Question: Mini - Project 1 : Mortgage Loan Analysis ( 5 0 points ) : You plan to buy a house in September 2 0 2

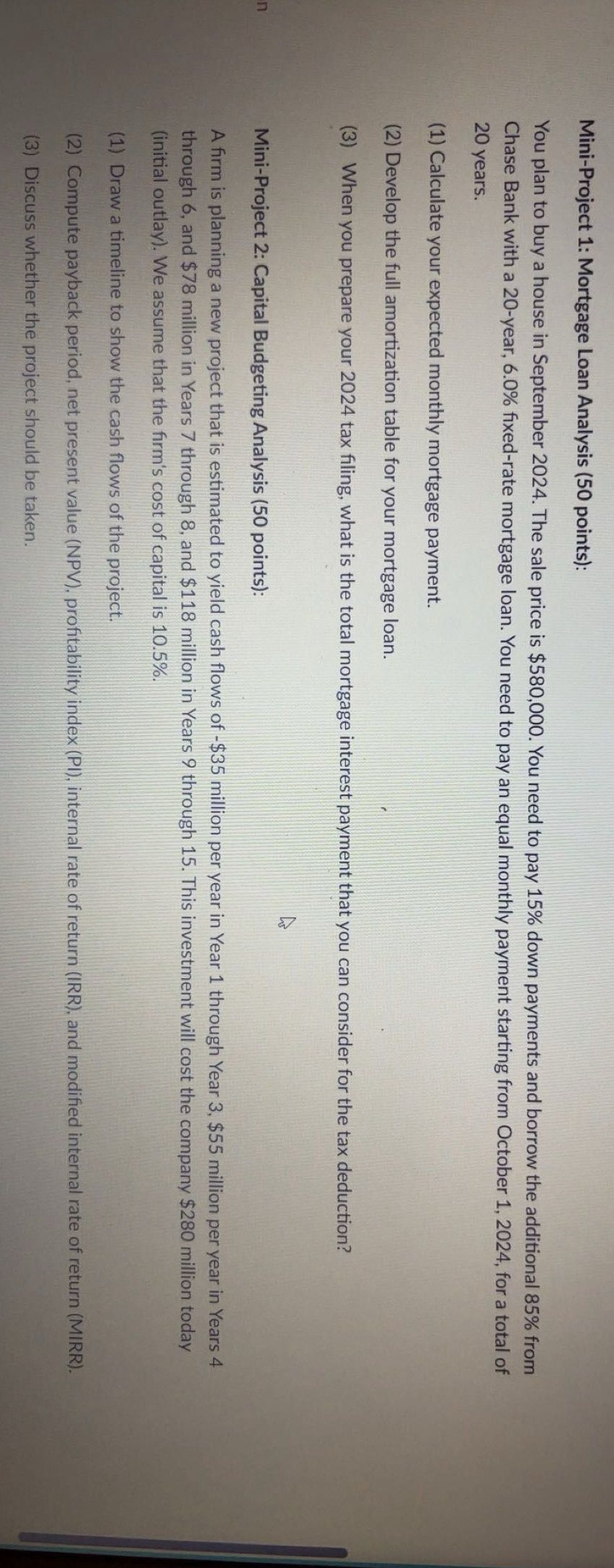

MiniProject : Mortgage Loan Analysis points:

You plan to buy a house in September The sale price is $ You need to pay down payments and borrow the additional from Chase Bank with a year, fixedrate mortgage loan. You need to pay an equal monthly payment starting from October for a total of years.

Calculate your expected monthly mortgage payment.

Develop the full amortization table for your mortgage loan.

When you prepare your tax filing, what is the total mortgage interest payment that you can consider for the tax deduction?

MiniProject : Capital Budgeting Analysis points:

A firm is planning a new project that is estimated to yield cash flows of $ million per year in Year through Year $ million per year in Years through and $ million in Years through and $ million in Years through This investment will cost the company $ million today initial outlay We assume that the firm's cost of capital is

Draw a timeline to show the cash flows of the project.

Compute payback period, net present value NPV profitability index PI internal rate of return IRR and modified internal rate of return MIRR

Discuss whether the project should be taken.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock