Question: mExam - Protected View - Saved to this PC- Search Mailings Review View Help Jnless you need to edit, it's safer to stay in Protected

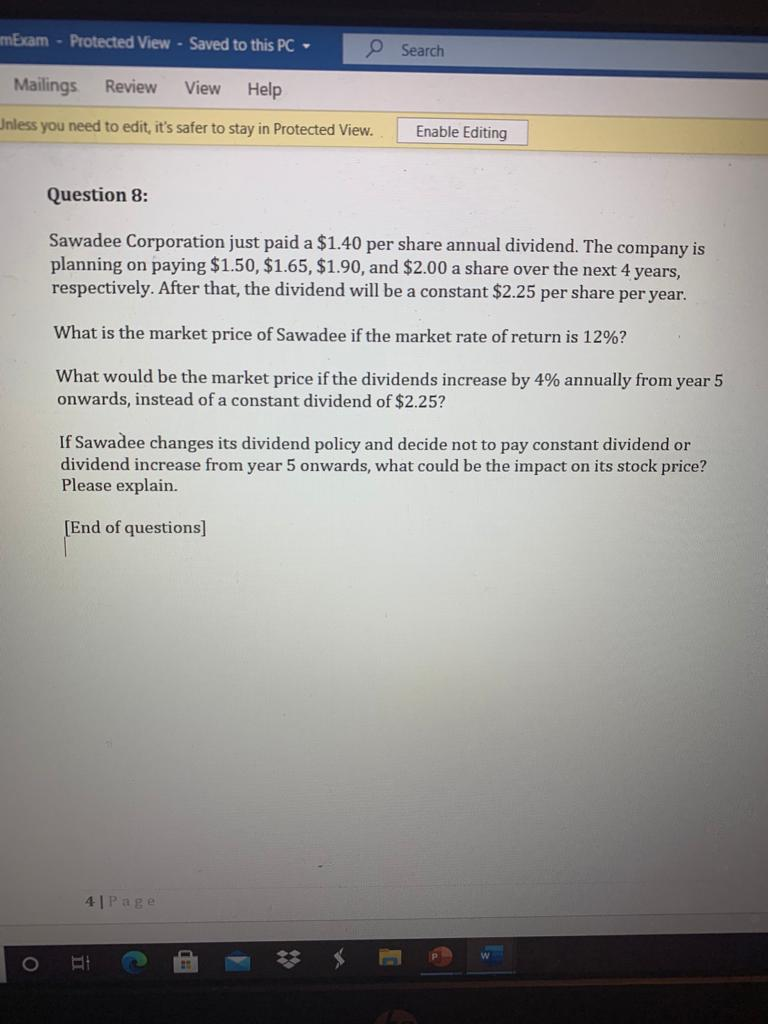

mExam - Protected View - Saved to this PC- Search Mailings Review View Help Jnless you need to edit, it's safer to stay in Protected View. Enable Editing Question 8: Sawadee Corporation just paid a $1.40 per share annual dividend. The company is planning on paying $1.50, $1.65, $1.90, and $2.00 a share over the next 4 years, respectively. After that, the dividend will be a constant $2.25 per share per year. What is the market price of Sawadee if the market rate of return is 12%? What would be the market price if the dividends increase by 4% annually from year 5 onwards, instead of a constant dividend of $2.25? If Sawadee changes its dividend policy and decide not to pay constant dividend or dividend increase from year 5 onwards, what could be the impact on its stock price? Please explain. [End of questions] 4 Page E

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts