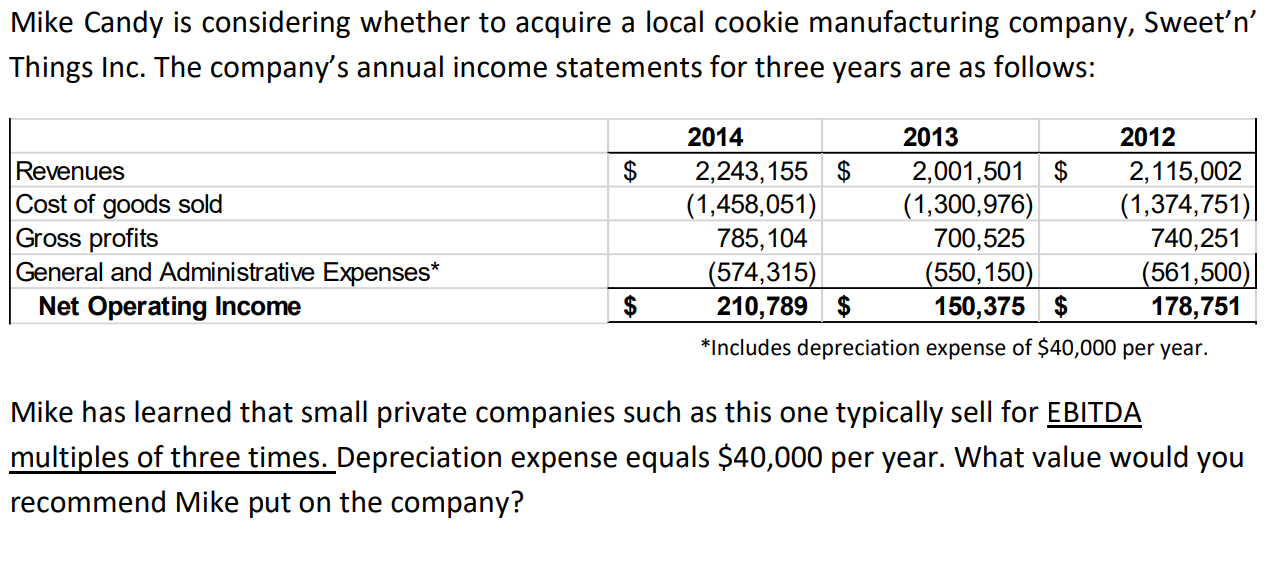

Question: Mike Candy is considering whether to acquire a local cookie manufacturing company, Sweetn Things Inc. The company's annual income statements for three years are as

Mike Candy is considering whether to acquire a local cookie manufacturing company, Sweetn Things Inc. The company's annual income statements for three years are as follows: $ Revenues Cost of goods sold Gross profits General and Administrative Expenses* Net Operating Income 2014 2013 2012 2,243, 155 $ 2,001,501 $ 2,115,002 (1,458,051) (1,300,976) (1,374,751) 785, 104 700,525 740,251 (574,315) (550, 150) (561,500) 210,789 $ 150,375 $ 178,751 *Includes depreciation expense of $40,000 per year. $ Mike has learned that small private companies such as this one typically sell for EBITDA multiples of three times. Depreciation expense equals $40,000 per year. What value would you recommend Mike put on the company

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts