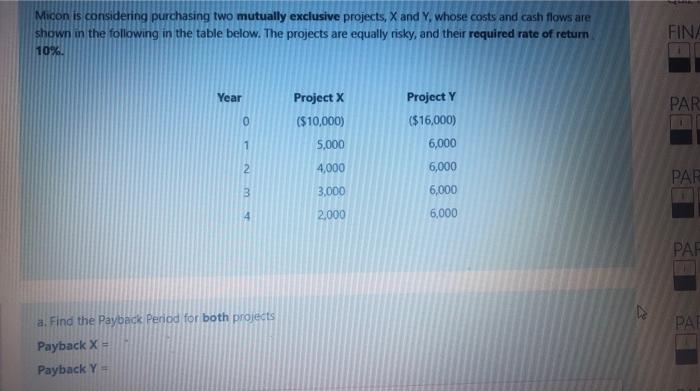

Question: Micon is considering purchasing two mutually exclusive projects, X and Y, whose costs and cash flows are shown in the following in the table below.

Micon is considering purchasing two mutually exclusive projects, X and Y, whose costs and cash flows are shown in the following in the table below. The projects are equally risky, and their required rate of return FINA 10%. Year Project X ($10,000) PAR 0 1 5,000 Project Y ($16,000) 6,000 6,000 6,000 6,000 2 PAR 3 4,000 3,000 2,000 PAR PAT a. Find the Payback period for both projects Payback X- Payback Y- b. Find the NPV for both X and Y projects NPV X = NPV Y = c. Which project should Micon choose? 7 " B I - d. What does it mean to have a positive or negative NPV? (what is the logic of NPV)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts