Question: Mildred is a trader at Turtle Funds based in the Cayman Island, where she can invest going long/short. Mildred is bullish about the upside for

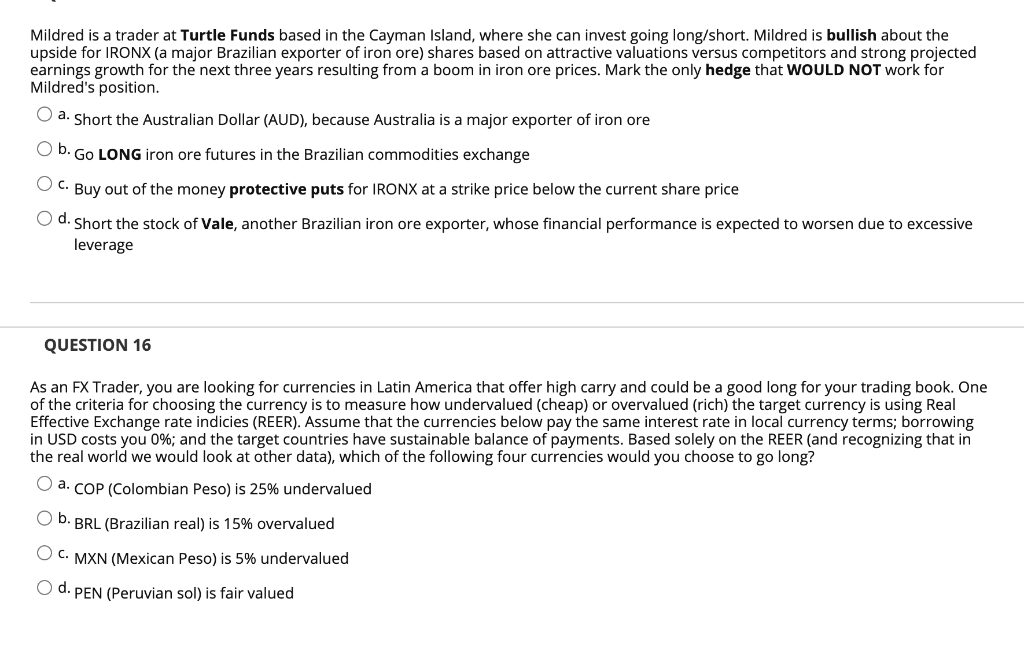

Mildred is a trader at Turtle Funds based in the Cayman Island, where she can invest going long/short. Mildred is bullish about the upside for IRONX (a major Brazilian exporter of iron ore) shares based on attractive valuations versus competitors and strong projected earnings growth for the next three years resulting from a boom in iron ore prices. Mark the only hedge that WOULD NOT work for Mildred's position. O a. Short the Australian Dollar (AUD), because Australia is a major exporter of iron ore O b. Go LONG iron ore futures in the Brazilian commodities exchange Oc. Buy out of the money protective puts for IRONX at a strike price below the current share price O d. Short the stock of Vale, another Brazilian iron ore exporter, whose financial performance is expected to worsen due to excessive leverage QUESTION 16 As an FX Trader, you are looking for currencies in Latin America that offer high carry and could be a good long for your trading book. One of the criteria for choosing the currency is to measure how undervalued (cheap) or overvalued (rich) the target currency is using Real Effective Exchange rate indicies (REER). Assume that the currencies below pay the same interest rate in local currency terms; borrowing in USD costs you 0%; and the target countries have sustainable balance of payments. Based solely on the REER (and recognizing that in the real world we would look at other data), which of the following four currencies would you choose to go long? O a. COP (Colombian Peso) is 25% undervalued O b. BRL (Brazilian real) is 15% overvalued OC. MXN (Mexican Peso) is 5% undervalued Od.PEN (Peruvian sol) is fair valued Mildred is a trader at Turtle Funds based in the Cayman Island, where she can invest going long/short. Mildred is bullish about the upside for IRONX (a major Brazilian exporter of iron ore) shares based on attractive valuations versus competitors and strong projected earnings growth for the next three years resulting from a boom in iron ore prices. Mark the only hedge that WOULD NOT work for Mildred's position. O a. Short the Australian Dollar (AUD), because Australia is a major exporter of iron ore O b. Go LONG iron ore futures in the Brazilian commodities exchange Oc. Buy out of the money protective puts for IRONX at a strike price below the current share price O d. Short the stock of Vale, another Brazilian iron ore exporter, whose financial performance is expected to worsen due to excessive leverage QUESTION 16 As an FX Trader, you are looking for currencies in Latin America that offer high carry and could be a good long for your trading book. One of the criteria for choosing the currency is to measure how undervalued (cheap) or overvalued (rich) the target currency is using Real Effective Exchange rate indicies (REER). Assume that the currencies below pay the same interest rate in local currency terms; borrowing in USD costs you 0%; and the target countries have sustainable balance of payments. Based solely on the REER (and recognizing that in the real world we would look at other data), which of the following four currencies would you choose to go long? O a. COP (Colombian Peso) is 25% undervalued O b. BRL (Brazilian real) is 15% overvalued OC. MXN (Mexican Peso) is 5% undervalued Od.PEN (Peruvian sol) is fair valued

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts