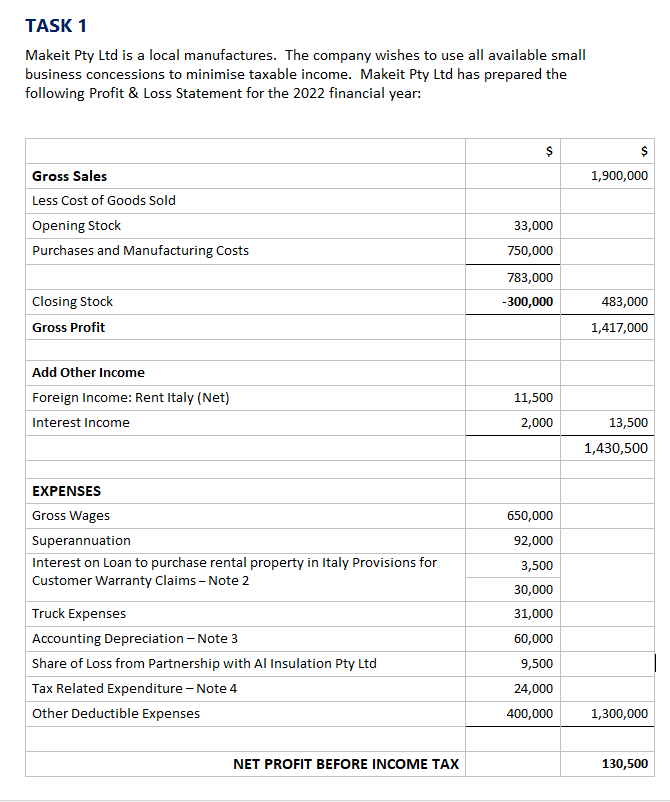

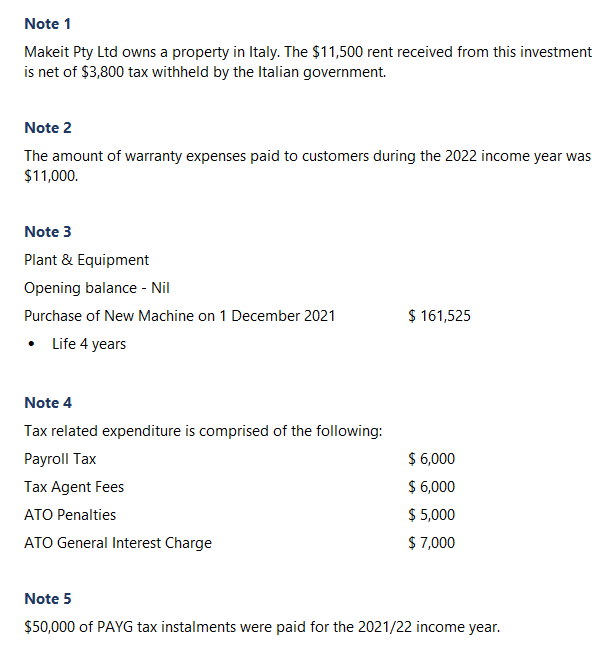

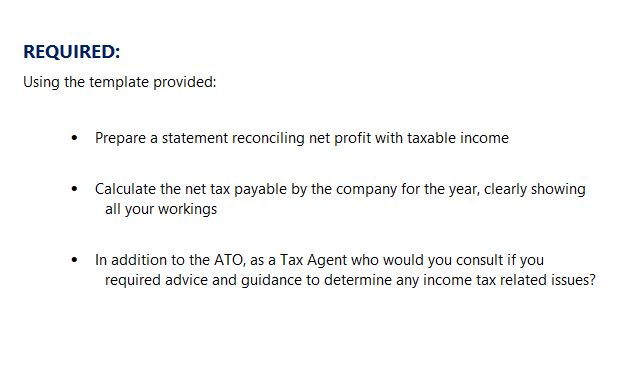

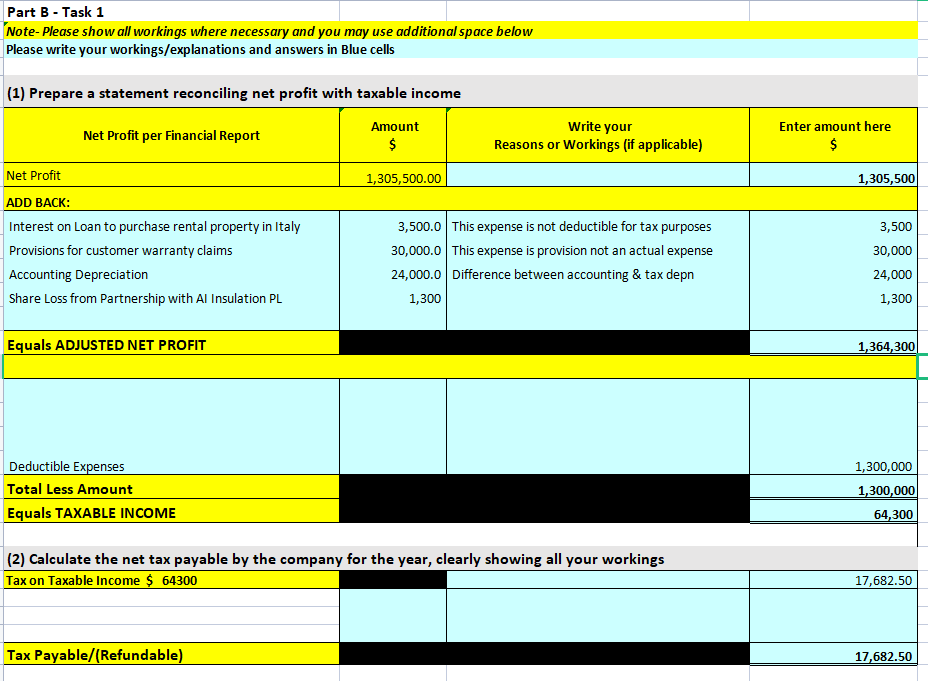

Question: ffREQUIRED: Using the template proyided: I Prepare a statement reconciling net profit with taxable income I Calculate the net tam: payable by the company for

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts