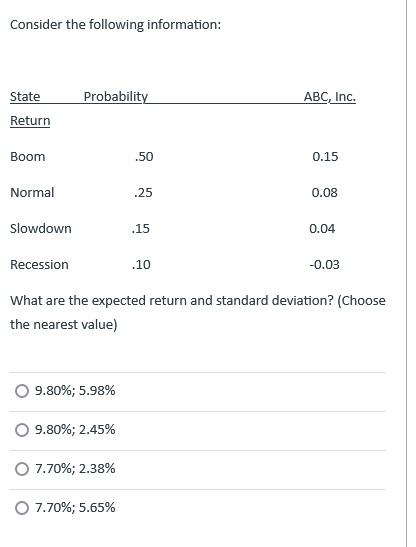

Question: Consider the following information: State Probability ABC, Inc. Return Boom .50 0.15 Normal .25 0.08 Slowdown .15 0.04 Recession .10 -0.03 What are the expected

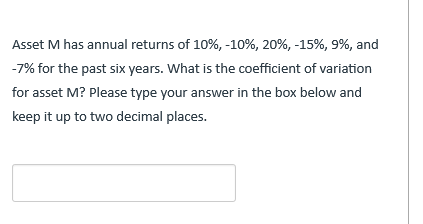

Consider the following information: State Probability ABC, Inc. Return Boom .50 0.15 Normal .25 0.08 Slowdown .15 0.04 Recession .10 -0.03 What are the expected return and standard deviation? (Choose the nearest value) 9.80%; 5.98% 9.80%; 2.45% O 7.70%; 2.38% O 7.70%; 5.65% Asset M has annual returns of 10%, -10%, 20%, -15%, 9%, and -7% for the past six years. What is the coefficient of variation for asset M? Please type your answer in the box below and keep it up to two decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts