Question: mework 5: Chap 13,14,19 Saved Help Save & Exit Sub Check my wo 35 Vernon Glass Company has $20 million in 10 percent, $1000 par

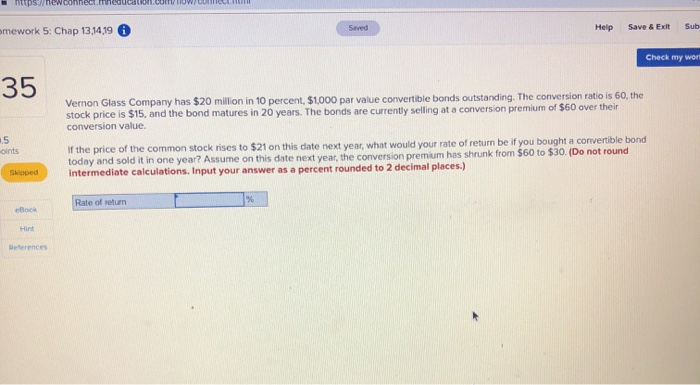

mework 5: Chap 13,14,19 Saved Help Save & Exit Sub Check my wo 35 Vernon Glass Company has $20 million in 10 percent, $1000 par value convertible bonds outstanding. The conversion ratio is 60, the stock price is $15, and the bond matures in 20 years. The bonds are currently selling at a conversion premium of $60 over their conversion value. oints If the price of the common stock rises to $21 on this date next year, what would your rate of return be if you bought a convertible bond today and sold it in one year? Assume on this date next year, the conversion premium has shrunk from $60 to $30. (Do not round intermediate calculations. Input your answer as a percent rounded to 2 decimal places.) Soped Rate of return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts