Question: MIND Assignment 15-Working Capital Management Due on Dec 10 at 11PM PST Consider the case of Blue Ostrich Manufacturing Company: Blue Ostrich Manufacturing Company is

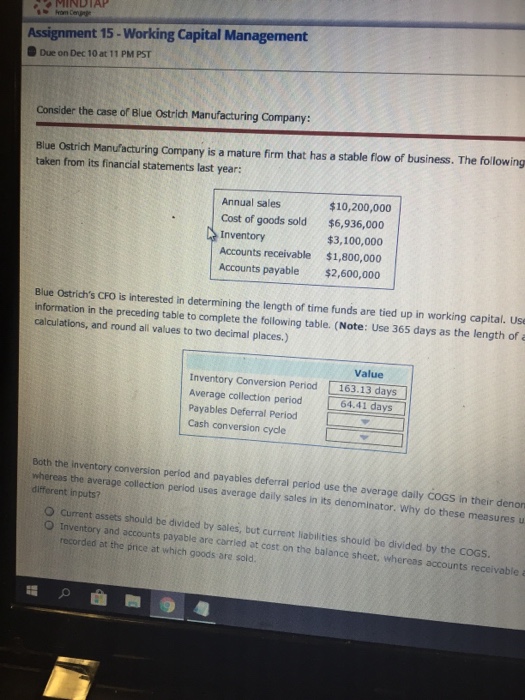

MIND Assignment 15-Working Capital Management Due on Dec 10 at 11PM PST Consider the case of Blue Ostrich Manufacturing Company: Blue Ostrich Manufacturing Company is a mature firm that has a stable flow of business. The following taken from its financial statements last year: Annual sales Cost of goods sold $6,936,000 Inventory Accounts receivable $1,800,000 Accounts payable$2,600,000 $10,200,000 $3,100,000 Blue Ostrich's CFO is interested in determining the length of time funds are tied up in working capital. Use information in the preceding table to complete the following table. (Note: Use 365 days as the length of calculations, and round all values to two decimal places.) Value Inventory Conversion Period 163.13 days Average collection period64.41 days Payables Deferral Period [ Cash conversion cyde ] Both the inventory conversion period and payables deferral period use the average daily COGS in their denon whereas the average collection period uses average daily sales in its denominator. Why do these measures u different inputs? O Current assets should be divided by sale, but current liabilities should be divided by the CoGs. O Inventory and accounts payable are carried at cost on the balance sheet, whereas accounts receivable a recorded at the price at which goods are sold. 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts