., Inc. Statement of Cash Flows Balance Sheet For the Year Ended December 31, 2019 December 31, 2019 Cash flows from operating activities Assets Net income........... OMR 35 Plant assets (net) OMR 69 Adjustments to reconcile net income to net cash provided by operating activities Land 108 OMR 12 Accounts receivable 42 Depreciation expense ......... Loss on sale of investments ........................"; 5 Cash 70.2 Increase in accounts payable OMR 10 289.2 (OMR 40,000 - OMR 30,000) ... Increase in accounts receivable Equity and Liabilities (OMR 42,000 - OMR 21,200) ..........";;;"; (20.8) 6.2 41.2 Share capital-ordinary OMR 130 Net cash provided by operating activities ..............................".".". Retained earnings 48.2 Bonds payable 71 Cash flows from investing activities Sale of investments ........... 27 Accounts payable 40 Purchase of land........ (38 ) OMR 289.2 Net cash used by investing activities ..............................."..."; (11) Cash flows from financing activities Issuance of ordinary shares ..................... 30 Payment of cash dividends .. (10) 5Income Statement (OMR million) Positive, Inc., Inc. Income Statement For the Year Ended December 31, 2019 Revenue Sales revenue ...... OMR 120 Cost of goods sold .... 39 Gross profit ..... 81 Selling expenses...... 15 Admin. and general expenses ............................" 19 34 Other Expenses 1 Income from operations .... 46 Interest expense .... Income before income tax....................."; 40 Income tax ..... 5 Net income...... OMR 35 Note: Depreciation expense = OMR 12 million