Question: MINI CASE STUDY Bivient Company Corporation (BCC) is a medium electronics manufacturer located in KKIP, Sepanggar Kota Kinabalu Sabah. The company was founded 30 years

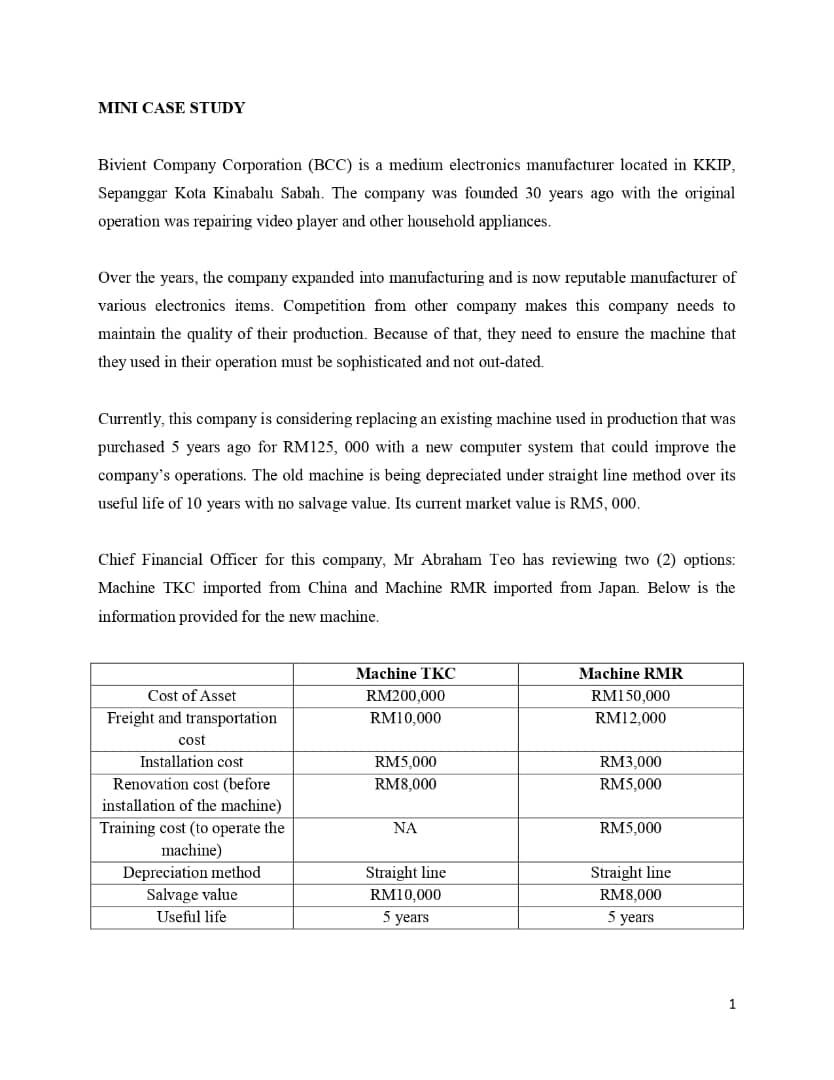

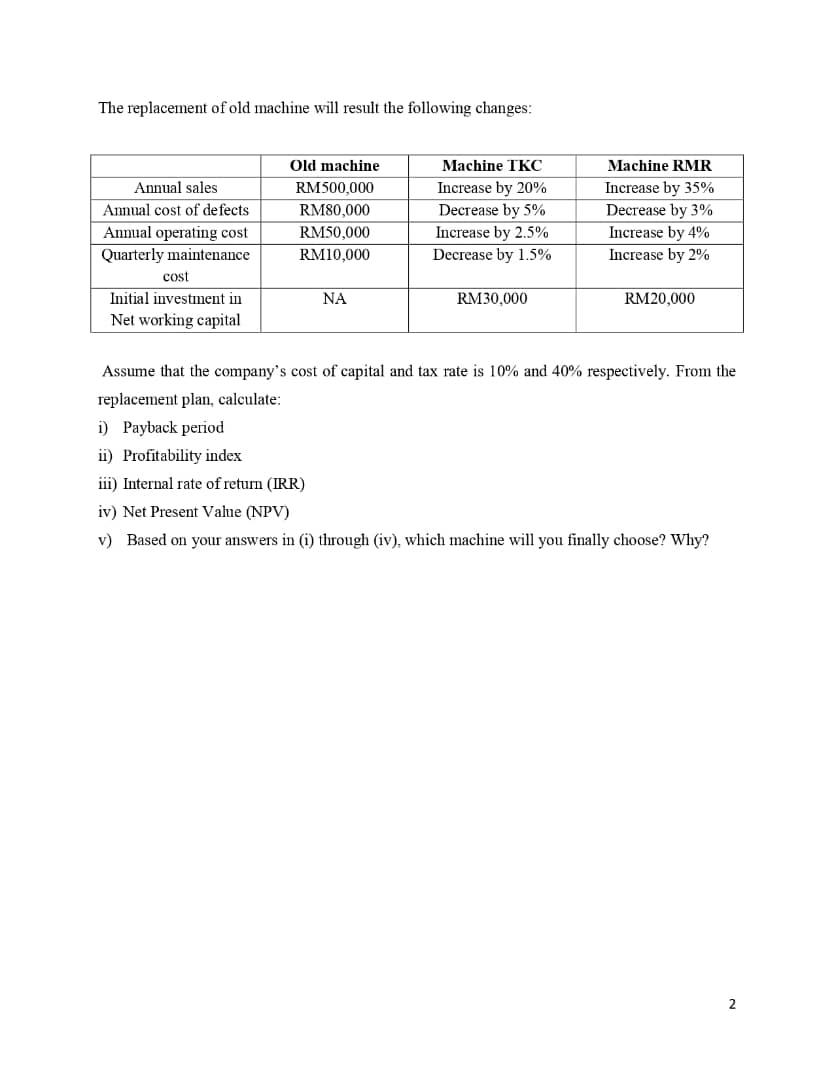

MINI CASE STUDY Bivient Company Corporation (BCC) is a medium electronics manufacturer located in KKIP, Sepanggar Kota Kinabalu Sabah. The company was founded 30 years ago with the original operation was repairing video player and other household appliances. Over the years, the company expanded into manufacturing and is now reputable manufacturer of various electronics items. Competition from other company makes this company needs to maintain the quality of their production. Because of that, they need to ensure the machine that they used in their operation must be sophisticated and not out-dated, Currently, this company is considering replacing an existing machine used in production that was purchased 5 years ago for RM125, 000 with a new computer system that could improve the company's operations. The old machine is being depreciated under straight line method over its useful life of 10 years with no salvage value. Its current market value is RM5,000. Chief Financial Officer for this company, Mr Abraham Teo has reviewing two (2) options: Machine TKC imported from China and Machine RMR imported from Japan. Below is the information provided for the new machine. Machine TKC RM200,000 RM10,000 Machine RMR RM150,000 RM12,000 RM5,000 RM8,000 RM3,000 RM5,000 Cost of Asset Freight and transportation cost Installation cost Renovation cost (before installation of the machine) Training cost (to operate the machine) Depreciation method Salvage value Useful life NA RM5,000 Straight line RM10,000 5 years Straight line RM8,000 5 years 1 The replacement of old machine will result the following changes: Annual sales Annual cost of defects Annual operating cost Quarterly maintenance COST Initial investment in Net working capital Old machine RM500,000 RM80,000 RM50,000 RM10,000 Machine TKC Increase by 20% Decrease by 5% Increase by 2.5% Decrease by 1.5% Machine RMR Increase by 35% Decrease by 3% Increase by 4% Increase by 2% NA RM30,000 RM20,000 Assume that the company's cost of capital and tax rate is 10% and 40% respectively. From the replacement plan, calculate: i) Payback period ii) Profitability index iii) Internal rate of return (IRR) iv) Net Present Value (NPV) v) Based on your answers in (1) through (iv), which machine will you finally choose? Why? 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts