Question: Practice Set 2-is the basis for Project Set 3 and your Project. Michael Canton works for a small company called the Epic Company. He is

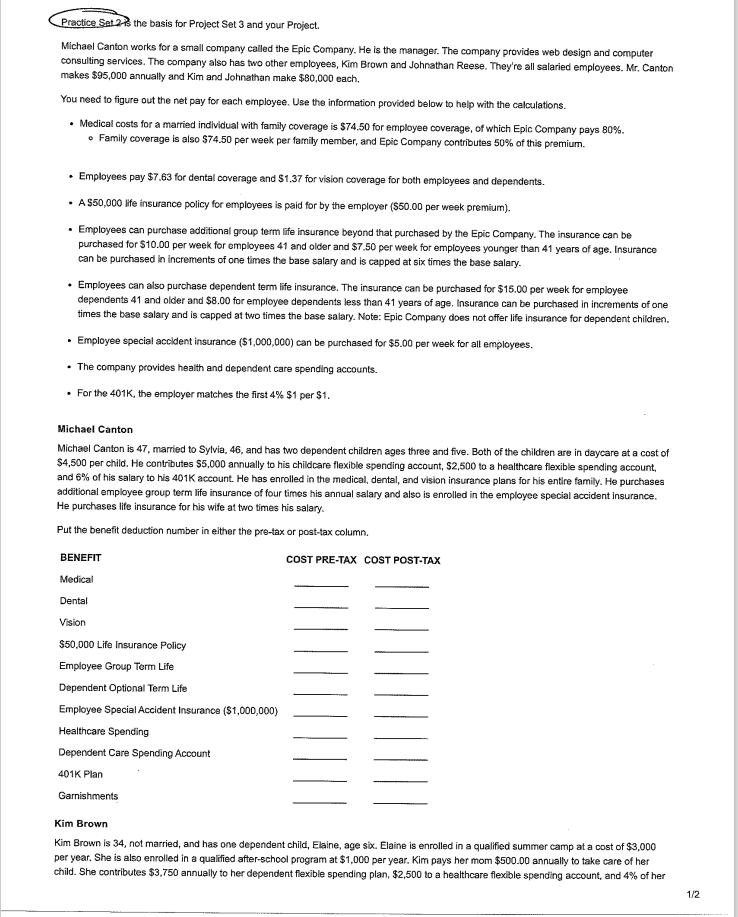

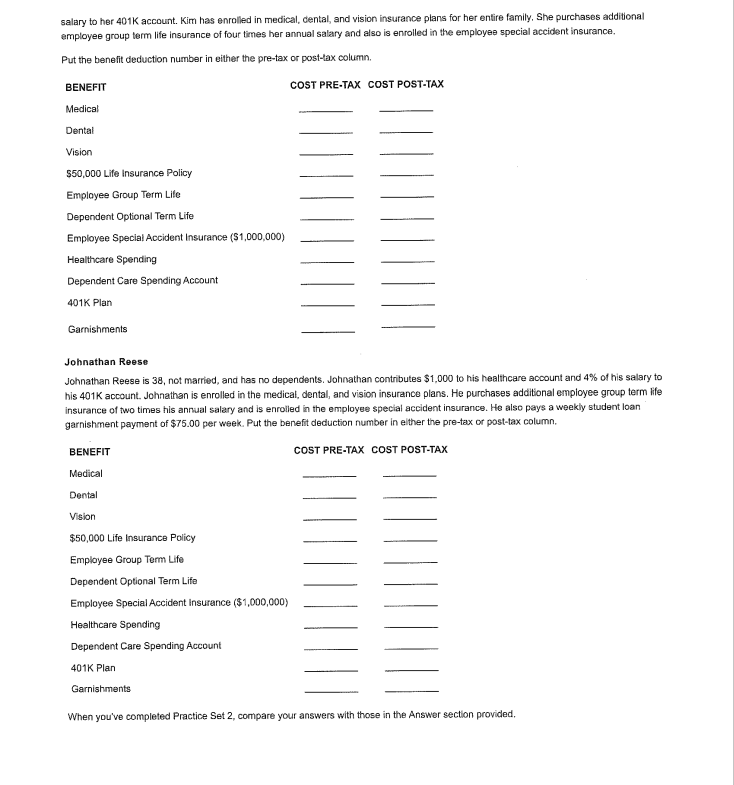

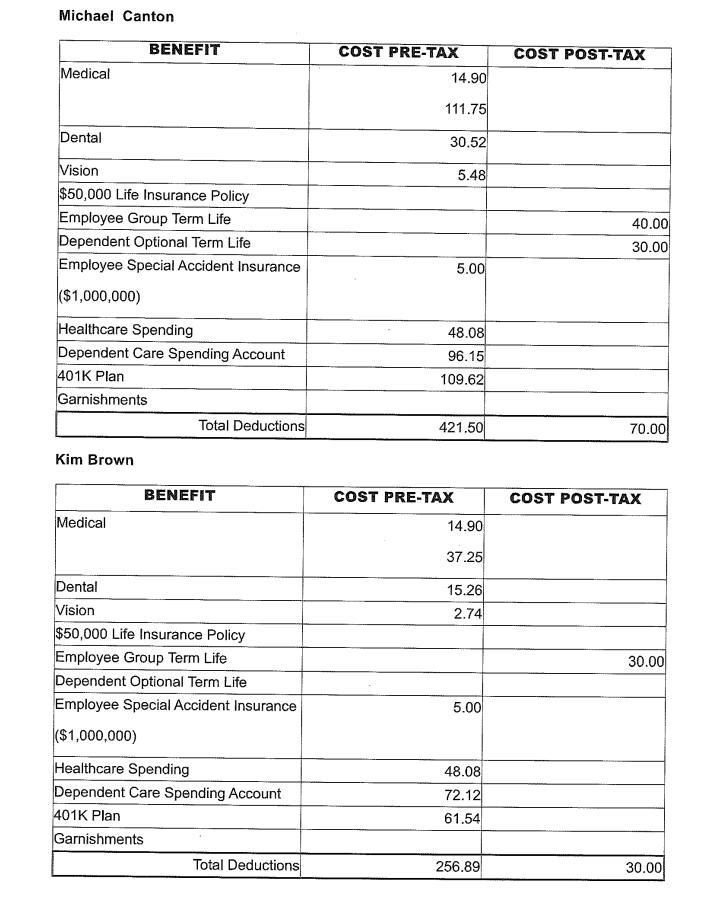

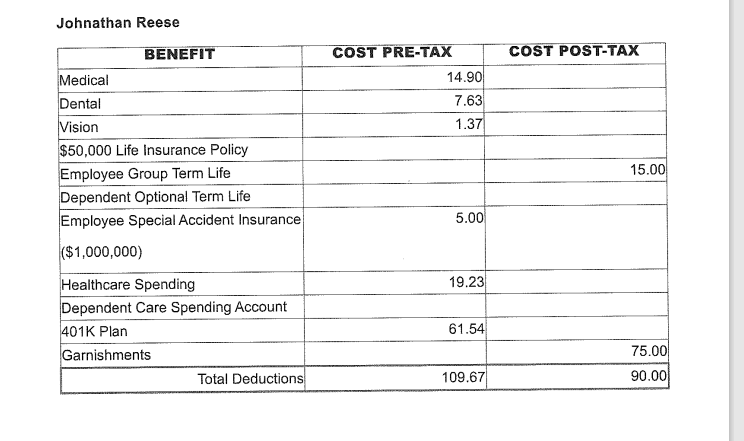

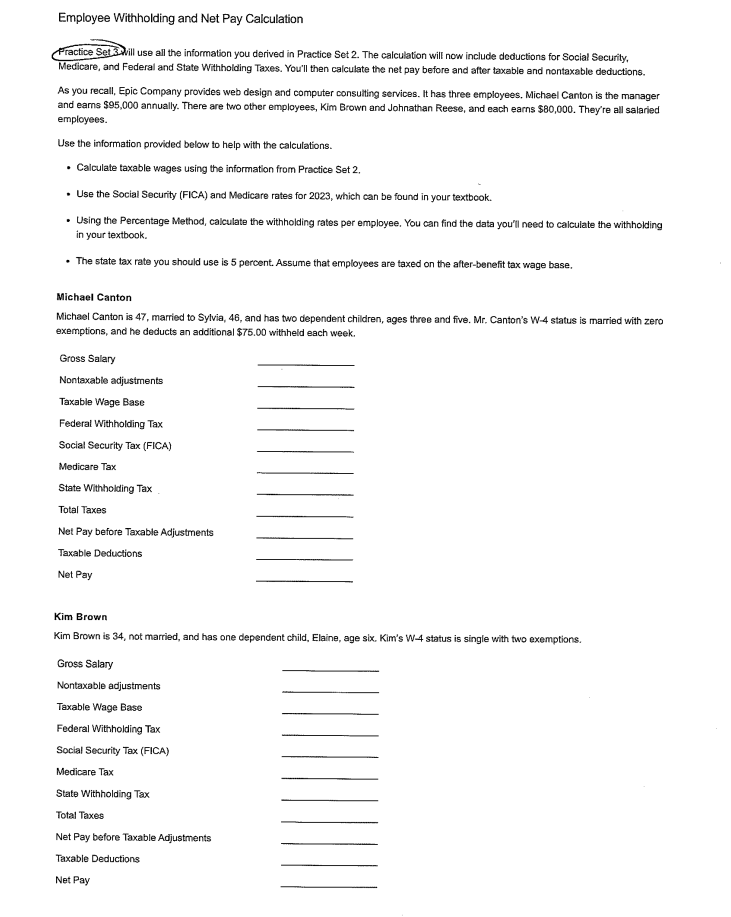

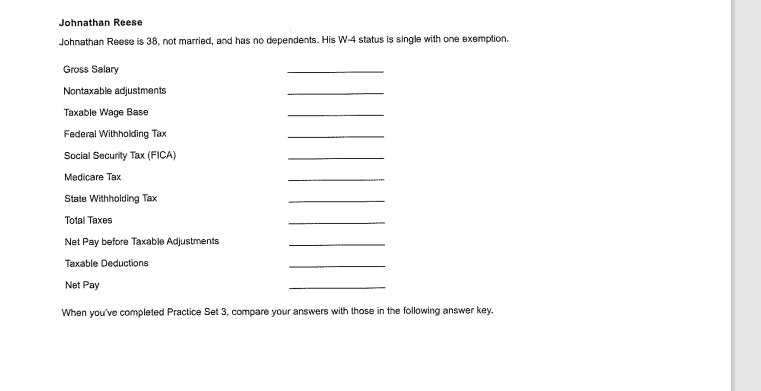

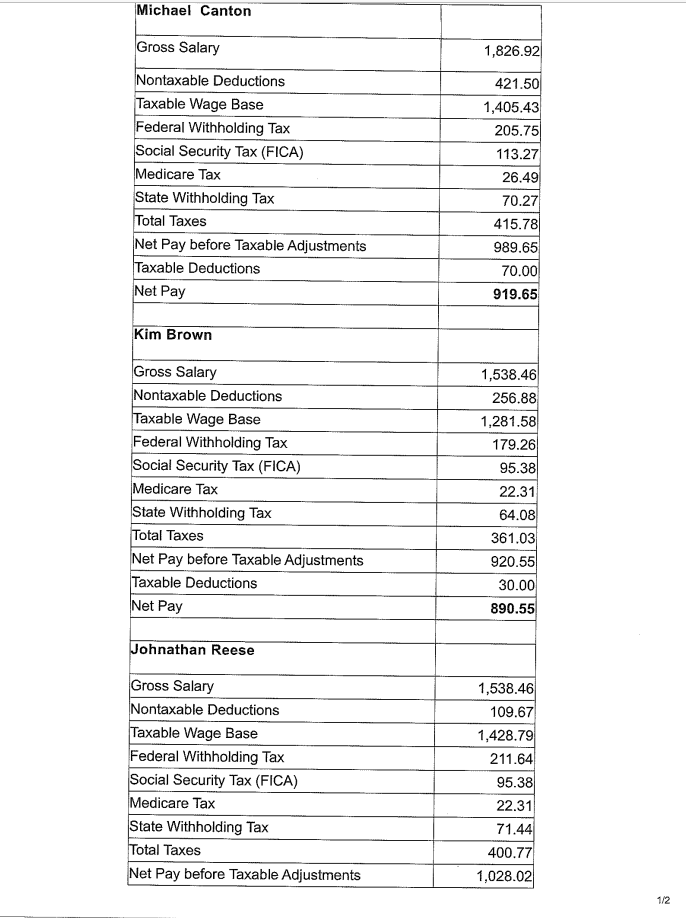

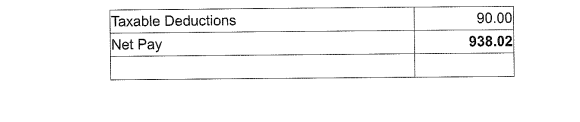

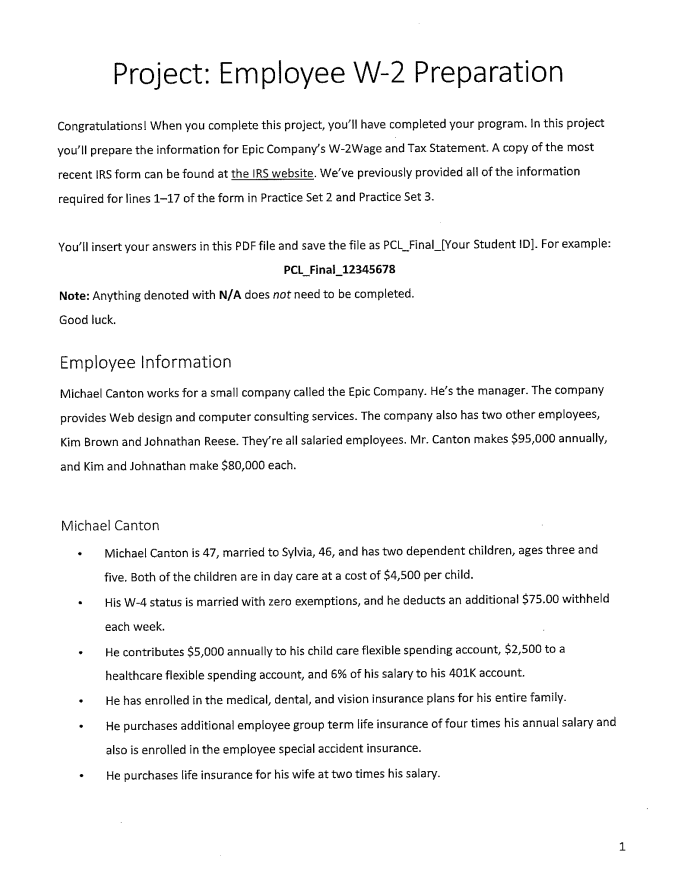

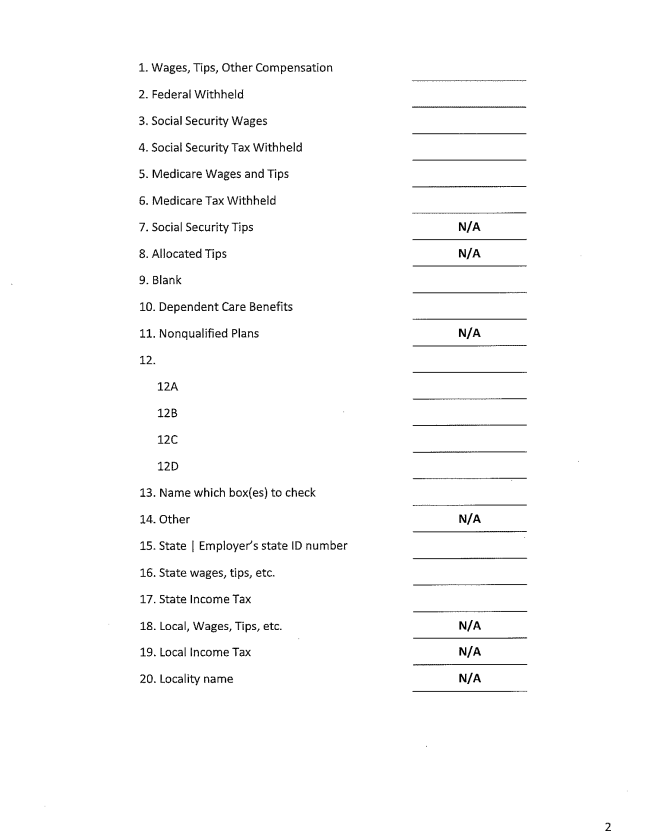

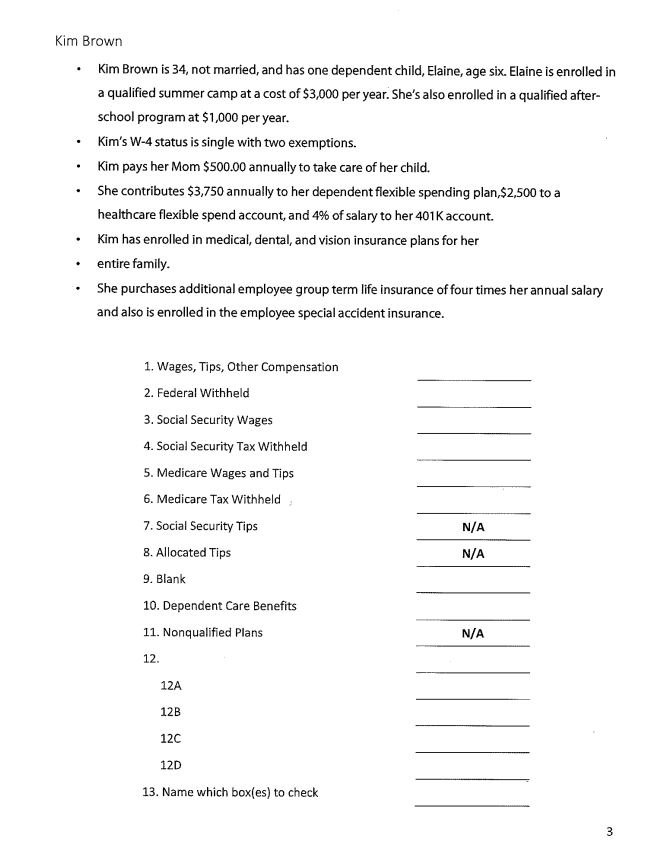

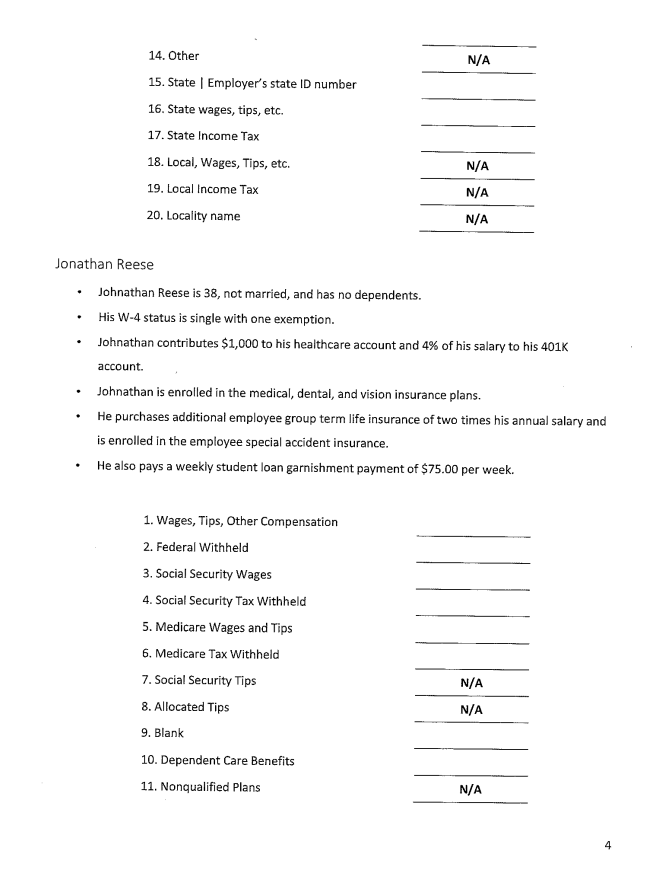

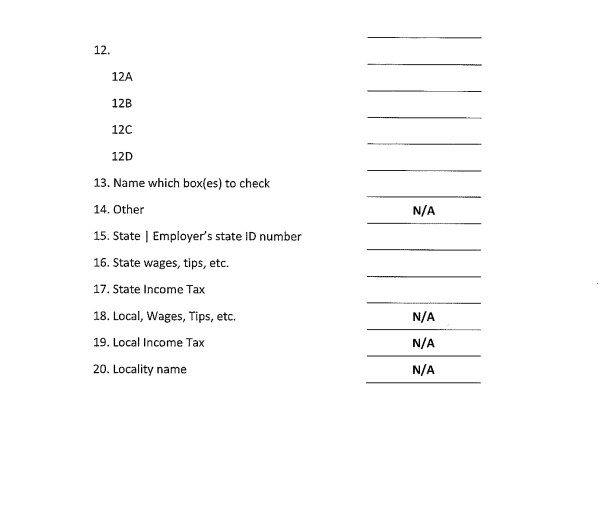

Practice Set 2-is the basis for Project Set 3 and your Project. Michael Canton works for a small company called the Epic Company. He is the manager. The company provides web design and computer consulting services. The company also has two other employees, Kim Brown and Johnathan Reese. They're all salaried employees. Mr. Canton makes $95,000 annually and Kim and Johnathan make $80,000 each, You need to figure out the net pay for each employee. Use the information provided below to help with the calculations. . Medical costs for a married individual with family coverage is $74.50 for employee coverage, of which Epic Company pays 80%. Family coverage is also $74.50 per week per family member, and Epic Company contributes 50% of this premium. . Employees pay $7.63 for dental coverage and $1.37 for vision coverage for both employees and dependents. . A $50,000 life insurance policy for employees is paid for by the employer ($50.00 per week premium). . Employees can purchase additional group term life insurance beyond that purchased by the Epic Company. The insurance can be purchased for $10.00 per week for employees 41 and older and $7.50 per week for employees younger than 41 years of age. Insurance can be purchased In increments of one times the base salary and is capped at six times the base salary. . Employees can also purchase dependent term life insurance. The insurance can be purchased for $15.00 per week for employee dependents 41 and older and $8.00 for employee dependents less than 41 years of age. Insurance can be purchased in increments of one times the base salary and is capped at two times the base salary. Note: Epic Company does not offer life insurance for dependent children. Employee special accident insurance ($1,000,000) can be purchased for $5.00 per week for all employees. . The company provides health and dependent care spending accounts. For the 401K, the employer matches the first 4% $1 per $1. Michael Canton Michael Canton is 47, married to Sylvia, 46, and has two dependent children ages three and five. Both of the children are in daycare at a cost of $4,500 per child. He contributes $5,000 annually to his childcare flexible spending account, $2,500 to a healthcare flexible spending account and 6% of his salary to his 401K account. He has enrolled in the medical, dental, and vision insurance plans for his entire family. He purchases additional employee group term life insurance of four times his annual salary and also is enrolled in the employee special accident insurance. He purchases life insurance for his wife at two times his salary. Put the benefit deduction number in either the pre-tax or post-tax column. BENEFIT COST PRE-TAX COST POST-TAX Medical Dental Vision $50,000 Life Insurance Policy Employee Group Term Life Dependent Optional Term Life Employee Special Accident Insurance ($1,000,000) Healthcare Spending 1IIIII Dependent Care Spending Account 401K Plan Garnishments Kim Brown Kim Brown is 34, not married, and has one dependent child, Elaine, age six. Elaine is enrolled in a qualified summer camp at a cost of $3,000 per year. She is also enrolled in a qualified after-school program at $1,000 per year. Kim pays her mom $500.00 annually to take care of her child. She contributes $3.750 annually to her dependent flexible spending plan, $2,500 to a healthcare flexible spending account, and 4% of her 1/2salary to her 401K account. Kim has enrolled in medical, dental, and vision insurance plans for her entire family. She purchases additional employee group term life insurance of four times her annual salary and also is enrolled in the employee special accident insurance. Put the benefit deduction number in either the pre-tax or post-tax column, BENEFIT COST PRE-TAX COST POST-TAX Medical Dental Vision $50,000 Life Insurance Policy Employee Group Term Life Dependent Optional Term Life Employee Special Accident Insurance ($1,000,000) Healthcare Spending Dependent Care Spending Account 401K Plan Garnishments Johnathan Reese Johnathan Reese is 38, not married, and has no dependents. Johnathan contributes $1,000 to his healthcare account and 4% of his salary to his 401K account. Johnathan is enrolled in the medical, dental, and vision insurance plans. He purchases additional employee group term life insurance of two times his annual salary and is enrolled in the employee special accident insurance. He also pays a weekly student loan garnishment payment of $75.00 per week. Put the benefit deduction number in either the pre-tax or post-tax column. BENEFIT COST PRE-TAX COST POST-TAX Medical Dental Vision $50,000 Life Insurance Policy Employee Group Term Life Dependent Optional Term Life Employee Special Accident Insurance ($1,000,000) Healthcare Spending Dependent Care Spending Account 401K Plan Garnishments When you've completed Practice Set 2, compare your answers with those in the Answer section provided.Michael Canton BENEFIT COST PRE-TAX COST POST-TAX Medical 14.90 111.75 Dental 30.52 Vision 5.48 $50,000 Life Insurance Policy Employee Group Term Life 40.00 Dependent Optional Term Life 30.00 Employee Special Accident Insurance 5.00 ($1,000,000) Healthcare Spending 48.08 Dependent Care Spending Account 96.15 401K Plan 109.62 Garnishments Total Deductions 421.50 70.00 Kim Brown BENEFIT COST PRE-TAX COST POST-TAX Medical 14.90 37.25 Dental 15.26 Vision 2.74 $50,000 Life Insurance Policy Employee Group Term Life 30.00 Dependent Optional Term Life Employee Special Accident Insurance 5.00 ($1,000,000) Healthcare Spending 48.08 Dependent Care Spending Account 72.12 401K Plan 61.54 Garishments Total Deductions 256.89 30.00Johnathan Reese BENEFIT COST PRE-TAX COST POST-TAX Medical 14.90 Dental 7.63 Vision 1.37 $50,000 Life Insurance Policy Employee Group Term Life 15.00 Dependent Optional Term Life Employee Special Accident Insurance 5.00 ($1,000,000) Healthcare Spending 19.23 Dependent Care Spending Account 401K Plan 61.54 Garnishments 75.00 Total Deductions 109.67 90.00Employee Withholding and Net Pay Calculation Practice Set s Will use all the information you derived in Practice Set 2. The calculation will now include deductions for Social Security, Medicare, and Federal and State Withholding Taxes. You'll then calculate the net pay before and after taxable and nontaxable deductions. As you recall, Epic Company provides web design and computer consulting services. It has three employees. Michael Canton is the manager and earns $95,000 annually. There are two other employees, Kim Brown and Johnathan Reese, and each earns $80,000. They're all salaried employees. Use the information provided below to help with the calculations. . Calculate taxable wages using the information from Practice Set 2. . Use the Social Security (FICA) and Medicare rates for 2023, which can be found in your textbook. . Using the Percentage Method, calculate the withholding rates per employee. You can find the data you'll need to calculate the withholding in your textbook. . The state tax rate you should use is 5 percent. Assume that employees are taxed on the after-benefit tax wage base. Michael Canton Michael Canton is 47, married to Sylvia, 46, and has two dependent children, ages three and five. Mr. Canton's W-4 status is married with zero exemptions, and he deducts an additional $75.00 withheld each week. Gross Salary Nontaxable adjustments Taxable Wage Base Federal Withholding Tax Social Security Tax (FICA) Medicare Tax State Withholding Tax Total Taxes Net Pay before Taxable Adjustments Taxable Deductions Net Pay Kim Brown Kim Brown is 34, not married, and has one dependent child, Elaine, age six. Kim's W-4 status is single with two exemptions. Gross Salary Nontaxable adjustments Taxable Wage Base Federal Withholding Tax Social Security Tax (FICA) Medicare Tax State Withholding Tax Total Taxes Net Pay before Taxable Adjustments Taxable Deductions Net PayJohnathan Reese Johnathan Reese is 38, not married, and has no dependents. His W-4 status is single with one exemption. Gross Salary Nontaxable adjustments Taxable Wage Base Federal Withholding Tax Social Security Tax (FICA) Medicare Tax State Withholding Tax Total Taxes Net Pay before Taxable Adjustments Taxable Deductions Net Pay When you've completed Practice Set 3, compare your answers with those in the following answer key.Michael Canton Gross Salary 1,826.92 Nontaxable Deductions 421.50 Taxable Wage Base 1,405.43 Federal Withholding Tax 205.75 Social Security Tax (FICA) 113.27 Medicare Tax 26.49 State Withholding Tax 70.27 Total Taxes 415.78 Net Pay before Taxable Adjustments 989.65 Taxable Deductions 70.00 Net Pay 919.65 Kim Brown Gross Salary 1,538.46 Nontaxable Deductions 256.88 Taxable Wage Base 1,281.58 Federal Withholding Tax 179.26 Social Security Tax (FICA) 95.38 Medicare Tax 22.31 State Withholding Tax 64.08 Total Taxes 361.03 Net Pay before Taxable Adjustments 920.55 Taxable Deductions 30.00 Net Pay 890.55 Johnathan Reese Gross Salary 1,538.46 Nontaxable Deductions 109.67 Taxable Wage Base 1,428.79 Federal Withholding Tax 211.64 Social Security Tax (FICA) 95.38 Medicare Tax 22.31 State Withholding Tax 71.44 Total Taxes 400.77 Net Pay before Taxable Adjustments 1,028.02 1/2\fProject: Employee W-2 Preparation Congratulations! When you complete this project, you'll have completed your program. In this project you'll prepare the information for Epic Company's W-2Wage and Tax Statement. A copy of the most recent IRS form can be found at the IRS website. We've previously provided all of the information required for lines 1-17 of the form in Practice Set 2 and Practice Set 3. vou'll insert your answers in this PDF file and save the file as PCL_Final_[Your Student ID]. For example: PCL_Final_12345678 Mote: Anything denoted with NfA does nof need to be completed. Good luck. Employee Information Michael Canton works for a small company called the Epic Company. He's the manager. The company provides Web design and computer consulting services. The company also has two other employees, Kim Brown and Johnathan Reese. They're all salaried employees. Mr. Canton makes 395,000 annually, and Kim and Johnathan make $80,000 each. Michael Canton Michael Canton is 47, married to Sylvia, 46, and has two dependent children, ages three and five. Both of the children are in day care at a cost of 54,500 per child. . His W-4 status is married with zero exemptions, and he deducts an additional 575.00 withheld each week, . He contributes 55,000 annually to his child care flexible spending account, 52,500 to a healthcare flexible spending aceount, and 6% of his salary to his 401K account. He has enrolled in the medical, dental, and vision insurance plans for his entire family. + He purchases additional employee group term life insurance of four times his annual salary and also is enrolled in the employee special accident insurance. - He purchases life insurance for his wife at two times his salary. 1. Wages, Tips, Other Compensation 2. Federal Withheld 3. Social Security Wages 4. Social Security Tax Withheld 5. Medicare Wages and Tips 6. Medicare Tax Withheld 7. Social Security Tips N/A 8. Allocated Tips N/A 9. Blank 10. Dependent Care Benefits 11. Nonqualified Plans N/A 12. 12A 12B 12C 12D 13. Name which box(es) to check 14. Other N/A 15. State | Employer's state ID number 16. State wages, tips, etc. 17. State Income Tax 18. Local, Wages, Tips, etc. N/A 19. Local Income Tax N/A 20. Locality name N/A 2Kirn Brown Kim Brown is 34, not married, and has one dependent child, Elaine, age six. Elaine is enrolled in a qualified summer camp at a cost of 53,000 per year. She's also enrolled in a qualified after- school program at $1,000 per vear. Kim's W-4 status is single with two exemptians. Kim pays her Mom 5500.00 annually to take care of her child. She contributes $3,750 annually to her dependent flexible spending plan,$2,500 to a healthcare flexible spend account, and 4% of salary to her 401K account. Kim has enrolled in medical, dental, and vision insurance plans for her entire family. She purchases additional employee group term life insurance of four times her annual salary and also is enrolled in the employee special accident insurance, = . Wages, Tips, Other Compensation Pt . Federal Withheald 3. Social Security Wages 4. Social Security Tax Withheld 5. Medicare Wages and Tips 6. Medicare Tax Withheld 7. Social Security Tips N/A 8. Allocated Tips NfA 9. Blank 10. Dependent Care Benefits 11. Monqualified Plans | N/A 12, . 124 128 12C 12D 13. Name which box{es) to check 14. Other N/A 15. State | Employer's state ID number 16. State wages, tips, etc. 17. State Income Tax 18. Local, Wages, Tips, etc. N/A 19. Local Income Tax N/A 20. Locality name N/A Jonathan Reese Johnathan Reese is 38, not married, and has no dependents. His W-4 status is single with one exemption. Johnathan contributes $1,000 to his healthcare account and 4% of his salary to his 401K account. Johnathan is enrolled in the medical, dental, and vision insurance plans. He purchases additional employee group term life insurance of two times his annual salary and is enrolled in the employee special accident insurance. He also pays a weekly student loan garnishment payment of $75.00 per week. 1. Wages, Tips, Other Compensation 2. Federal Withheld 3. Social Security Wages 4. Social Security Tax Withheld 5. Medicare Wages and Tips 6. Medicare Tax Withheld 7. Social Security Tips V/A 8. Allocated Tips N/A 9. Blank 10. Dependent Care Benefits 11. Nonqualified Plans N/A 412. 12A 12B 12C 12D 13. Name which box(es) to check 14. Other N/A 15. State | Employer's state ID number 16. State wages, tips, etc. 17. State Income Tax 18. Local, Wages, Tips, etc. N/A 19. Local Income Tax N/A 20. Locality name N/A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts