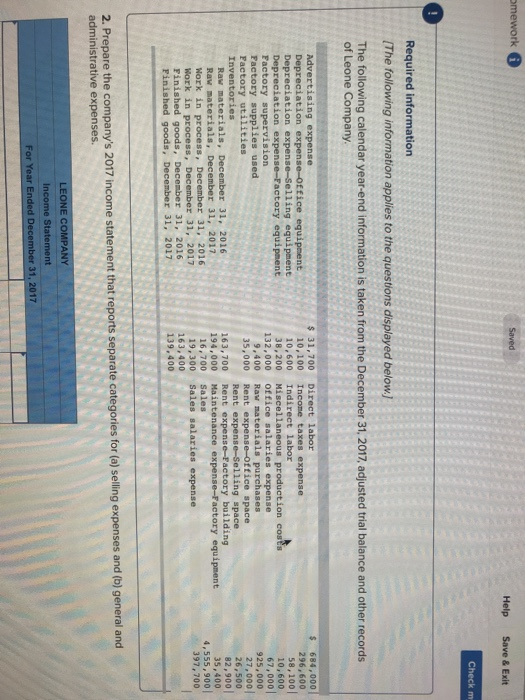

Question: mework Help Save & Exit Check m Required information (The following information applies to the questions displayed below] The following calendar year-end information is taken

![information applies to the questions displayed below] The following calendar year-end information](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66eaa745a7b54_27766eaa7450c1b5.jpg)

mework Help Save & Exit Check m Required information (The following information applies to the questions displayed below] The following calendar year-end information is taken from the December 31, 2017, adjusted trial balance and other records of Leone Company. Advertising expense Depreciation expense-office equipment Depreciation expense-Selling equipment Depreciation expense-Factory equipment Factory supervision Factory supplies used Factory utilities $ 31,700 Direct labor $ 684,000 296,600 58,100 10,600 67,000 925,000 27,000 26,500 82,900 35,400 4,555,900 397,700 10,100 Income taxes expense 10,600 Indirect labor 132,000 office salaries expense 35,000 Rent expense-office space Rent expense-Selling space Raw materials, December 31, 2016 163,700 Rent expense-Factory building 194,000 Maintenance expense-Factory equipment 16,700 Sales Work in process, December 31, 2016 Work in process, December 31, 2017 Finished goods, December 31, 2016 Finished goods, December 31, 2017 163,400 139,400 2. Prepare the company's 2017 income statement that reports separate categories for (o) selling expenses and (b) general ard administrative expenses. LEONE COMPANY Income Statement For Year Ended De 31, 2017 Income Statement and

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts