Question: Mikey's Machine Shop is considering a three - year machine press project to improve its production efficiency. Six months ago, it contracted with Joe Wrong

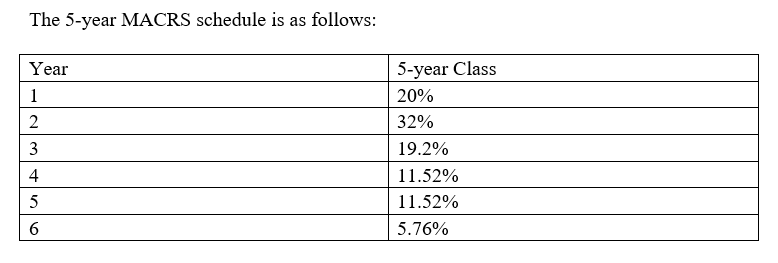

Mikey's Machine Shop is considering a threeyear machine press project to improve its production efficiency. Six months ago, it contracted with Joe Wrong to provide a thorough study of whether there would be a need for this threeyear efficiency project. The report was delivered one month ago and its cost was $ The report suggested that the company should go ahead with the project subject to Mikeys more detailed financial analysis. Buying a new machine press for $ will result in $ in annual pretax cost savings. The machine falls in the MACRS fiveyear class and it will have a salvage value at the end of the project of $ At time the press will also require an additional investment in inventory of $ and accounts payable will also increase by $ every other current accounts remain the same. Except for this one time increase of $ and $ the inventory and accounts payable levels will not change during the life of the project. If the companys tax rate is and its costing of funding is should the company accept the project?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock