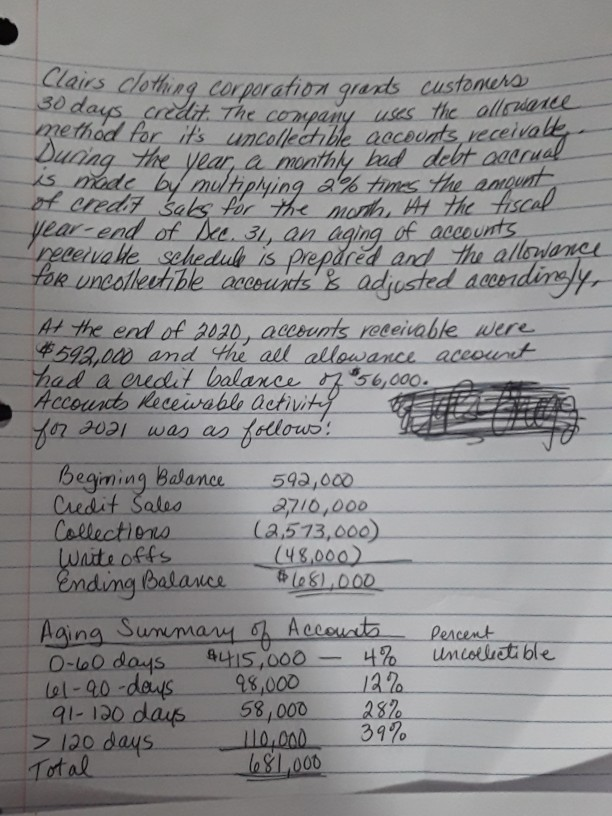

Question: method for it's uncollech ble accounts recent Duding the multiplying 2% times the amount clairs clothing corporation grands customers a monthly bad debt of credit

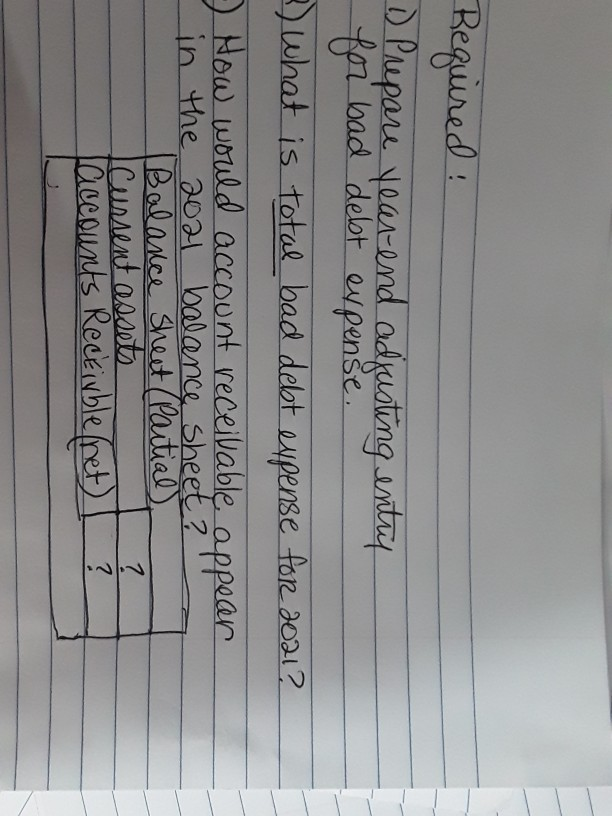

method for it's uncollech ble accounts recent Duding the multiplying 2% times the amount clairs clothing corporation grands customers a monthly bad debt of credit sals for the north, Ai the fiscal year end of sec. 31, an aging of accounts for unesiketi be accounts' adjusted accordingly, pecetvelte schedule is prepared and the allowance At the end of 2020, accounts receivable were 4592,000 and the all allowance account had a credit balance of 56,000. Account Recewable Activity for 2001 was as follows? Begiming Balance 592,000 Credit Sales 2710,000 Collections (2,573,000) Write offs (48,000) Ending Balance $68,000 Aging Summary of Accounts 0-60 days $415,000 4% Uncollectible 61-90 days 98,000 12% 91-120 days 58,000 28% > 120 days 110.000 39% Total 681,000 percent Required: 1) Prepare year and adjusting entry for bad debt expense. 2) What is total bad debt expense for 2021? ) How would account receivable appear in the 2021 balance sheet? Balance sheet (Partial) Current assets Laccounts Receivble (net)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts