Question: MGT 1 2 1 8 Inventory & Materials Management Assignment 1 Amalgamated Fenderdenter's sales are $ 1 2 million. The company spends $ 3 .

MGT Inventory & Materials Management Assignment

Amalgamated Fenderdenter's sales are $ million. The company spends $ million for purchase of direct materials and $ million for direct labor; overhead is $ million and profit is $ million. Direct labor and direct material vary directly with sales, but overhead does not. The company wants to increase its profit by

a By how much should the firm increase annual sales?

b By how much should the firm decrease material costs?

c By how much should the firm decrease labor cost?

Assume the following transactions have occurred regarding a specific SKU in :

Ending inventory in of units valued at $

January purchased units at $ per unit

January sold units at $ per unit

February sold units at $ per unit

March purchased units at $ per unit

March sold units at $ per unit

April sold units at $ per unit

May sold units at $ per unit

June purchased units at $ per unit

July sold units at $ per unit

August purchased units at $ per unit

October sold units at $ per unit

Determine the ending inventory and cost of goods sold using the three methods of inventory valuation: FIFO, LIFO, and weighted average method.

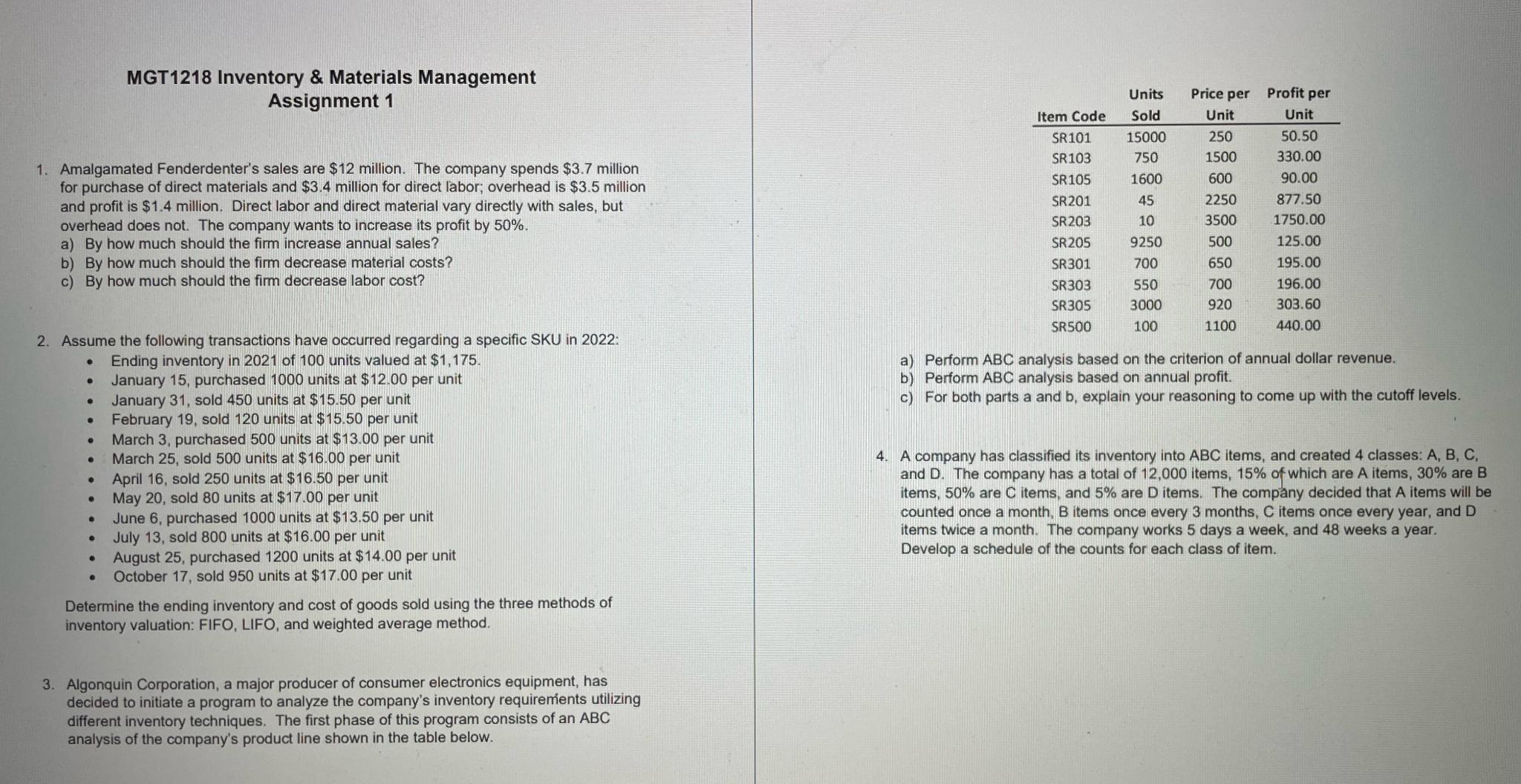

Algonquin Corporation, a major producer of consumer electronics equipment, has decided to initiate a program to analyze the company's inventory requiremients utilizing different inventory techniques. The first phase of this program consists of an ABC analysis of the company's product line shown in the table below.

tableItem Code,tableUnitsSoldtablePrice perUnittableProfit perUnitSRSRSRSRSRSRSRSRSRSR

a Perform ABC analysis based on the criterion of annual dollar revenue.

b Perform ABC analysis based on annual profit.

c For both parts a and b explain your reasoning to come up with the cutoff levels.

A company has classified its inventory into ABC items, and created classes: and D The company has a total of items, of which are A items, are B items, are items, and are items. The company decided that A items will be counted once a month, B items once every months, items once every year, and D items twice a month. The company works days a week, and weeks a year.

Develop a schedule of the counts for each class of item.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock