Question: Micro loans are small loans, which is beginning to gain popularity especially among borrowers in developing countries. The idea is to bring venture lenders together

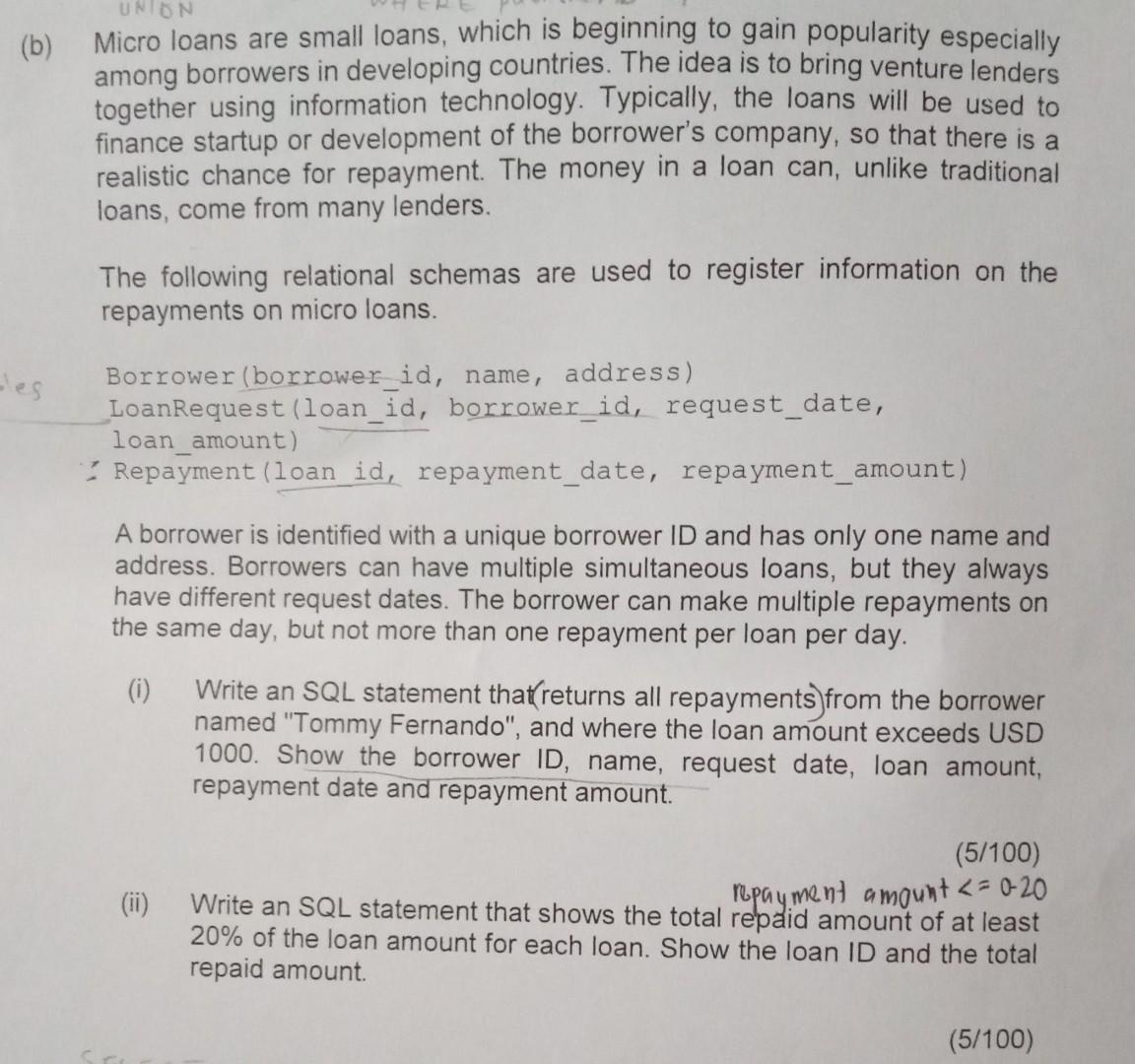

Micro loans are small loans, which is beginning to gain popularity especially among borrowers in developing countries. The idea is to bring venture lenders together using information technology. Typically, the loans will be used to finance startup or development of the borrower's company, so that there is a realistic chance for repayment. The money in a loan can, unlike traditional loans, come from many lenders. The following relational schemas are used to register information on the repayments on micro loans. Borrower(borrower_id, name, address) LoanRequest (loan_id, borrower_id, request_date, loan_amount) : Repayment (loan id, repayment_date, repayment_amount) A borrower is identified with a unique borrower ID and has only one name and address. Borrowers can have multiple simultaneous loans, but they always have different request dates. The borrower can make multiple repayments on the same day, but not more than one repayment per loan per day. (i) Write an SQL statement that(returns all repayments)from the borrower named "Tommy Fernando", and where the loan amount exceeds USD 1000. Show the borrower ID, name, request date, loan amount, repayment date and repayment amount. (ii) Write an SQL statement that shows the total repayment a mount

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts