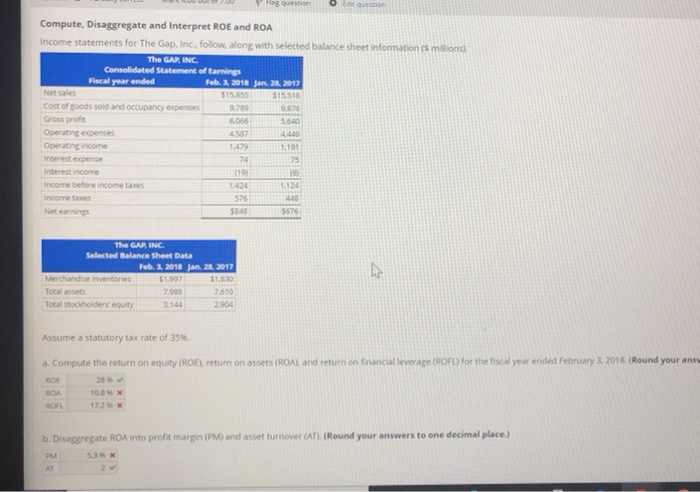

Question: Mes question oot Compute, Disaggregate and interpret ROE and ROA Income statements for The Gap, Inc., follow along with selected balance sheet information (5 millons

Mes question oot Compute, Disaggregate and interpret ROE and ROA Income statements for The Gap, Inc., follow along with selected balance sheet information (5 millons The GAP.INC Consolidated Statement of Earnings Fiscal year ended Feb. 2018 Jan. 24. 2017 Net sales $15.855 515516 Cost of goods sold and occupancy expenses 9.79 9.828 Gross profit 6.06 5.6.00 Operating expenses 452 Operating income 1:49 1.191 interest Expense 74 7 Interest income (19 Income before income taxes 1.124 Income taxes 576 Net earnings 5576 The GAP, INC Selected Balance Sheet Data Feb. 2. 2018 Jan 21, 2017 Merchandise inventories 513 Tots assets 7.90 7.610 Total stockholders' equity 2.904 Assume a statutory tax rate of 35% a. Compute the return on equity (ROE), return on assets (ROA), and return on financial leverage (ORL) for the fiscal year ended February 3, 2018. (Round your ans Rot ROA 10.8 ROR 17.2 X b. Disaggregate ROA into profit margin (PM) and asset turnover (AT) (Round your answers to one decimal place.) PM 53X AT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts