Question: Method 1 would most likely not be an appropriate valuation technique for the bond issued by: A Peaton Scorpio Motors . B Luna y Estrellas

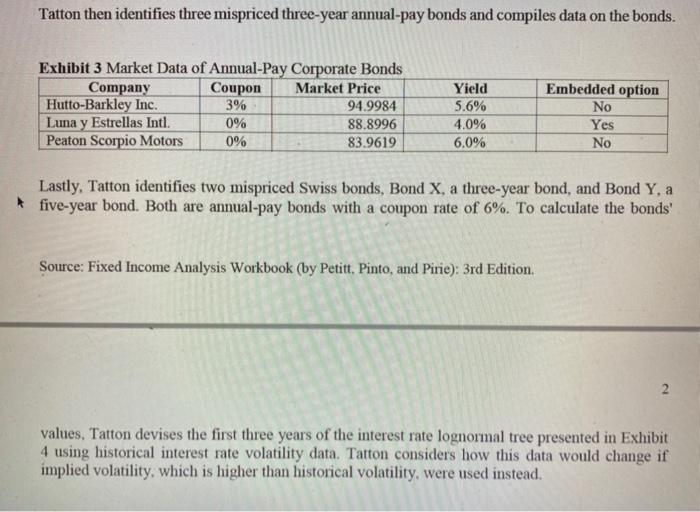

Method 1 would most likely not be an appropriate valuation technique for the bond issued by: A Peaton Scorpio Motors . B Luna y Estrellas Intl. C Hutto - Barkley Inc. Tatton then identifies three mispriced three-year annual-pay bonds and compiles data on the bonds. Exhibit 3 Market Data of Annual-Pay Corporate Bonds Company Coupon Market Price Hutto-Barkley Inc. 3% 94.9984 Luna y Estrellas Intl. 0% 88.8996 Peaton Scorpio Motors 0% 83.9619 Yield 5.6% 4.0% 6.0% Embedded option No Yes No Lastly, Tatton identifies two mispriced Swiss bonds, Bond X, a three-year bond, and Bond Y. a five-year bond. Both are annual-pay bonds with a coupon rate of 6%. To calculate the bonds' Source: Fixed Income Analysis Workbook (by Petitt. Pinto, and Pirie): 3rd Edition. 2 values, Tatton devises the first three years of the interest rate lognormal tree presented in Exhibit 4 using historical interest rate volatility data. Tatton considers how this data would change if implied volatility, which is higher than historical volatility, were used instead. Method 1 would most likely not be an appropriate valuation technique for the bond issued by: A Peaton Scorpio Motors . B Luna y Estrellas Intl. C Hutto - Barkley Inc. Tatton then identifies three mispriced three-year annual-pay bonds and compiles data on the bonds. Exhibit 3 Market Data of Annual-Pay Corporate Bonds Company Coupon Market Price Hutto-Barkley Inc. 3% 94.9984 Luna y Estrellas Intl. 0% 88.8996 Peaton Scorpio Motors 0% 83.9619 Yield 5.6% 4.0% 6.0% Embedded option No Yes No Lastly, Tatton identifies two mispriced Swiss bonds, Bond X, a three-year bond, and Bond Y. a five-year bond. Both are annual-pay bonds with a coupon rate of 6%. To calculate the bonds' Source: Fixed Income Analysis Workbook (by Petitt. Pinto, and Pirie): 3rd Edition. 2 values, Tatton devises the first three years of the interest rate lognormal tree presented in Exhibit 4 using historical interest rate volatility data. Tatton considers how this data would change if implied volatility, which is higher than historical volatility, were used instead

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts