Question: Metrics Standard Internal Control Import Controls 1. Documented Procedures Each operating unit must have written procedures in place to ensure compliance with applicable laws and

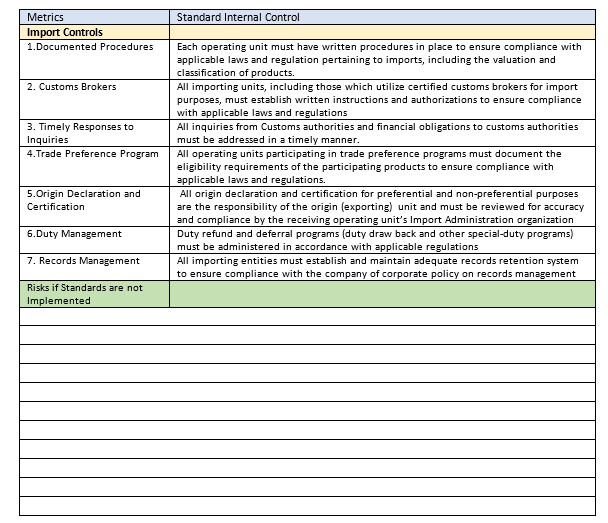

Metrics Standard Internal Control Import Controls 1. Documented Procedures Each operating unit must have written procedures in place to ensure compliance with applicable laws and regulation pertaining to imports, including the valuation and classification of products. 2. Customs Brokers All importing units, including those which utilize certified customs brokers for import purposes, must establish written instructions and authorizations to ensure compliance with applicable laws and regulations 3. Timely Responses to All inquiries from Customs authorities and financial obligations to customs authorities Inquiries must be addressed in a timely manner. 4. Trade Preference Program All operating units participating in trade preference programs must document the eligibility requirements of the participating products to ensure compliance with applicable laws and regulations. 5. Origin Declaration and All origin declaration and certification for preferential and non-preferential purposes Certification are the responsibility of the origin (exporting) unit and must be reviewed for accuracy and compliance by the receiving operating unit's Import Administration organization 6. Duty Management Duty refund and deferral programs (duty draw back and other special-duty programs) must be administered in accordance with applicable regulations 7. Records Management All importing entities must establish and maintain adequate records retention system to ensure compliance with the company of corporate policy on records management Risks if Standards are not Implemented

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts