Question: Using the information above how do I calculate the NPV for the building, equipment, and bonds? Financial Option 1: Purchase a $10 Million Building Rationale

Using the information above how do I calculate the NPV for the building, equipment, and bonds?

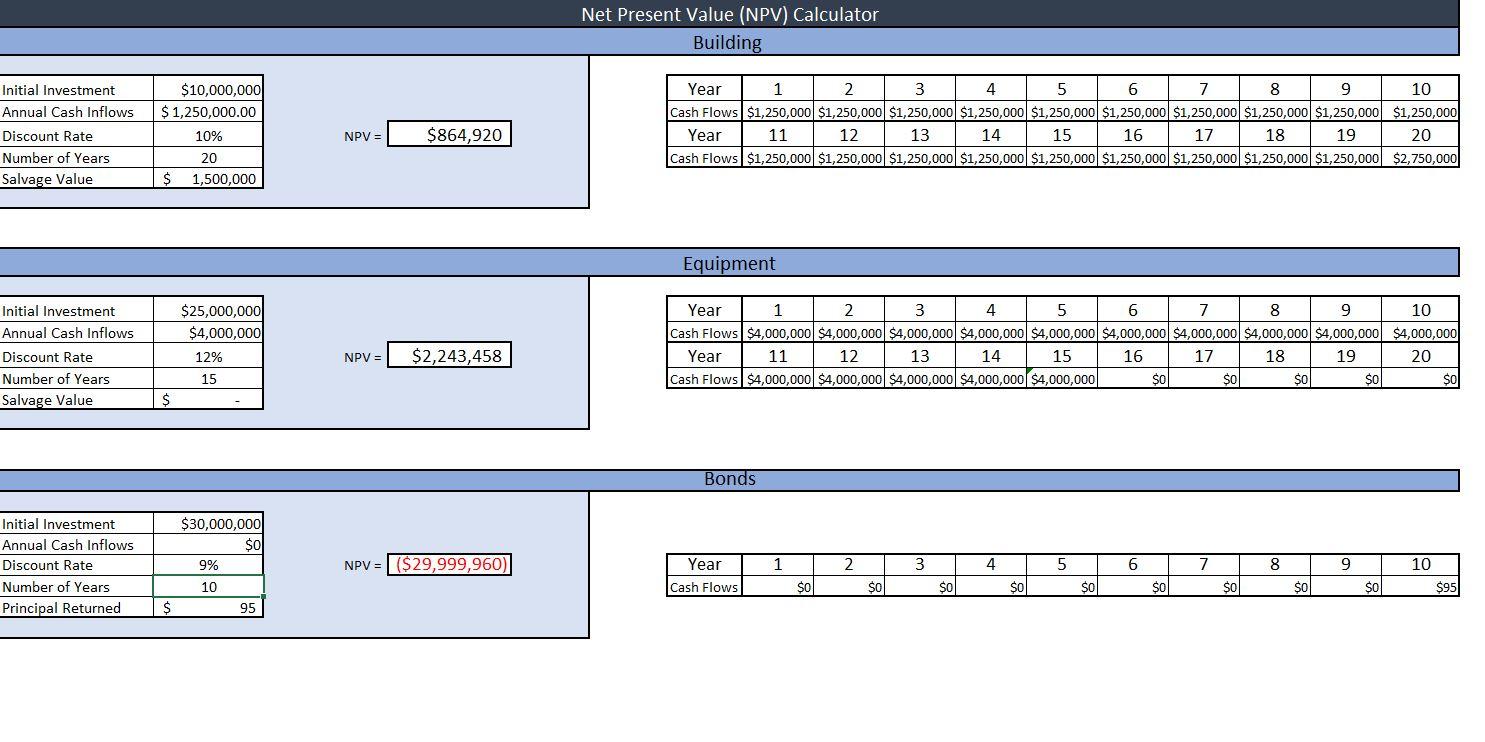

Financial Option 1: Purchase a $10 Million Building Rationale for investment: The business is considering environmental, social, and corporate governance (ESG) factors as part of its investment into a new building for its headquarters. The building itself will be a Leadership in Energy and Environmental Design (LEED)-certified building, but the new site being considered currently houses a large, inactive gas station that sold both gasoline and diesel fuel. The new site also has a sizable repair facility left over that was used for deliveries and tractor-trailer trucks for more than 50 years. While some restoration was performed on the site prior to the new building's construction, the previous owner ran out of funds before they were ever able to bring the site up to LEED standards. Four large fuel tanks remain on the site, and they will also need to be addressed per LEED standards. Assumptions to consider: $10 million cash purchase Building generates additional net profits after tax of $1.25 million per year 20 year expected useful life of building Salvage value: $1.5 million Discount rate is 10% Financial Option 2: Purchase of $25 Million in Equipment Rationale for investment: The business's current equipment is efficient, but it uses a substantial amount of electricity. Operating the production line also creates significant waste material, including waste plastics. The business is looking into purchasing newer, more environmentally friendly equipment that will still allow it to be at least as efficient in production as it is now. Assumptions to consider: Annual cash flows generated with equipment: $4 million Discount rate is 12% snhu 15-year useful life No salvage value Financial Option 3: $30 Million Investment in Bonds Rationale for investment: The business that's offering these bonds for sale contracts with another business in China to assemble computer components. The Chinese business is known to have used child labor in the past, but claims it has stopped this practice. However, the U.S. business selling these bonds has not investigated to verify whether these claims are true or not. Assumptions to consider: 10-year bond 8% coupon . Priced at a discount: $95 Discount rate is 9% Net Present Value (NPV) Calculator Building Initial Investment $10,000,000 $ 1,250,000.00 Annual Cash Inflows Year 1 2 3 4 5 6 7 8 9 10 Cash Flows $1,250,000 $1,250,000 $1,250,000 $1,250,000 $1,250,000 $1,250,000 $1,250,000 $1,250,000 $1,250,000 $1,250,000 Year 11 12 13 14 15 16 17 18 19 20 Cash Flows $1,250,000 $1,250,000 $1,250,000 $1,250,000 $1,250,000 $1,250,000 $1,250,000 $1,250,000 $1,250,000 $2,750,000 Discount Rate 10% NPV = $864,920 Number of Years 20 Salvage Value $ 1,500,000 Equipment Initial Investment $25,000,000 $4,000,000 Annual Cash Inflows Year 1 2 3 4 5 6 7 8 9 10 Cash Flows $4,000,000 $4,000,000 $4,000,000 $4,000,000 $4,000,000 $4,000,000 $4,000,000 $4,000,000 $4,000,000 $4,000,000 Year 11 12 13 14 15 16 17 18 19 20 Cash Flows $4,000,000 $4,000,000 $4,000,000 $4,000,000 $4,000,000 $0 $0 $0 $0 SO Discount Rate 12% NPV = $2,243,458 Number of Years 15 Salvage Value $ Bonds Initial Investment $30,000,000 $0 Annual Cash Inflows Discount Rate 9% NPV = ($29,999,960) Year 1 2 3 4 5 6 7 8 9 10 10 Cash Flows $0 $0 $ol $0 $0 $0 $0 $0 $0 $95 Number of Years Principal Returned $ 95

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts