Question: Michael Canton works for a small company called the Epic Company. He's the manager. The company provides Web design and computer consulting services. The

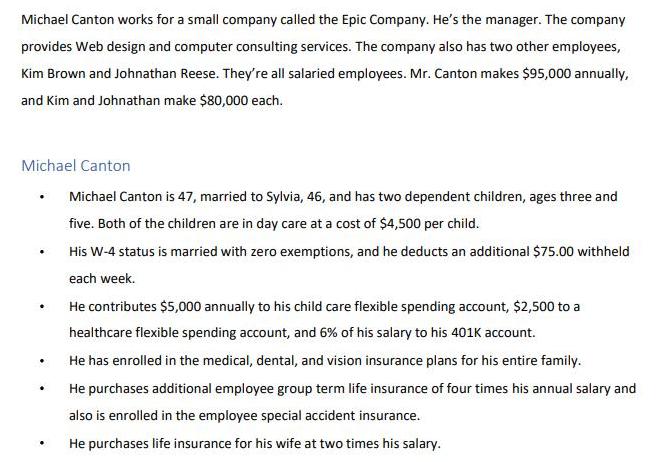

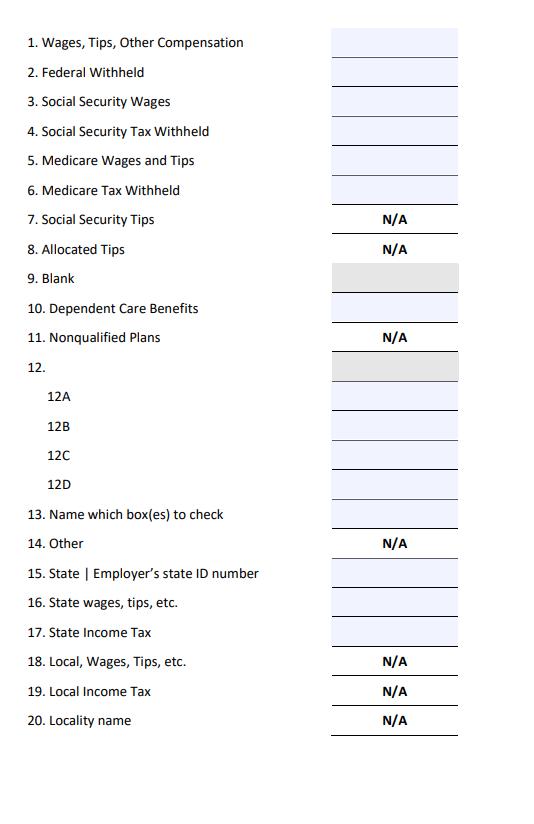

Michael Canton works for a small company called the Epic Company. He's the manager. The company provides Web design and computer consulting services. The company also has two other employees, Kim Brown and Johnathan Reese. They're all salaried employees. Mr. Canton makes $95,000 annually, and Kim and Johnathan make $80,000 each. Michael Canton Michael Canton is 47, married to Sylvia, 46, and has two dependent children, ages three and five. Both of the children are in day care at a cost of $4,500 per child. His W-4 status is married with zero exemptions, and he deducts an additional $75.00 withheld each week. . . . . . . He contributes $5,000 annually to his child care flexible spending account, $2,500 to a healthcare flexible spending account, and 6% of his salary to his 401K account. He has enrolled in the medical, dental, and vision insurance plans for his entire family. He purchases additional employee group term life insurance of four times his annual salary and also is enrolled in the employee special accident insurance. He purchases life insurance for his wife at two times his salary. Calculate the answers for Michael Canton's W-2 and give an explanation for each 1. Wages, Tips, Other Compensation 2. Federal Withheld 3. Social Security Wages 4. Social Security Tax Withheld 5. Medicare Wages and Tips 6. Medicare Tax Withheld 7. Social Security Tips 8. Allocated Tips 9. Blank 10. Dependent Care Benefits 11. Nonqualified Plans 12. 12A 12B 12C 12D 13. Name which box(es) to check 14. Other 15. State | Employer's state ID number 16. State wages, tips, etc. 17. State Income Tax 18. Local, Wages, Tips, etc. 19. Local Income Tax 20. Locality name N/A N/A N/A N/A N/A N/A N/A

Step by Step Solution

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Michael Cantons W2 Calculation 1 Wages Tips and Other Compensation Annual Salary 95000 Subtract 401K contribution 95000 6 5700 Subtract Child Care FSA ... View full answer

Get step-by-step solutions from verified subject matter experts