Question: Mini-Case {A} Leasing the car Down payment Interest (compounded annually) List Price Additional purchase costs* Term in months Monthly payments (without HST) {B} {C} {D}

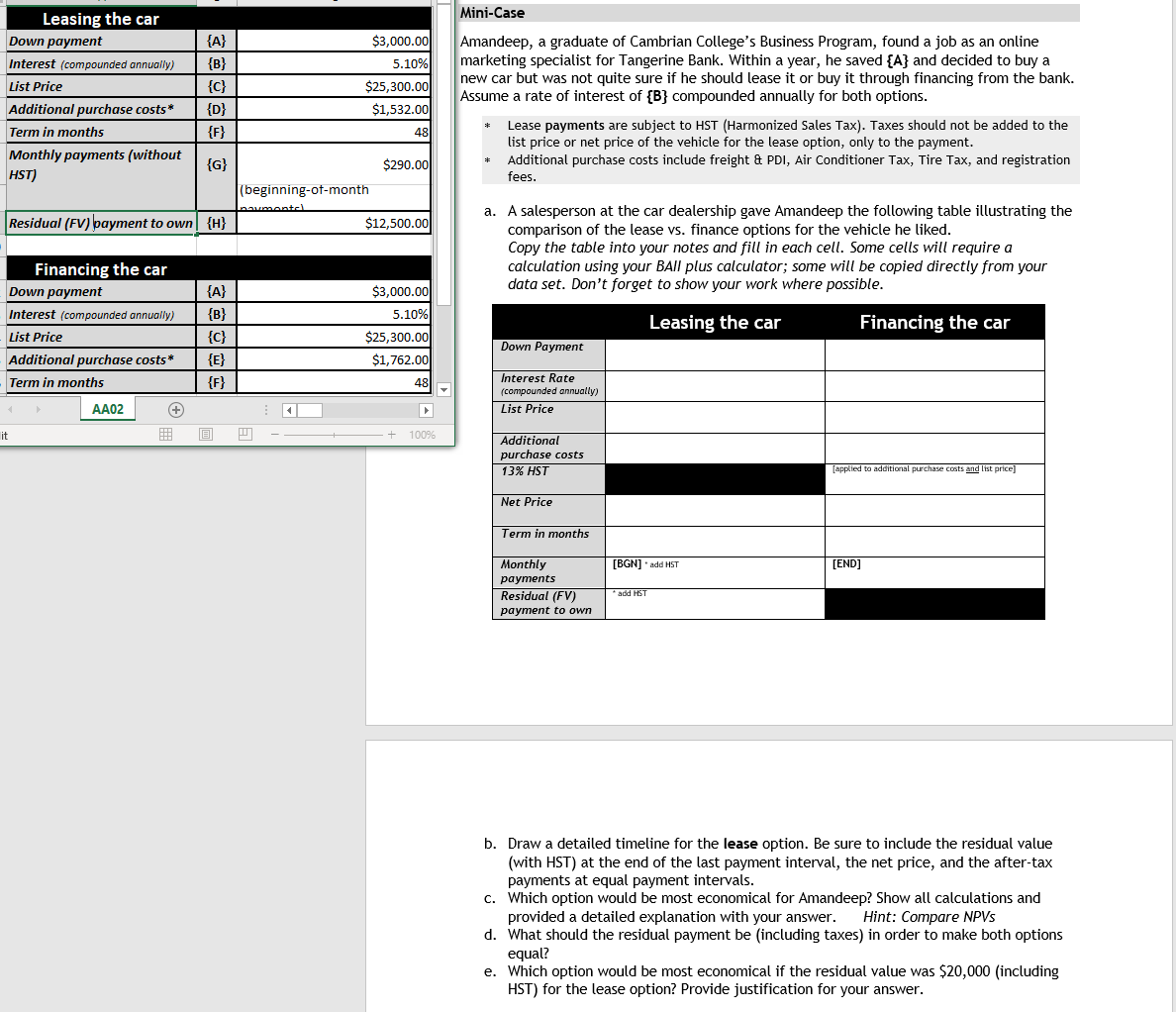

Mini-Case {A} Leasing the car Down payment Interest (compounded annually) List Price Additional purchase costs* Term in months Monthly payments (without HST) {B} {C} {D} {f} $3,000.00 5.10% $25,300.00 $1,532.00 Amandeep, a graduate of Cambrian College's Business Program, found a job as an online marketing specialist for Tangerine Bank. Within a year, he saved {A} and decided to buy a new car but was not quite sure if he should lease it or buy it through financing from the bank. Assume a rate of interest of {B} compounded annually for both options. Lease payments are subject to HST (Harmonized Sales Tax). Taxes should not be added to the list price or net price of the vehicle for the lease option, only to the payment. Additional purchase costs include freight & PDI, Air Conditioner Tax, Tire Tax, and registration fees. 48 {G} $290.00 (beginning-ot-month Residual (FV) payment to own {H} $12,500.00 a. A salesperson at the car dealership gave Amandeep the following table illustrating the comparison of the lease vs. finance options for the vehicle he liked. Copy the table into your notes and fill in each cell. Some cells will require a calculation using your BAll plus calculator; some will be copied directly from your data set. Don't forget to show your work where possible. {A} {B} $3,000.00 5.10% Financing the car Down payment Interest (compounded annually) List Price Additional purchase costs* Term in months Leasing the car Financing the car {C} {E} {f} $25,300.00 $1,762.00 Down Payment 48 Interest Rate (compounded annually) List Price AAO2 + it 1009 Additional purchase costs 13% HST [applied to additional purchase costs and list price] Net Price Term in months [BGN] add HST [END] Monthly payments Residual (FV) payment to own add HST b. Draw a detailed timeline for the lease option. Be sure to include the residual value (with HST) at the end of the last payment interval, the net price, and the after-tax payments at equal payment intervals. c. Which option would be most economical for Amandeep? Show all calculations and provided a detailed explanation with your answer. Hint: Compare NPVs d. What should the residual payment be including taxes) in order to make both options equal? e. Which option would be most economical if the residual value was $20,000 (including HST) for the lease option? Provide justification for your answer. Mini-Case {A} Leasing the car Down payment Interest (compounded annually) List Price Additional purchase costs* Term in months Monthly payments (without HST) {B} {C} {D} {f} $3,000.00 5.10% $25,300.00 $1,532.00 Amandeep, a graduate of Cambrian College's Business Program, found a job as an online marketing specialist for Tangerine Bank. Within a year, he saved {A} and decided to buy a new car but was not quite sure if he should lease it or buy it through financing from the bank. Assume a rate of interest of {B} compounded annually for both options. Lease payments are subject to HST (Harmonized Sales Tax). Taxes should not be added to the list price or net price of the vehicle for the lease option, only to the payment. Additional purchase costs include freight & PDI, Air Conditioner Tax, Tire Tax, and registration fees. 48 {G} $290.00 (beginning-ot-month Residual (FV) payment to own {H} $12,500.00 a. A salesperson at the car dealership gave Amandeep the following table illustrating the comparison of the lease vs. finance options for the vehicle he liked. Copy the table into your notes and fill in each cell. Some cells will require a calculation using your BAll plus calculator; some will be copied directly from your data set. Don't forget to show your work where possible. {A} {B} $3,000.00 5.10% Financing the car Down payment Interest (compounded annually) List Price Additional purchase costs* Term in months Leasing the car Financing the car {C} {E} {f} $25,300.00 $1,762.00 Down Payment 48 Interest Rate (compounded annually) List Price AAO2 + it 1009 Additional purchase costs 13% HST [applied to additional purchase costs and list price] Net Price Term in months [BGN] add HST [END] Monthly payments Residual (FV) payment to own add HST b. Draw a detailed timeline for the lease option. Be sure to include the residual value (with HST) at the end of the last payment interval, the net price, and the after-tax payments at equal payment intervals. c. Which option would be most economical for Amandeep? Show all calculations and provided a detailed explanation with your answer. Hint: Compare NPVs d. What should the residual payment be including taxes) in order to make both options equal? e. Which option would be most economical if the residual value was $20,000 (including HST) for the lease option? Provide justification for your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts